Diagnosing Your Finances: Common Tax Ailments and Cures

Nick Carter, Partner, wealthstart

28 August 2023

07 March 2024

minutes

Tax time can be overwhelming for a lot of people, but it can be worse for Doctors in Training if you're unsure about your new tax obligations, haven't kept the right records, or miss out on deductions that can save you money.

As Medico specialists, we know that doctors can have numerous income tax benefits available to them, but the path to receiving them can be full of timing and terminology pitfalls.

Below are the most common topics our clients have questions about when they first start out:

Going On A "Tax Holiday"?

A great way for Doctors in Training to gain experience and exposure to different hospitals and career options is by locuming (or consulting) outside of their direct employment, and it's also a good way to earn additional income. However, it's important to understand the different compliance obligations before you start so you don't get caught out at tax time.

Locum work allows fully registered doctors to substitute at other hospitals, but not as an employee. During consulting work, doctors operate as Sole Traders (considered as running your own business), which changes the way you are paid, and ultimately, how you are taxed.

Some things to consider and address before you begin:

- ABN – You will need to apply for and acquire an Australian Business Number before starting any work as a Sole Trader

- GST Registration (required if you're expected to earn over $75,000 in 12 months) – While locuming, medical services are not always GST-free and you'll be required to bill for GST on top of your consulting work and report it to the ATO

- Business Activity Statements (BAS) – Required to report your GST

- Tax Planning – It’s important to keep accurate records of your Sole Trader income and carefully plan how much tax you’ll need to pay (including increased HECS-HELP repayments)

- Superannuation – Sole Traders don’t generally receive Super contributions, so if appropriate, you can make your own

- Insurances – You’ll likely be responsible for your own indemnity and should review your coverage

Laws and tax requirements for locum doctors can differ between states, so it's always best to check these before working across state borders.

Do I Need To Lodge A BAS?

A Business Activity Statement (BAS) provides the ATO with a report of sale and a summary of the taxes you have paid relating to your Sole Trader activity (i.e. business taxes). This can include Goods and Services Tax (GST), Pay As You Go (PAYG) tax, Fringe Benefits Tax (FBT), and more. A BAS is only required once you have received your ABN, are GST-registered, and are gaining income through it.

Frequency of Lodgment:

- Monthly – GST turnover of more than $20 million

- Quarterly – GST turnover of less than $20 million

- Annual – GST turnover of less than $75,000 and you are voluntarily registered for GST

Should I Salary Sacrifice?

Salary Sacrificing (or Salary Packaging) can be an effective tool for Doctors in Training as incomes start to increase, pushing you into higher tax brackets. It can allow you to pay for certain expenses or make additional Superannuation contributions pre-tax, resulting in a lower taxable income and potentially saving you money.

However, the conditions surrounding Salary Packaging can be complex for those who have a HECS-HELP debt.

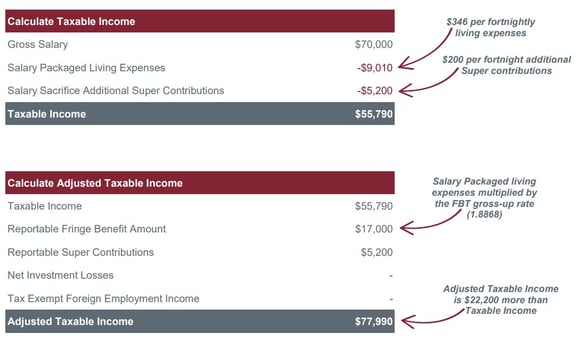

A common assumption is that by reducing your taxable income to below the HECS-HELP debt threshold, no repayments are required. However, the ATO calculates your repayments based on your 'adjusted taxable income', also known as your HECS-HELP Repayment Income (RI). With Salary Packaging, your ‘adjusted taxable income’ can end up higher than your taxable income as shown below.

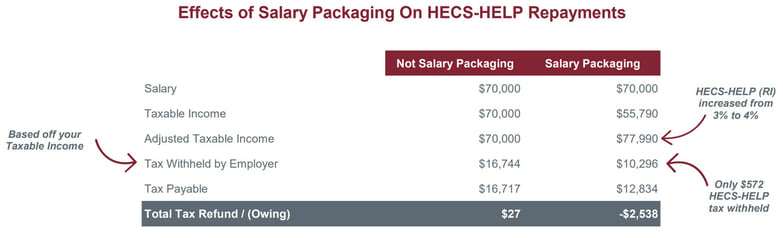

This can result in your employer not withholding enough tax to cover your increased HECS-HELP repayment amount. It's important to understand how this ‘adjusted taxable income’ affects your total tax payable, which can be different from the tax withheld by your employer, so you don’t end up with a debt when you lodge your return.

This can be exacerbated by the fact that income increases have an exponential impact on your HECS-HELP debt repayments, even within a singular year as you progress into higher-paying roles or accrue overtime pay. For example, the HECS-HELP repayment rate on a $70,000 salary is 3%, while a $100,000 income rate is 6%, resulting in a $3,900 repayment increase at tax time.

While the additional HECS-HELP repayment debt above can be mitigated by requesting additional tax be withheld by your employer, Doctors in Training are also well positioned to optimise their Salary Packaging for their HECS-HELP debt.

Hospitals are exempt from paying FBT, meaning employees can salary sacrifice directly to their HECS-HELP debt without having a fee passed onto them, unlike many other professionals. If you don't have a mortgage or other debt, paying off your HECS-HELP loan sooner through packaging allows you to not only reduce your taxable income (on something you wouldn't ordinarily receive a tax deduction for) but also lower your repayments faster by lowering your debt faster.

Our medico specialist accountants have the knowledge and experience to guide you around potential tax blunders as you advance along your career pathway. As your tax requirements become more complicated, it's best to seek advice.

Contact us today to learn more about our WealthStart Packages available to Doctors in Training.

Nick Carter joined the firm in 2005 and became Partner in 2025. Specialising in guiding medical professionals through their financial journey, Nick is known for his motivated, analytical, and trustworthy approach. He played a key role in growing the wealthstart client base beyond 200, helping early-career doctors gain confidence and clarity in their financial future.