Pre-Open Data

Key Data for the Week

- Monday – CoreLogic Dwelling Prices

- Tuesday – AUS – RBA Interest Rate Decision

- Wednesday – UK – House Prices

- Wednesday – US – FOMC Rate Decision

- Wednesday – AUS – Building Approvals

- Wednesday – EUR – Unemployment Rate

- Thursday – AUS – Retail Sales

- Thursday – UK – BoE Policy Meeting

- Friday – EUR – Retail Sales

- Friday – US – Unemployment Rate

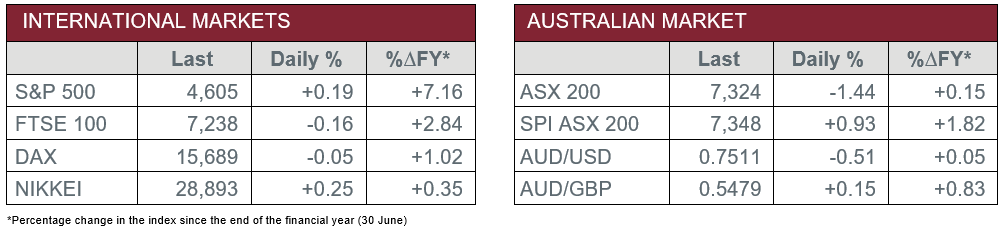

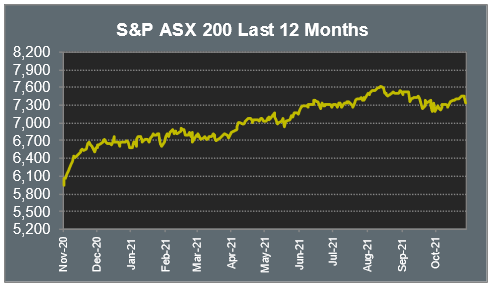

Australian Market

The Australian sharemarket closed Friday’s session 1.4% lower, as the Australian three-year bond yield increased to 0.775%.

The Financials sector lost 1.8%, as all the ‘big four’ banks lost ground. NAB shares feared worst, down 2.5%, while Westpac lost 2.1%. Commonwealth Bank and ANZ slipped 2.0% and 1.6% respectively. Macquarie Group reported their earnings, which more than doubled their first-half profit. The company also announced a $1.5 billion capital raising to pursue new opportunities.

Losses among the major miners dragged the Materials sector 1.0% lower. BHP and Rio Tinto shed 1.2% and 2.7% respectively, while Fortescue Metals conceded 0.6%. Lithium producer, Vulcan Energy, closed the session 16.5% lower after the company responded to an online ‘short’ report.

The Australian futures market points to a 0.93% rise today.

Overseas Markets

European sharemarkets ended Friday’s trading session relatively flat. The Financials sector was boosted by increased bond yields; Barclays gained 1.5% and Deutsche Bank lifted 0.6%, while ING Groep added 0.3%. The Energy sector lost ground as oil prices slipped from recent highs. BP lost 1.5% and Royal Dutch Shell conceded 1.7%. By the close of trade, the UK’s FTSE 100 and the German DAX both lost 0.1%, while the STOXX Europe 600 rose 0.1%.

US sharemarkets lifted on Friday, as Microsoft shares reached a record high and closed 2.2% higher. Apple shares fell 1.8% after warning investors of potential supply-chain disruptions. Amazon slipped 2.2% after the company forecasted downbeat holiday-quarter sales as a result of labor shortages, as well as increased shipping costs. By the close of trade, the Dow Jones closed up 0.2%, while the S&P 500 and NASDAQ gained 0.2% and 0.3% respectively.

CNIS Perspective

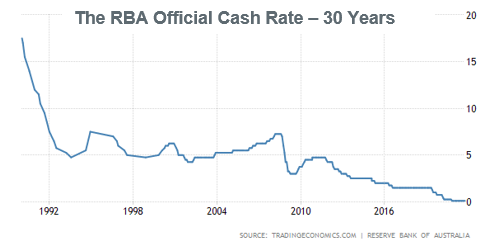

Australia’s love affair with home ownership has been a rewarding one, with an annualised growth rate of ~7% for 30 years, largely the result of low interest rates due to low inflation. In 1990 the best performing major global asset class according to Vanguard was Australian cash, returning 18.5% that year. This was due to the Reserve Bank of Australia’s (RBA) official cash interest rate reaching an all-time high of 17.5% in January 1990, which created tremendous mortgage stress that many of us would like to forget, or if too young, cannot fathom.

As we now sit at a record low cash rate of 0.10%, set in November of 2020, the RBA ponders its next move after inflation slipped into its target band between 2-3% after core inflation hit 2.1% last week. The Consumer Price Index does not include changes in land prices, so soaring house prices have been ignored in these figures. Australia has the second-highest mortgage debt as a proportion of GDP among OECD nations, with the Australian residential property asset class now valued at $9 trillion.

The current stance by RBA Governor Philip Lowe is to leave rates at 0.10% until 2024. However, last Thursday following the release of the inflation data, bond traders started to bet against this forward guidance provided by our central bank, pushing the Australian Government Bond 2-year yield to 0.48%, more than doubling from the previous session. What was more interesting is the RBA’s decision against buying any of the target bond, telegraphing that its Yield Curve Control - at least on the short end - is now, for all intents and purposes, over.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.