Pre-Open Data

Key Data for the Week

- Thursday – AUS – Trade Balance widened by $1.9 billion to $9.3 billion in March.

- Thursday – UK – BoE Bank Rate lifted by 0.25%, to 1.0%, as expected.

- Friday – US – Unemployment Rate

Australian Market

The Australian sharemarket snapped its three-day losing streak on Thursday, after it rebounded 0.8%, driven by strong performances from US sharemarkets on Tuesday night. By the close of trade, 10 out of 11 sectors were in the green, led by Information Technology (2.5%), which experienced its largest daily gain in about a month.

In company news, Alliance Aviation Services (AQZ) surged 21.1% yesterday, after it received an acquisition proposal from Qantas. The deal would see shareholders receive $4.75 in Qantas shares per AQZ share held. Meanwhile, Magellan Financial Group recorded a 2.0% decrease in its funds under management, to total $68.6 billion. It seemed market participants expected worse, as shares in the fund manager rose 5.1%.

The Financials sector closed flat after mixed performances from the major banks. Commonwealth Bank was the only gainer, up 0.7%, while Westpac edged 0.3% lower and ANZ fell 1.7%. NAB (-0.6%) also lost ground, despite its report that net interest income was up 3.5% and profits were 10.6% higher. Investors seemed more focused on NAB’s net interest margin, a key measure of future profitability, which fell 0.11%.

Other notable movers in yesterday’s session included fund manager Australian Ethical Investment (4.8%), litigation manager Omni Bridgeway (4.4%), Super Retail Group (4.6%) and lithium producer Allkem (4.8%).

The Australian futures market points to a 1.57% decline today.

Overseas Markets

European sharemarkets were mostly lower on Thursday, after a session of mixed performances. Travel and leisure related stocks led losses, to be broadly down 3.7%. Meanwhile, the Oil and Gas sector rose 0.6%, pushed higher by Shell (3.1%), which reported record quarterly profit. Aerospace manufacturer, Airbus (6.3%), also posted better than expected quarterly profit. Another notable mover in the session included Siemens Gamesa Renewable Energy (-8.1%). By the close of trade, the STOXX Europe 600 gave up 0.7% and the German DAX lost 0.5%, while the UK FTSE 100 inched 0.1% higher.

US sharemarkets slumped on Thursday, after concern of global stagflation was reignited by the Bank of England. It seemed investors were also doubtful as to whether the US Federal Reserve will be able to get inflation under control. All sectors closed in the red, led by those most sensitive to economic conditions, which included Consumer Discretionary (-5.8%) and Information Technology (4.9%). The most notable movers included technology related mega caps Microsoft (-4.4%), Apple (-5.6%), Meta Platforms (-6.8%), Amazon (-7.6%) and Netflix (-7.7%). By the close of trade, the Dow Jones (-3.1%), S&P 500 (-3.6%) and NASDAQ (-5.0%) all declined.

CNIS Perspective

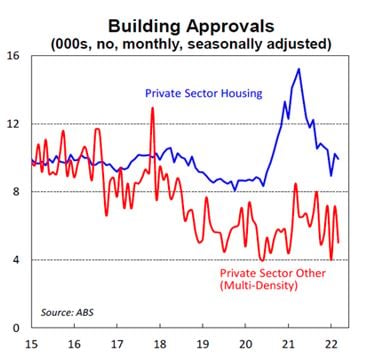

During the week we have flagged the property sector as one which will suffer as interest rates rise and yesterday’s building approvals data confirms the softening may have already started.

In the March quarter, building approvals were 10.0% lower than that of the December quarter. Meanwhile, private sector house approvals declined 3.0%, which shows a 34.8% decline from the April 2021 high.

In the near term, the surge in prior approvals has created a pipeline of residential construction that needs to be completed. This is expected to support activity as projects are finalised. More generally, the construction sector faces challenges from labour shortages and supply disruptions, which have pushed up costs, and in turn, squeezing margins.

The housing boom continues to slow as stretched affordability and higher fixed rates weigh on sentiment and these headwinds are likely to slow building approvals in coming months.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025