Several key changes to super contribution rules came into effect on 1 July 2022.

This means there are new and expanded opportunities for individuals aged 67 to 74 years to contribute to and grow their super. What has changed?

Removal of the work test requirement

Prior to 1 July 2022, individuals aged 67 to 74 years were required to meet a work test requirement, to be eligible to make non-concessional contributions to super. The work test requires you to be gainfully employed for at least 40 hours in a consecutive 30-day period in the financial year in which the contribution is made.

From 1 July 2022, this work test requirement has been removed for individuals aged 67 to 74 years if making non-concessional contributions and salary sacrifice contributions. It is important to note that the work test still applies if you make a personal contribution and wish to claim a tax deduction.

Please note that other eligibility requirements to make contributions continue to apply, such as the total super balance limits and contribution caps.

‘Bring-forward’ rule age limit extended to 75

Prior to 1 July 2022, only those aged under 67 years on 1 July of a financial year were able to access the ‘bring-forward’ rules. The ‘bring-forward’ rules allow you to potentially make up to three years’ worth of non-concessional contributions in a single financial year, subject to your total super balance.

From 1 July 2022, the ‘bring-forward’ rule has been extended to those aged under 75 on 1 July of a financial year. This is great news for people who want to put as much money as possible into their super before they retire, or for people who receive an inheritance, proceeds from the sale of assets or any other windfall, and want to contribute those into super.

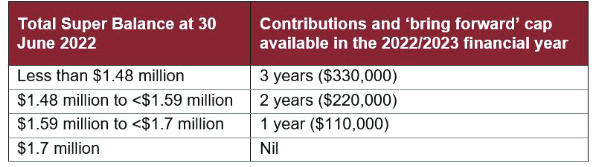

The following table summarises the maximum ‘bring-forward’ cap available in the 2022/2023 financial year, based on your total super balance as at 30 June 2022:

Example: Let’s consider Deborah, who is aged 69 years on 1 July 2022, is fully retired and has a total super balance of $1.32 million at 30 June 2022.

Deborah has received an inheritance of $400,000 from her deceased mother’s estate and is looking to boost her retirement savings.

Prior to 1 July 2022, Deborah would have been unable to make non-concessional contributions to her super, as she was unable to meet a work test. Even if she did meet the work test, she would only have been able to make a maximum of $110,000 in non-concessional contributions in a single financial year.

From 1 July 2022 this changes and Deborah is able to access the ‘bring-forward’ rules. Plus, as her total super balance is less than $1.48 million at 30 June 2022, she is able to contribute up to $330,000 from her inheritance money into her super fund without the need to meet a work test.

Are you interested in knowing more about these super changes and how they apply to you? Please reach out to your advisor.

Cutcher's Investment Lens | 14-18 April 2025

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot