|

|

Quick TakeGlobal financial markets recorded a fourth consecutive month of gains in February, with Japan notably surpassing its 1989 record high. Iron ore prices declined in February due to ongoing struggles in the Chinese economy, dampening expectations for the construction sector despite earlier hopes pinned on stimulus measures. The prevailing theme across markets in February was one of patience. In the US, higher-than- With inflation easing towards central bank targets, we remain cautiously optimistic for markets |

|

Snapshot

Global financial markets finished higher in February, marking the fourth consecutive month of gains.

Japan had a particularly strong month, finally surpassing the record high last set in 1989, while the Australian Dollar was relatively unchanged against major currencies. For the first time in a while, however, Australian bond yields diverged from their global counterparts, finishing broadly flat, while US and European bond yields moved higher.

Commodity markets witnessed mixed performance, with iron ore notably weak due to the continued slowdown in the Chinese economy.

This decline dashed hopes for a rapid recovery in the construction sector heavily reliant on steel. Despite reaching a peak of US$145 in early January on the back of anticipated Chinese stimulus measures, iron ore prices fell to US$115 in late February as these measures failed to produce significant economic improvements.

Throughout February, the main theme in markets was one of patience. The ebullient mood from

December and January moderated somewhat, as inflation data proved more stubborn than anticipated and interest rate markets repriced expectations of rate cuts this year and next.

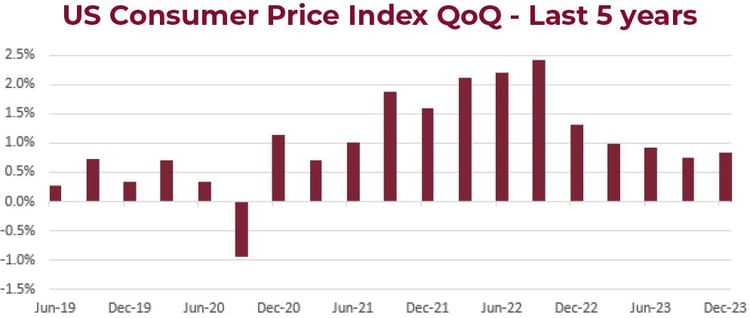

In the US, the Consumer Price Index for January exceeded expectations, rising by 0.3% month-on-month, driven primarily by a 0.6% increase in shelter costs. Although this data indicates a stronger-than-expected inflationary trend, recent reports suggest softer rental growth, mitigating concerns.

Consequently, the futures market now predicts the US Federal Reserve will maintain interest rates in March and May, before implementing a 0.25% cut in June.

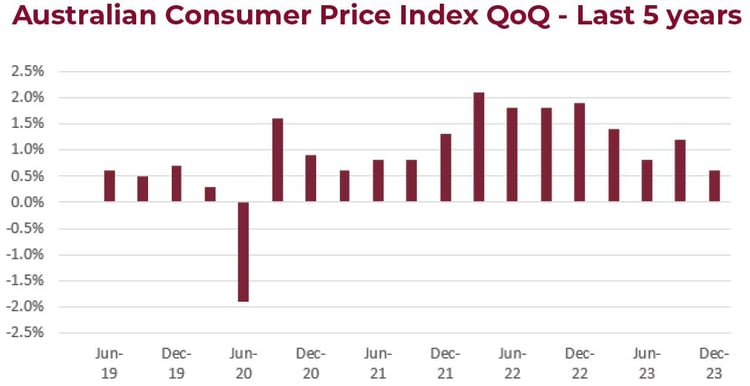

In Australia, despite slowing growth and declining inflation, the Reserve Bank of Australia (RBA) maintained the interest rate at 4.35% in early February for the second consecutive meeting.

Governor Michele Bullock reiterated the board's commitment to achieving the 2-3% inflation

target by 2025. Moreover, Australia's Consumer Price Index recorded a 3.4% increase over the last 12 months to January, remaining steady from December.

This represents the lowest annual inflation rate since November 2021, further supporting market

expectations of a 0.25% rate cut by the RBA in September.

We remain cautiously optimistic for the year ahead given the progress that has been made.

Inflationary pressures have alleviated somewhat, with core inflation metrics nearing central bank targets on an annualised basis. Thus, 2024 presents a favourable market environment as the path towards lower rates becomes clearer.

Key Stocks

AUB Group

Cutcher & Neale Australian Shares Model

AUB Group is a wholesale and retail

insurance broker and underwriting company, based in Australia, with more than 570 locations around the world. AUB derives the majority of their business from commercial (89%) insurance policies, while also providing some personal (11%) insurance.

AUB is the second largest general insurance broker in Australia and New Zealand. The company receives majority of their revenue from commissions, which are paid by insurers based on the written premiums. AUB has benefited from higher insurance premiums across the sector, which has helped achieve a 36% increase in revenue for the first half of the financial year.

The Investment Committee added AUB

Group to the portfolio in the second half

of last year, to increase our exposure to the Financials sector. AUB is seen as a value company, as its size provides them with the ability to negotiate more favourable policies, compared to smaller brokers.

Stellantis

Cutcher & Neale International Shares Model

Stellantis is a global automaker, with over 14 brands, now making it the fifth largest automaker worldwide. The company is largely based in Europe (44%), followed by North America (31%) and South America (14%). Some of Stellantis’ brands include Dodge, Jeep, Fiat, Ram and Maserati. Stellantis was founded in 2021, from the merger of Peugeot and Fiat Chrysler.

The company has a large focus on achieving net zero carbon emissions, which has seen the creation of their Dare Forward 2030 strategic plan. The plan sets out a path to achieve not only net zero emissions by 2038, but a financial plan to double net revenue by 2030 and sustain double digit operating income margins throughout the decade.

Stellantis has been a core holding in the

International Share Model since 2021 and continues to achieve stellar returns for the portfolio. The Investment Committee remains confident on the growth potential of the company and its ability to transition further into electric vehicle production.

AUB Group

Cutcher & Neale Australian Shares Model

AUB Group is a wholesale and retail

insurance broker and underwriting company, based in Australia, with more than 570 locations around the world. AUB derives the majority of their business from commercial (89%) insurance policies, while also providing some personal (11%) insurance.

AUB is the second largest general insurance broker in Australia and New Zealand. The company receives majority of their revenue from commissions, which are paid by insurers based on the written premiums. AUB has benefited from higher insurance premiums across the sector, which has helped achieve a 36% increase in revenue for the first half of the financial year.

The Investment Committee added AUB

Group to the portfolio in the second half

of last year, to increase our exposure to the Financials sector. AUB is seen as a value company, as its size provides them with the ability to negotiate more favourable policies, compared to smaller brokers.

Stellantis

Cutcher & Neale International Shares Model

Stellantis is a global automaker, with over 14 brands, now making it the fifth largest automaker worldwide. The company is largely based in Europe (44%), followed by North America (31%) and South America (14%). Some of Stellantis’ brands include Dodge, Jeep, Fiat, Ram and Maserati. Stellantis was founded in 2021, from the merger of Peugeot and Fiat Chrysler.

The company has a large focus on achieving net zero carbon emissions, which has seen the creation of their Dare Forward 2030 strategic plan. The plan sets out a path to achieve not only net zero emissions by 2038, but a financial plan to double net revenue by 2030 and sustain double digit operating income margins throughout the decade.

Stellantis has been a core holding in the

International Share Model since 2021 and continues to achieve stellar returns for the portfolio. The Investment Committee remains confident on the growth potential of the company and its ability to transition further into electric vehicle production.

Wade is the head of the Investment Services division at Cutcher & Neale and has over 15 years of industry experience in accounting and investment advisory roles.

Wade guides his division on the belief that investment portfolios should be built on transparency and flexibility. His expertise focuses on direct portfolio exposure to both Australian and Global Investment markets.

Cutcher's Investment Lens | 10-14 February 2025

Cutcher's Investment Lens | 3-7 February 2025

Trump 2.0 - February 2025 Snapshot

Big super changes from July 2025: Contributions and additional pensions for higher balances

Cutcher's Investment Lens | 27-31 January 2025