Snapshot

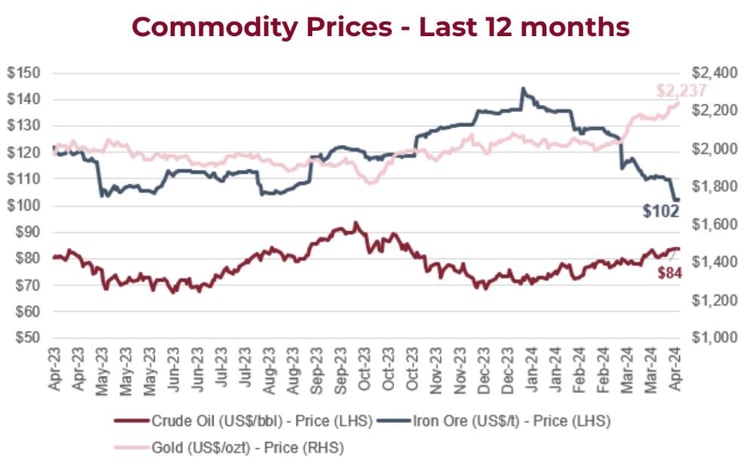

Global financial markets finished higher in March, marking the fifth consecutive month of gains. This was supported by several factors including the resilience of the US economy and corporate profits, growing enthusiasm surrounding artificial intelligence technology, and anticipated interest rate reductions throughout the year. However, commodity markets exhibited a mixed performance during the same period. While gold and oil prices rose, iron ore prices fell due to the ongoing slowdown in the Chinese economy.

Furthermore, March also incorporated several important central bank meetings, including the Reserve Bank of Australia (RBA), the Bank of Japan (BOJ), and the US Federal Reserve (Fed).

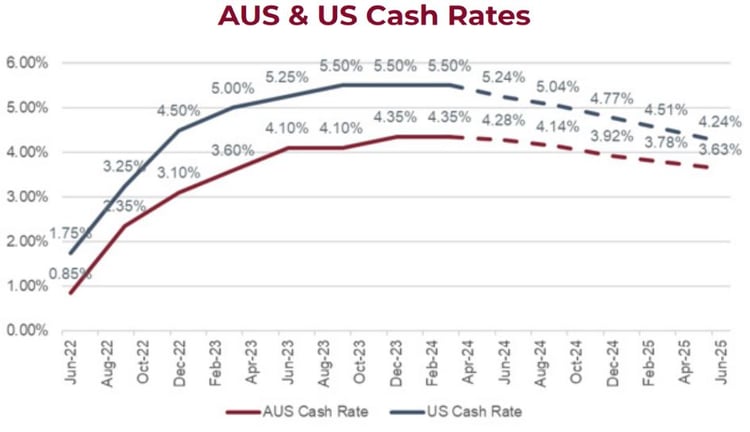

The RBA unsurprisingly opted to maintain the cash rate at 4.35% following its meeting. The central bank stated the “path of interest rates that will ensure that inflation returns to target (of 2–3%) in a reasonable time-frame remains uncertain, and the Board is not ruling anything in or out”. The market took this as an indication the central bank’s tightening bias had eased to instead favour a more balanced stance, with the market expecting the first 0.25% rate cut by the RBA in September.

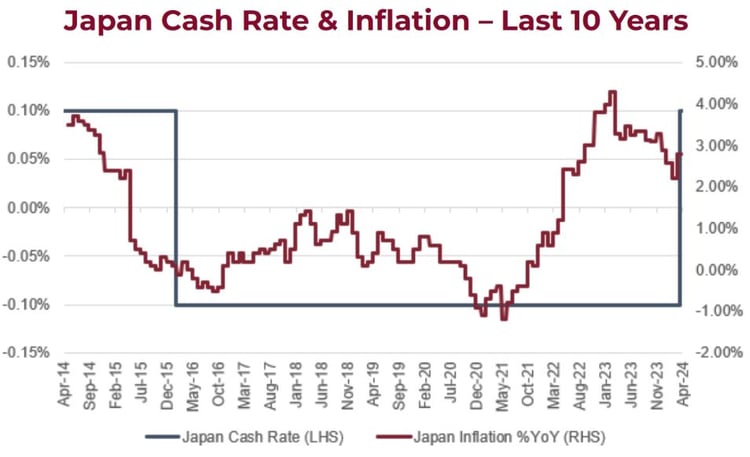

The BOJ meanwhile made significant policy changes by discontinuing negative interest rates after eight years and unwound most of its unconventional monetary policy measures. This decision was made in anticipation of achieving stable inflation in Japan. As a result, the BOJ raised interest rates from –0.10% to a range of 0.00–0.10%, marking the end of the global era of negative interest rates that began in the 2010s.

Other central banks that previously implemented negative rates, such as the European Central Bank and the Swiss National Bank, have also transitioned back to positive territory in response to inflationary pressures stemming from the COVID-19 pandemic and the conflict in Ukraine.

Despite robust economic growth and higher-than-expected inflation leading up to its meeting, the Fed chose to maintain interest rates at 5.25–5.50%. The Fed's projections, as reflected in the so-called dot plot, continued to indicate expectations of three rate cuts in 2024, consistent with previous forecasts from December.

Fed Chair Jerome Powell acknowledged the persistent inflationary pressures over the past two months, emphasising the importance of interpreting data cautiously. At the time of writing, the market anticipates the first 0.25% rate cut by the Fed will occur in June.

We remain cautiously optimistic for the year ahead given the progress that has been made. Inflationary pressures have alleviated somewhat, with core inflation metrics nearing central bank targets on an annualised basis.

Thus, 2024 presents a favourable market environment as the path towards lower rates becomes clearer.

Key Stocks

Brambles

Cutcher & Neale Australian Shares Model

Brambles is the largest global supplier of reusable wooden pallets and services the consumer goods, fresh produce, beverage, retail and general manufacturing industries. The company established its competitive position in markets around the world by being a first mover, achieving critical scale and maintaining positive network effects.

The Investment Committee added Brambles to the Australian Shares Model Portfolio in 2023, to gain exposure to an extremely high quality industrial company with pricing power and reliable revenue streams. The objective being to target moderate growth with a defensive earnings profile, given the ongoing uncertainty in economic conditions.

More recently, Brambles has performed well and beaten earnings expectations. This has been driven by productivity improvements and cost deflation for critical inputs like lumber, energy and transport. Notably, with global growth expected to slow as higher interest rates take effect, customers began destocking. Brambles has successfully offset this weaker near term volume outlook with successful cost discipline and effective price increases.

Airbus

Cutcher & Neale International Shares Model

Airbus is a major aerospace and defence firm. It designs, develops, and manufactures commercial and military aircraft, as well as space launch vehicles and satellites. The company has been in the International Shares Model Portfolio for a number of years, identified primarily for being a high quality, European business with a strong industry position and sustainable growth trajectory.

More recently, Airbus has indirectly benefited from reputational damage experienced by its primary competitor Boeing. Boeing has suffered from a number of incidents over the past five years, with one being in January this year, when a panel blew off its brand-new Alaska Airlines 737 Max.

Investigations are ongoing and operational issues will need to be addressed by Boeing. Given the two effectively run a duopoly, Airbus stands to benefit, as customers rethink their preferred aircraft manufacturer. Airbus’ share price has risen 22% this calendar year to date, while Boeing is down 24%.

Brambles

Cutcher & Neale Australian Shares Model

Brambles is the largest global supplier of reusable wooden pallets and services the consumer goods, fresh produce, beverage, retail and general manufacturing industries. The company established its competitive position in markets around the world by being a first mover, achieving critical scale and maintaining positive network effects.

The Investment Committee added Brambles to the Australian Shares Model Portfolio in 2023, to gain exposure to an extremely high quality industrial company with pricing power and reliable revenue streams. The objective being to target moderate growth with a defensive earnings profile, given the ongoing uncertainty in economic conditions.

More recently, Brambles has performed well and beaten earnings expectations. This has been driven by productivity improvements and cost deflation for critical inputs like lumber, energy and transport. Notably, with global growth expected to slow as higher interest rates take effect, customers began destocking. Brambles has successfully offset this weaker near term volume outlook with successful cost discipline and effective price increases.

Airbus

Cutcher & Neale International Shares Model

Airbus is a major aerospace and defence firm. It designs, develops, and manufactures commercial and military aircraft, as well as space launch vehicles and satellites. The company has been in the International Shares Model Portfolio for a number of years, identified primarily for being a high quality, European business with a strong industry position and sustainable growth trajectory.

More recently, Airbus has indirectly benefited from reputational damage experienced by its primary competitor Boeing. Boeing has suffered from a number of incidents over the past five years, with one being in January this year, when a panel blew off its brand-new Alaska Airlines 737 Max.

Investigations are ongoing and operational issues will need to be addressed by Boeing. Given the two effectively run a duopoly, Airbus stands to benefit, as customers rethink their preferred aircraft manufacturer. Airbus’ share price has risen 22% this calendar year to date, while Boeing is down 24%.

Wade is the head of the Investment Services division at Cutcher & Neale and has over 15 years of industry experience in accounting and investment advisory roles.

Wade guides his division on the belief that investment portfolios should be built on transparency and flexibility. His expertise focuses on direct portfolio exposure to both Australian and Global Investment markets.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.