Pre-Open Data

Key Data for the Week

- Monday – AUS – MI Inflation

- Monday – US – Markit Manufacturing PMI

- Tuesday – AUS – RBA Cash Rate Decision

- Tuesday – EUR – Unemployment Rate

- Wednesday – AUS – Retail Sales

- Wednesday – US – FOMC Funds Rate Decision

- Thursday – AUS – Trade Balance

- Thursday – UK – BoE Bank rate Decision

- Friday – US – Unemployment Rate

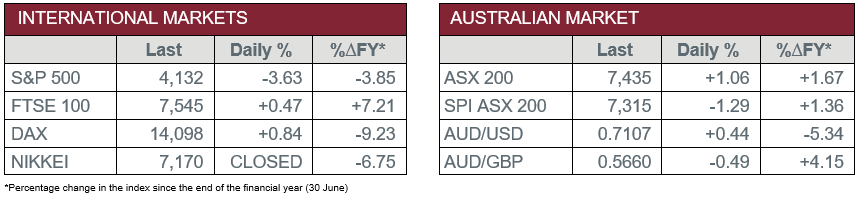

Australian Market

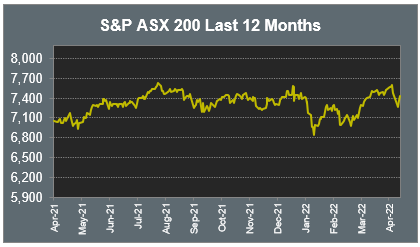

The Australian sharemarket advanced 1.1% on Friday, as all sectors improved. The Information Technology sector was the strongest performer, up 2.2%, followed by Consumer Discretionary and Consumer Staples, which added 1.5% and 1.3% respectively. The local ASX 200 slipped 0.5% over the week and eased 0.9% over April.

Mining heavyweights underperformed on Friday; Rio Tinto and BHP both finished the session relatively flat, while Fortescue Metals gave up 0.5%. However, gold miners posted gains; Newcrest Mining lifted 0.6% and Northern Star Resources added 0.7%, while Evolution Mining rose 1.3%.

All major banks contributed gains; Commonwealth Bank and ANZ closed up 0.6% and 0.8% respectively, while Westpac lifted 1.2% and NAB rose 1.4%. Fund managers also advanced; Australian Ethical Investment closed 3.2% higher, while Challenger and Magellan Financial Group gained 4.6% and 4.8% respectively.

Buy-now-pay-later providers outperformed; Sezzle climbed 8.0% and Zip Co jumped 7.9%, while Afterpay owner Block added 0.6%. Nitro Software climbed 20.2% after the company’s Q1 2022 earnings update reported a 42% increase in cash receipts from customers and 59% year-on-year rise in subscription revenue.

The Australian futures market points to a 1.29% fall today.

Overseas Markets

European sharemarkets closed higher on Friday following positive earnings results. Markets were boosted by gains from miners, following reports the Chinese Government has promised greater stimulus, raising prospects for stable demand of raw materials. Rio Tinto lifted 1.4% and Anglo American rose 3.0%. Banking stocks advanced; Barclays gained 1.2%, HSBC rose 3.9% and Credit Suisse closed up 5.6%. Renewable energy stocks also improved; Vestas Wind Systems added 3.2%, while Siemens Gamesa Renewable Energy rose 2.5%. By the close of trade, the UK FTSE 100 added 0.5% and the STOXX Europe 600 lifted 0.7%, while the German DAX closed up 0.8%.

US sharemarkets weakened on Friday, weighed down by the Consumer Discretionary sector. Amazon shed 14.1% following the company’s Q1 2022 earnings release, in which revenue was in line with expectations, however, operating income was lower than expected due to costs. Information Technology stocks also declined; Fortinet slid 6.4% and NVIDIA gave up 6.3%, while Apple lost 3.7% after the company reported revenue in line with expectations, however, wearables, home and accessories revenue was lower than expected. By the close of trade, the Dow Jones fell 2.8% and the S&P 500 gave up 3.6%, while the NASDAQ slid 4.2%. For the month of April, the Dow Jones lost 4.9%, while the S&P 500 and NASDAQ shed 8.8% and 13.3% respectively.

CNIS Perspective

The NASDAQ composite index underwent it’s heaviest one-month sell-off since the Global Financial Crisis, as concerns about rising interest rates and slowing economic growth were exacerbated by weaker than expected business updates from some of the major technology companies listed on the exchange.

This included businesses such as Amazon, Apple and Netflix.

The index gave up 4.2% on Friday, which brought the monthly loss to 13.3%, with more than US$5 trillion in total market capitalisation shed since it’s all time high last November.

The current rhetoric echoed in earnings updates is the impact that supply chain shortages and Chinese factory shutdowns will have an impact on future earnings in the short term.

However, on a positive note, more than 250 S&P 500 constituents have reported first quarter results, with greater than 80% beating their earnings forecasts.

Given the last decade of strong outperformance of the NASDAQ, and the significant weighting the major technology companies have in the broader S&P 500 index, we may be reaching an inflection point where other sectors in the market are beginning to create stronger arguments for investment than we have seen in the past.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025