Whether it’s Christmas parties, EOFY celebrations, or any events in between, a little bit of planning now could save you from a rude FBT shock come tax time.

What Is FBT?

If you (an employer) provide your employees, employees’ families, or other associates with certain benefits, you might be liable to pay Fringe Benefits Tax (FBT).

As an employer, it’s your responsibility to keep track of the Fringe Benefits you provide to your employees and because it’s self-assessed, it’s something that can be easily and innocently misunderstood.

Calculated separately from income tax, FBT is based on the value of the benefit provided and must be lodged with the ATO (the FBT year is 1 April to 31 March).

What Can Be a Fringe Benefit?

A Fringe Benefit is like making a payment to an employee that isn’t a salary, wage, or bonus.

Something may be deemed as a Fringe Benefit when provided to your employee if it is:

- something that you, as the employer, have incurred as an expense, and

- something that your employee would ordinarily incur the cost of otherwise

Situations such as providing car parking on the business premises, letting an employee use a company car for private purposes, covering study expenses, or giving employees tickets to a concert or football game are all benefits you’ll be required to pay FBT on.

This also includes holiday and event functions, as well as employee gifts.

Be Ready for the Holiday Period

Events and entertainment can seem like the grey area for FBT, and misunderstanding what qualifies and what doesn’t can catch you out if you’re not careful.

Everyone loves the holiday season, and we’re sure you enjoy taking the opportunity to reward your staff for their hard work during the year with parties or presents to celebrate.

However, you probably want to do your best to avoid costing yourself and your business more than you meant to spend.

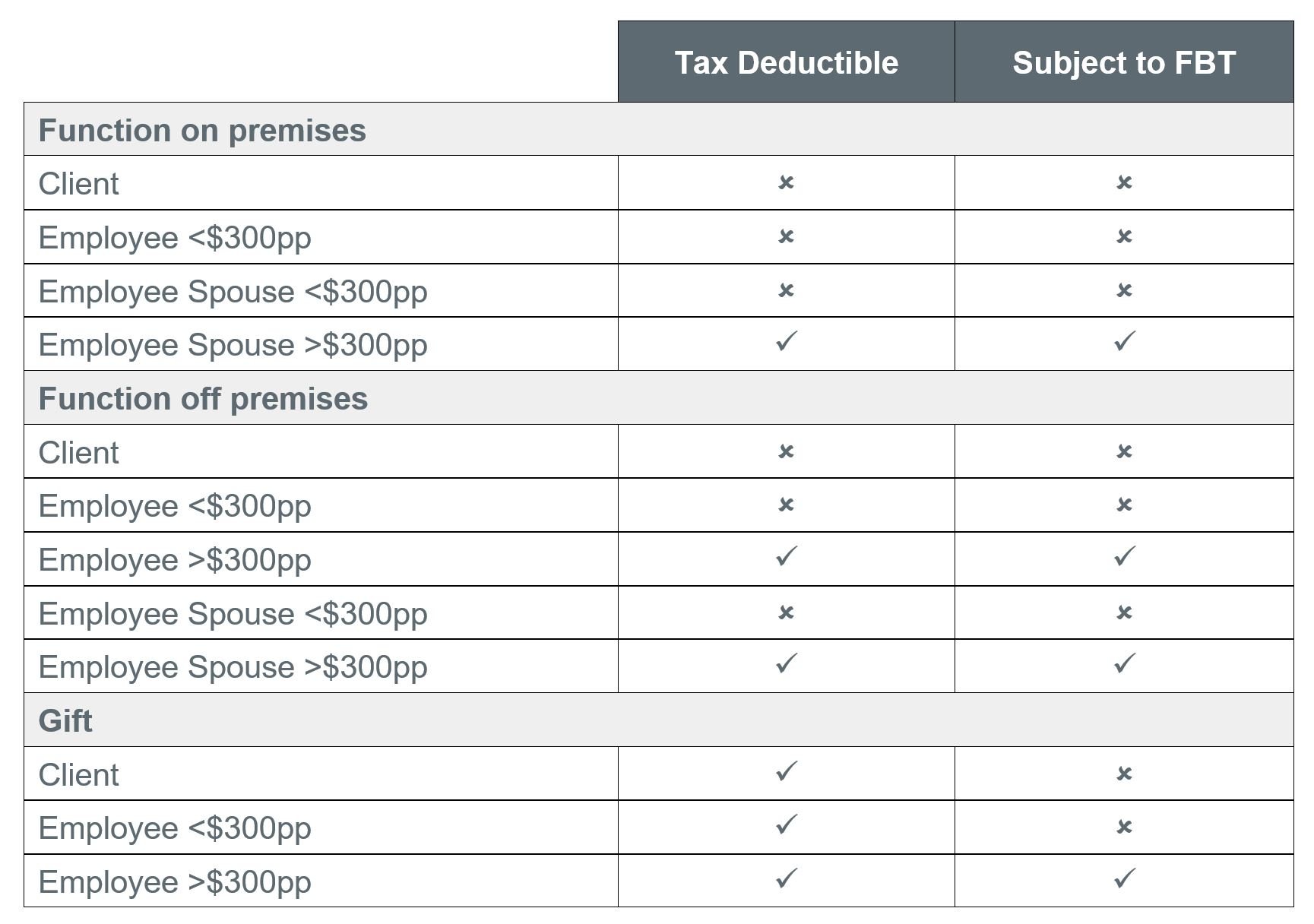

So, here’s our gift to you! Our FBT event summary can help you navigate the gift of giving to your employees for the upcoming season:

Please note the above only applies if you are using the actual method to calculate FBT, as opposed to the 50/50 method.

If gifting cash bonuses you should always consider the tax consequences. Bonuses are regarded as ordinary times earnings and must be included when calculating the 11% super.

Not factoring in the appropriate withholding tax may result in a tax bill to your employee come year-end. The responsibility rests with you, the employer, to ensure PAYG, FBT and superannuation are appropriately remitted.

Unsure about Fringe Benefits Tax and want to make sure you get it right? Speak to one of our Advisors today for guidance.

Jarrod Bramble is the Managing Partner of Cutcher & Neale, leading a 22-Partner firm with more than 220 staff across four Australian offices and offshore support teams. He has driven the firm’s east coast expansion, embedding core values, corporate governance and an Executive Leadership model that fosters alignment across the partnership. Recognised as Innovative Partner of the Year at the 2019 Xero Awards, Jarrod is passionate about developing forward-thinking strategies that help clients achieve their financial, business and investment goals. As custodian of Cutcher & Neale, he is committed to nurturing its legacy for the next generation.

A fully funded opportunity to improve efficiency for regional NSW manufacturers

Start strong in January: Why smart tax planning begins well before June

AI Explainer: Who’s Behind the Tools You Keep Hearing About?

Ready for Next-Level Automation? See What’s New in Ostendo 243

Thinking ahead, acting today: Must-know succession strategies for practice owners