It is important to note that the indexation of the general transfer balance cap (“TBC”) did not result in the contribution caps changing.

However, the annual concessional contributions cap, currently $25,000, is indexed in line with average weekly ordinary times earnings (“AWOTE”) in increments of $2,500. On 25 February 2021, the AWOTE data released confirmed that indexation will occur from 1 July 2021. Therefore, the annual concessional contribution cap commencing 1 July 2021 will be $27,500.

The annual non-concessional contributions cap, currently $100,000, is four times the concessional contribution cap, so it will increase to $110,000 from 1 July 2021. Further the Bring Forward Provision which allows an individual to utilise 2 or 3 years’ worth of their non-concessional contribution cap in a single year will also be impacted.

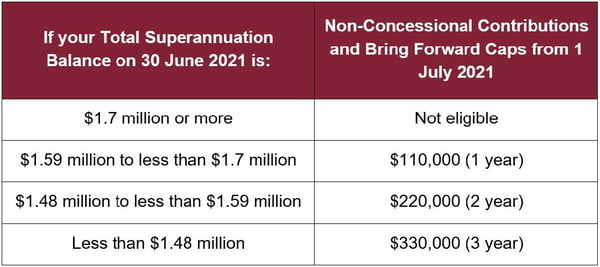

Further as a result of the indexation of the TBC (refer to previous article), the total superannuation balance cap (TSB) has also increased from $1.6 million to $1.7 million on 1 July 2021. This will have an impact on the eligibility of several contribution caps with the main cap impacted being non-concessional contributions and bring forward provision.

The following table outlines the new annual and bring forward provision cap for non-concessional contributions from 1 July 2021:

What has not changed?

It is important to note that not all superannuation measures have been impacted by the indexation of the general TBC. Below are the measures that have not been affected:

- The $500,000 TSB limit which determines one’s eligibility to make ‘carry-forward’ catch-up concessional contributions from 1 July 2018 has not changed.

- The $300,000 TSB limit which determines one’s eligibility to access the work test exemption from 1 July 2019 has not changed.

- The $1.6 million threshold used to work out whether an SMSF can claim a tax exemption on its investment income using the “segregated method” has not changed.

- The $1 million TSB threshold which determines how often an SMSF is required to report transfer balance account events to the ATO has not changed.

As superannuation is about to get a lot more complex from 1 July 2021, we strongly recommend that you seek professional advice from your adviser before deciding to implement any contribution and pension strategies in your superannuation fund.

If you would like to discuss this further with one of our superannuation specialists, please contact the Superannuation team.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025