Would you rather put extra money into your savings account or your super? For most young Australians, the quick answer is probably the former.

Retirement is decades away! Making additional super contributions is probably the last thing on your mind. The fun of a savings account is watching your balance grow and knowing that you can use it whenever you want for a holiday or indulgent purchase, unlike the funds in your super that are “locked away” and forgotten about.

However, it’s worth thinking about, especially while you’re young.

For many, retirement is a non-urgent reality of life, and if you’re currently thinking about buying your first home or starting a family, finding extra cash for super can seem like a low priority. But contributing to your super early can have a big impact on how easy your twilight years will be.

The best part? It doesn’t take much right now to get a lot later on.

Super vs Pension

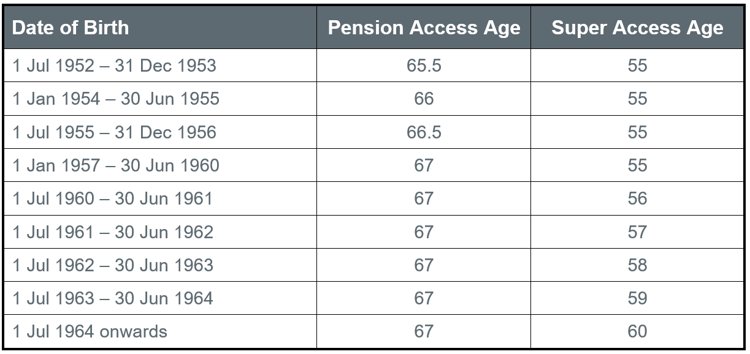

Like most people, you’ve probably thought about the day when you don’t have to work anymore. But when will that be? The pension age has been steadily increasing over the last two years, reaching 67 as of 1 July 2023. This doesn’t mean you can’t retire before then, but it does change how you do so in terms of your retirement income stream.

Age Pension

The Age Pension is a support benefit paid by the government to ensure basic living standards for Australians once they reach the qualification age. You can access the pension once you reach this age, but the amount you receive will depend on factors such as your assets, whether you’re still receiving an income, and your Super balance.

Superannuation Fund

Your super fund is an investment account that is, ordinarily, comprised of savings contributed by your employers over the course of your working life. These deposits are based on a percentage of your earnings (currently 11%), although this is set to increase over the coming years until it reaches 12% in the 2026 Financial year.

You can gain access to your super once you either:

- reach your ‘preservation age’ and are permanently retired

- reach ‘preservation age’ and are eligible for a transition to retirement pension

- turn 65

For most people, you’re super will be your primary income source when you retire. Due to the compounding nature of super funds, the more you put in early, the more it ends up being once you can access it.

How Does It Work?

You can elect to direct additional contributions into your superannuation in a couple of ways, and a small amount can grow exponentially over the life of the fund. For instance, the average return over the past 30 years within a growth super fund has been 8.2% per annum.

CASE STUDY

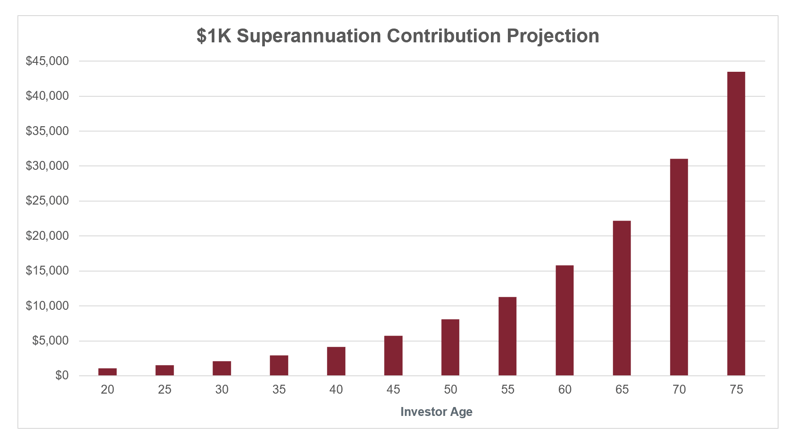

When Simon is 20 years old, he makes an additional superannuation contribution of $1,000 into his super fund. After 20 years with an anticipated 8.2% p.a. growth rate, Simon’s single deposit will grow to be approximately $3,848, or almost 4 times the amount invested.

The longer it’s in the fund, the more it grows. By the time Simon is 75 years old, this amount will grow to over $43,000 or more than 43 times the original investment.

*The above graph shows the interest projection of $1k invested at 20 years of age with a growth rate of 8.2% sustained over all periods after accounting for tax

The graph above shows how much of Simon’s investment growth happened in the final 10–15 years. If Simon had waited until he was 30 years old to make the same contribution, he would only have just over $22,000 by the time he was 75, nearly half as much.

Kinds of Contributions

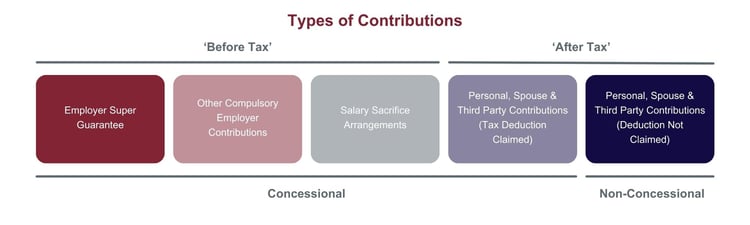

There are two different ways you can contribute funds into your superannuation:

- Concessional Contributions — contributions made to the fund that the individual claims a tax deduction on

- Non-Concessional Contributions — contributions made to the fund that the individual does not claim a tax deduction on

Your superannuation is taxed at a lower taxation rate. You can make additional contributions into your super fund in several ways. The below are the most common:

Salary Sacrifice

You can nominate your employer to withhold a specified amount of your pre-tax income to contribute on your behalf, which can lower your taxable income. These deposits are taxed at 15% on entry.

Post-Tax Non-Concessional Contribution

You can contribute to your super from your post-tax (take-home) income. As this money has already been taxed at your effective tax rate, it pays no tax upon entry into your fund.

Post-Tax Concessional Contribution

This works the same as the above, except once you claim this contribution as a tax deduction in your Return, your super fund will then make a 15% tax payment on your behalf to the ATO.

Once your contributions have been made to your super fund, only your earnings are taxed at 15%.

Contribution Limits

Hint: it’s important to put a little more into your super while you’re young because you can’t put a lot in when you’re older.

There are caps that limit the amount of superannuation that can be contributed into your funds each year.

- Concessional Cap – $27,500

- Non-Concessional Cap – $110,000

This means that when you’re later in your life and career and are looking to buff up your super balance in preparation for retirement, you’re restricted in how much you’re able to add.

Prior to the reduction of these caps to their current levels, it was common for investors to pay off their mortgage and any other debt first, and then in the years leading up to retirement they would make large contributions into their super. Because the current caps are much lower now, this means that when you’re later in your life and career and looking to buff up your super balance, you’re restricted in how much you’re able to add, and making large contributions can be trickier.

This, combined with the benefit of compounding on the earnings, can mean that it absolutely pays to start thinking about your superannuation when you’re young and to make early additional contributions when you can.

While retirement may seem like a long way off for many and that your super isn’t a priority because of it, those that have a better understanding of how it works will benefit. Your superannuation fund is designed to grow significantly over time — it will likely be the longest and largest investment you will ever have, so get excited as you watch it grow!

Unsure if there’s enough in your super for retirement or need help with your contribution strategies? Our expert advisors can help you optimise your investments.

Get in touch with us today to get started.

Sam is the Partner of Cutcher & Neale's Superannuation Division. He believes that with continual changes to Superannuation, it's essential to stay ahead and develop tactical strategies for our clients to ensure their wealth is protected and secured.

With a wealth of knowledge and experience, Sam takes a hands-on, personal approach to ensure our clients have the very best plans in place from the very beginning.

Cutcher's Investment Lens | 30 June - 4 July 2025

Cautious Optimism - July 2025 Snapshot

Cloud accounting for small business: More clarity, less admin.

Key business actions for the new financial year.

Cutcher's Investment Lens | 23 - 27 June 2025