|

|

Quick TakeGlobal financial markets rose in January as the US Federal Reserve signalled a pause in rate hikes, aiming for a normalised interest rate environment in 2024 following two lower inflation figures. Despite cautious optimism for the year, slower global growth is expected in 2024, attributed to a weaker consumer sector and job market. Most central banks have likely reached peak interest rates, but residual inflation risks, especially in services, require monitoring. Expectations for 2024 include declining interest rates by year-end, with the US leading, followed by the UK and Europe, with Australia expected to lag. Attention now shifts to balancing monetary policy adjustments to control inflation and sustain growth amid geopolitical tensions and technological shifts. |

|

Snapshot

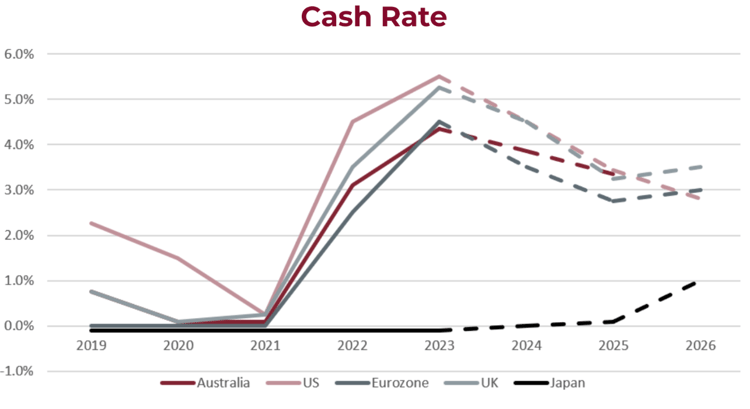

Global financial markets finished mostly higher in January following an announcement by the US Federal Reserve in mid-December that they are all but done raising rates in the world’s largest economy. The Fed's decision to shift towards a more normalised interest rate environment for 2024 was influenced by lower inflation figures.

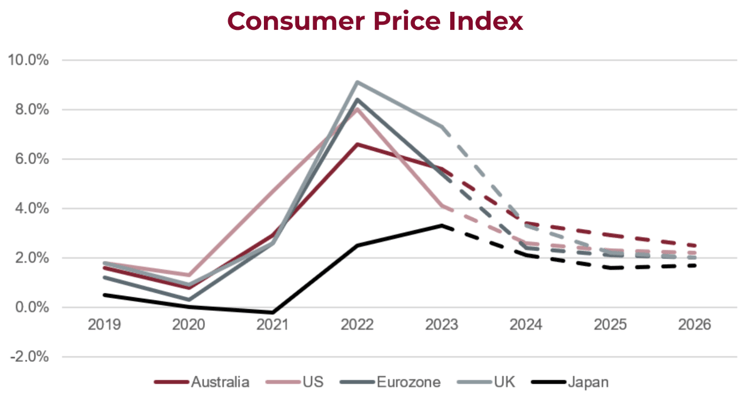

Looking ahead to the remainder of the year, we are cautiously optimistic given the progress that has been made. Inflationary pressures have alleviated somewhat, with core inflation metrics nearing central bank targets on an annualised basis.

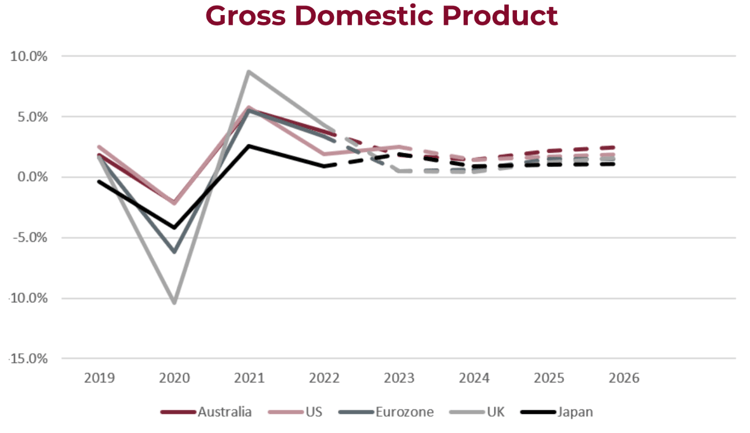

There are indications that global growth will be slower in 2024, primarily due to a less robust consumer sector and a less favourable job market. For most central banks, it appears that interest rates have peaked. However, further time is required to address residual inflation risks — particularly in the services sector — throughout 2024. The prospect of a soft economic landing is becoming more feasible, albeit posing challenges in returning to a low inflation environment.

The US economy demonstrated remarkable resilience throughout 2023, benefiting from increased fiscal stimulus and policy support to sustain growth. However, data showed a deceleration in growth towards the end of 2023, with forecasts predicting a moderate slowdown by mid-2024.

Factors contributing to softer growth include a stagnant housing sector, the waning effects of pandemic stimulus, and slight weakness in the job market.

It is anticipated that interest rates will decrease by the end of 2024, with central banks expected to begin rate cuts by mid-year. Slower growth and increasing real rates as inflation recedes are likely catalysts for this action. The US is anticipated to lead this shift, followed by the UK and Europe, while Japan is expected to maintain stimulative policies. Australia may well lag behind given inflation is taking longer to return to target levels.

For central banks, the immediate challenge lies in ensuring that monetary policy adjustments have been adequate to steer inflation back towards target levels, typically around 2% (or 2-3% in Australia). Subsequently, attention will shift to determining the duration of restrictive measures required to safeguard the growth outlook without causing undue economic harm.

Thus, 2024 presents the potential for a more favourable market environment as the path towards lower rates becomes clearer. Nonetheless, the year also brings the prospect of renewed volatility, with geopolitical tensions in Europe and significant elections in the US and elsewhere involving billions of voters.

Furthermore, structural shifts such as the advancement of artificial intelligence and the energy transition will continue to impact markets and economies globally.

Key Stocks

Corporate Travel Management

Cutcher & Neale Australian Shares Model

Corporate Travel Management is an Australian-based company that provides travel services for business and government clients across the globe. The company specialises in a range of travel needs, including corporate, meetings and events, leisure, loyalty, and wholesale travel.

Corporate Travel Management is among the leaders in the travel sector, with the company now the fourth-largest travel service provider. Corporate Travel Management is in a strong position given its 97% historical retention rate, demonstrating a strong degree of management expertise.

The Investment Committee recently added the travel company to the Cutcher & Neale Australian Shares Model given its strong corporate earnings and expected growth within the Travel sector.

CSL

Cutcher & Neale Australian Shares Model

CSL is one of the world’s largest biopharmaceutical companies, engaging in the manufacturing and distribution of medical products. The company operates through three main segments: CSL Behring (Rare & Serious Diseases), CSL Seqirus (Vaccines) and CSL Vifor (Iron Deficiency & Nephrology).

The defensive healthcare company has a strong, proven track record for research and development. Now the second-largest influenza vaccine manufacturer worldwide and a leader in plasma collection, it owns 30% of collection centres globally.

CSL has remained a core holding in the Cutcher & Neale Australian Shares Model since the inception of the Model, providing stellar returns over this period.

Corporate Travel Management

Cutcher & Neale Australian Shares Model

Corporate Travel Management is an Australian-based company that provides travel services for business and government clients across the globe. The company specialises in a range of travel needs, including corporate, meetings and events, leisure, loyalty, and wholesale travel.

Corporate Travel Management is among the leaders in the travel sector, with the company now the fourth-largest travel service provider. Corporate Travel Management is in a strong position given its 97% historical retention rate, demonstrating a strong degree of management expertise.

The Investment Committee recently added the travel company to the Cutcher & Neale Australian Shares Model given its strong corporate earnings and expected growth within the Travel sector.

CSL

Cutcher & Neale Australian Shares Model

CSL is one of the world’s largest biopharmaceutical companies, engaging in the manufacturing and distribution of medical products. The company operates through three main segments: CSL Behring (Rare & Serious Diseases), CSL Seqirus (Vaccines) and CSL Vifor (Iron Deficiency & Nephrology).

The defensive healthcare company has a strong, proven track record for research and development. Now the second-largest influenza vaccine manufacturer worldwide and a leader in plasma collection, it owns 30% of collection centres globally.

CSL has remained a core holding in the Cutcher & Neale Australian Shares Model since the inception of the Model, providing stellar returns over this period.

Wade is the head of the Investment Services division at Cutcher & Neale and has over 15 years of industry experience in accounting and investment advisory roles.

Wade guides his division on the belief that investment portfolios should be built on transparency and flexibility. His expertise focuses on direct portfolio exposure to both Australian and Global Investment markets.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.