The ACNC urges charity leaders and their accountants to ensure that they comply with amended reporting regulations.

Amendments should be incorporated in 2022 annual information statements.

They affect charity-size thresholds based on revenue, disclosure of remuneration for key management personnel, and disclosure of related-party transactions.

ACNC director of reporting, Mel Yates, said it was important that charity leaders prepared for the changes as soon as possible.

The amendments will also require large charities to disclose in special-purpose financial reports remuneration of key management personnel. Key management personnel are senior managers and charity leaders such as directors, CEOs, and board members. The rule applies from the 2022 AIS reporting period.

For medium and large charities, there will be increased requirements to disclose related-party transactions in special-purpose financial statements. The change applies from the 2023 AIS reporting period.

‘Charity leaders need to speak to their accountants right now. They need to ask them if they have the appropriate systems, processes and controls in place to capture transactions that these amendments require to be captured,’ said Mr Yates.

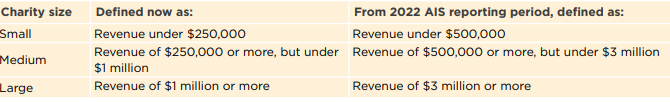

A charity’s ACNC financial reporting obligations relate to size based on annual revenue. Medium and large charities must submit an annual financial report, while small charities are required only to submit an annual information statement.

From the 2022 annual information statement reporting period, revenue thresholds will rise for all three categories as follows:

The commission will exercise discretion for charities preparing special-purpose financial statements for the first time.

Commissioner Johns has decided that charities preparing special-purpose financial statements for the first time under amended regulations will not have to provide comparative information for the preceding period in applying the relevant Australian accounting standard. They will need to provide disclosures for the reporting period only in the first year of adoption.

Start strong in January: Why smart tax planning begins well before June

AI Explainer: Who’s Behind the Tools You Keep Hearing About?

Ready for Next-Level Automation? See What’s New in Ostendo 243

Thinking ahead, acting today: Must-know succession strategies for practice owners

From locum shifts to running your own practice: When your cover needs an upgrade