With high rates of inflation both domestically and globally, central banks are aggressively increasing interest rates to bring inflation down to more acceptable levels.

The Reserve Bank of Australia (RBA) for example, has an inflation target of 2-3%, with the current rate running at 5.10% (as at 31 March) and expected to rise further. The RBA increased interest rates at their May meeting by 0.25%, as well as at both their June and July board meetings by 0.50%.

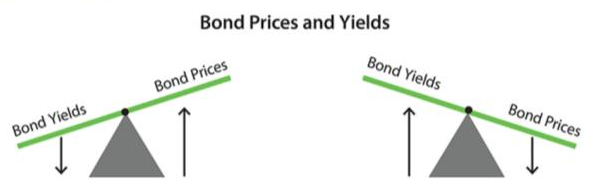

The official and market interest rate will directly affect the yield that can be expected on new bonds issued and those that are currently available on the secondary market, given there is an inverse relationship between bond prices and yields.

A bond is a loan made by an investor to a borrower for a set period of time, normally referred to as time to maturity, in return for regular interest or coupon payments. Bonds can be issued by the Australian Government and/or corporates, with the interest rate paid by the former commonly referred to as the risk-free rate of return, reflecting the low risk of default by the Australian Government. Corporate bonds will generally offer a higher yield to compensate for the higher risk of default.

Bonds can be traded on a secondary market and the price tends to move opposite to the expected yield of the bond. The coupon rate is fixed at time of issue, however, the prevailing market interest changes frequently, which can in turn, affects the yield. If prevailing interest rates increase above the bond’s coupon rate, the bond becomes less attractive. That is, the bond price drops to compensate for the less attractive yield. Conversely, if the prevailing interest rate drops below the bond’s coupon rate, the price of the bond goes up as it becomes more attractive.

Interest rates falling below a bond yield indicates you can achieve a better return by holding the bond than the prevailing market interest rate. Alternatively, interest rates that rise above a bond’s yield allows an investor to achieve a better return on market than by holding the bond.

Bonds are often considered as an investment that aims to generate a return better than cash and classed as a safer investment alternative to that of equities and property, due to their lower price volatility. However, as with all defensive assets such as cash and term deposits, the trade-off for lower risk via investing in bonds is often lower long term investment returns.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.