Superannuation Guarantee Increased to 10%

The Superannuation Guarantee (SG) contribution rate required to be paid by employers on behalf of employees increased from 9.5% to 10%.

Increased Concessional Contribution Cap.

The annual cap for concessional (before-tax) contributions increased from $25,000 to $27,500. Concessional Contributions include Superannuation Guarantee contributions, salary sacrificed contributions and contributions where an individual claims a personal tax deduction in their individual tax return.

Increased Non-Concessional Contribution Cap.

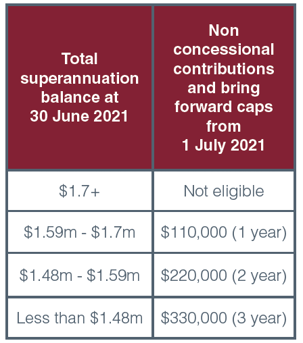

The annual cap for non-concessional (after-tax) contributions increased from $100,000 to $110,000. Eligible members can also trigger the bring forward rule and use two or three years' worth of non-concessional contributions caps in a single financial year (3 years x $110,000 = $330,000).

Bring-Forward Rule extended to 65 and 66 year olds.

Individuals aged 65 or 66 at the start of the financial year are now eligible to utilise the bring-forward rule when making non-concessional contributions. Previously, this provision was only available to individuals aged under 65 at the start of the financial year.

Increased Total Superannuation Balance (TSB) Cap.

The Total Superannuation Balance threshold a person can have and still be allowed to make non-concessional contributions increased from $1.6 million to $1.7 million. Further the Total Superannuation Balance a person can have and still make non-concessional contributions under the bring-forward rule also increased, as demonstrated in the table below:

Increase in the Transfer Balance Cap (TBC)

The transfer balance cap is the lifetime limit on how much super an individual can transfer into retirement phase income streams. The general transfer balance cap has been $1.6 million since 2017, and on 1 July 2021 it was indexed to $1.7 million. Indexation means that there will no longer be a single cap that applies to all individuals. Instead, every individual will have their own personal transfer balance cap of between $1.6 and $1.7 million, depending on their circumstances.

Extension of the temporary reduction in minimum pension draw-down rates.

The temporary 50% reduction in the minimum pension payment requirements has now been extended for another 12 months to cover the 2021-22 financial year.

Increase in the maximum number of members in an SMSF.

The maximum number of members that an SMSF can have increased from four to six from 1 July 2021.

Removal of the Excess Concessional Contributions Charge.

People exceeding their annual concessional contribution cap will no longer be liable to pay the ATO’s Excess Concessional Contributions Charge. Anyone exceeding their annual concessional cap will still be issued with a determination and be taxed at their marginal tax rate (less a 15% tax offset) on the excess amount.

If you are interested in knowing more about how these proposed superannuation measures will impact you or your superannuation fund, please reach out to your adviser.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.