There are system controls set by rules in Ostendo which when triggered, will set sales or job orders to ‘OnHold’ and prevent the user from changing this status.

This ‘OnHold’ order status will prevent order picking, delivery and invoicing until the control reason is addressed.

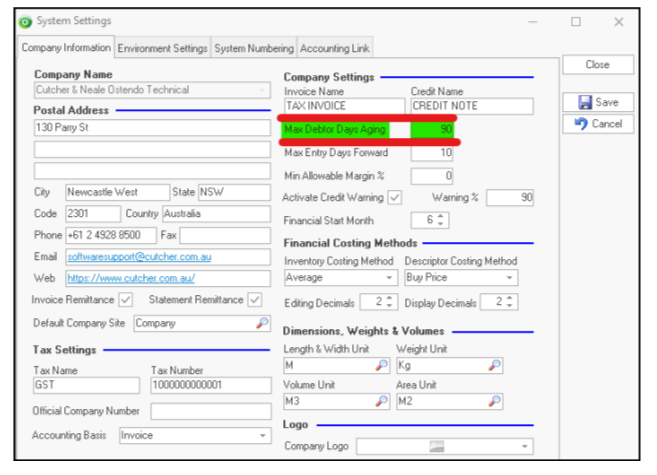

Breaching credit control is the most common reason Ostendo sets orders to ‘OnHold’ and of these the most common reason is a customer’s outstanding balance contains invoices with a due date that exceeds the system settings ‘Max Debtor Days Aging’ threshold. This threshold is the maximum number of days a customer’s debt can age.

This setting can also be overridden in the customer card under Customer Pricing & Invoicing>Credit Control Settings.

If you find an order in an ‘OnHold’ status that cannot be changed, review the following

- Ensure the customer card status is ‘Active’ for both the Order Customer and Billing Customer

- Ensure no invoice or invoice credits due date exceeds the system or customer specific maximum debtor days aging

- Other credit control conditions failed

o Stop Credit

o Credit limit

Further more, if the ‘OnHold’ reason is not clear, then you can add the ‘ONHOLDREASON’ field to your order grid by right clicking and selecting Customize Fields.

To resolve and update the status you will need to communicate internally with a sales manager, internal accountant, or system admin to address the credit control constraint. This typically requires a user with access to system configuration settings, a customer’s credit control settings or able to process a customer receipt in either the accounting or Ostendo system.

If you are unable to resolve, please contact the support team for expert assistance.

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025