Diversification is key in investing, but do you have true and considered diversification across multiple factors?

Diversification is a key investment principle, aiming to limit risk and volatility in investment outcomes and improve the risk-adjusted returns of a portfolio. The most simple and well-known adage of diversification is to “not have all your eggs in one basket”.

In practice, diversification involves spreading your investments across numerous asset classes, sectors, market economies and geographies. Through careful allocation to various investment types, you can limit the impact of any one particular investment on the overall performance of the portfolio.

When seeking to improve the diversification of any given portfolio, it’s important to consider the correlation between investments, that is, their relationship when it comes to performance. Historically, stocks and bonds have been considered to be negatively correlated, meaning when stocks performed poorly, bonds did well (vice versa).

This meant investors could ‘smoothen’ out their returns by constructing their portfolio with a mix of stocks and bonds to suit their investment objectives. The result of which was superior risk-adjusted returns over a long time horizon, compared to a portfolio comprised wholly of stocks or bonds. Famously, at least in the finance world, this effect is what economist and Nobel Prize winner Harry Markowitz referred to when he coined the phrase, “diversification is the only free lunch in investing”.

However, particularly in an inflationary and rising interest rate environment, stocks and bonds are not always negatively correlated. Throughout 2022, investors may have come to realise that both asset classes lost their value over the year. This emphasised the importance of true and considered diversification across multiple factors i.e., not just asset classes. For example, commodity related investments (gold) performed relatively well, given their value has historically held up amid rising inflation, which meant if they were included in a portfolio, they could have helped offset losses made in stocks and bonds.

While the level of diversification appropriate for one’s investment portfolio can vary, based on their time horizon, risk tolerance and financial goals, empirical evidence has proven diversification can assist in the optimisation of risk-adjusted returns for any given portfolio.

Investment Portfolio Examples

Portfolio Analysis

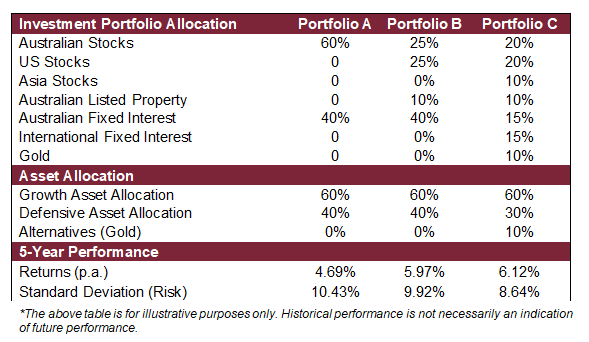

The above illustration can help explain the benefit of diversification over time. Portfolios A, B and C all have very similar total allocations when it comes to growth assets (i.e., stocks, property) and defensive assets (i.e., cash and fixed interest). However, Portfolio A has limited diversification across other factors like asset class,

market economies and geographies, while Portfolio B is somewhat diversified and Portfolio C is the most diversified.

We can clearly see that, historically over the past five years, Portfolio C (being the most diversified) has performed the best. Portfolio C has produced the greatest returns, with the least amount of volatility (risk), meaning it has achieved superior risk-adjust returns.

If you would like to discuss your investment options, get in touch with our team on 1800 988 522 or visit cutcher.com.au.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.

.png?width=728&height=73&name=Diversification%20(1).png)