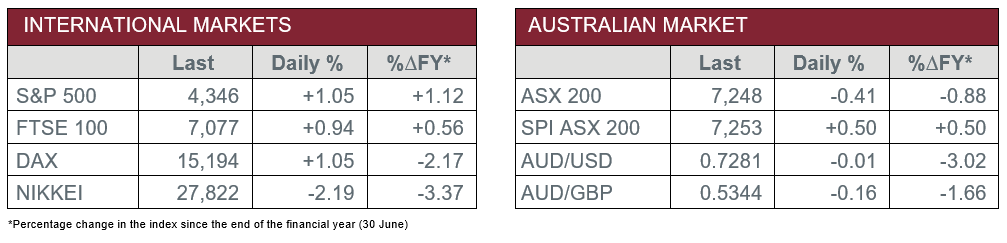

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – RBA Interest Rate Decision was left unchanged at 0.1%.

- Tuesday – AUS – Trade Surplus rose to $15.1 billion in August, up from $12.7 billion in July.

- Tuesday – US – Trade Deficit widened to US$73.3 billion in August.

- Wednesday – EUR – Retail Sales

Australian Market

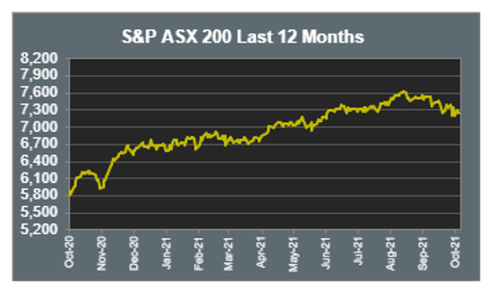

The Australian sharemarket closed 0.4% lower yesterday, as it followed a weak lead from US sharemarkets. However, some early losses were recovered as the RBA left the cash rate at 0.1% and stated bond purchases are to continue at $4 billion per week until February.

The Information Technology sector was heavily weakened during the day’s trade, down 3.0%. The buy-now-pay-later providers lost ground, as Afterpay shed 5.0% and Zip fell 4.8%. Artificial Intelligence company, Appen, slipped 5.0%, while accounting software provider, Xero, lost 2.1%.

The major miners lost ground, as the Materials sector closed the session 0.2% lower. Fortescue Metals conceded 1.3%, while BHP and Rio Tinto dropped 1.1% and 1.4% respectively. Lithium producers were mixed; Pilbara Minerals lost 1.1%, while Orocobre added 0.9%.

The Energy sector outperformed, as OPEC agreed to continue their existing pact for a gradual increase in oil output. As a result, Woodside Petroleum lifted 4.0% and Santos added 2.5%, while Oil Search closed the session 2.3% higher.

The Australian futures market points to a 0.5% gain today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets lifted overnight, aided by gains in the Financials and Information Technology sectors. In the Financials sector, Barclays added 3.9%, while Deutsche Bank and ING Groep lifted 3.6% and 3.3% respectively. A 4.8% gain in Infineon Technologies boosted the Information Technology sector, after the company confirmed their 2021 revenue and provided positive outlook. By the close of trade, the STOXX Europe 600 added 1.2%, while the German DAX and UK’s FTSE 100 gained 1.1% and 0.9% respectively.

US sharemarkets enjoyed gains on Tuesday as the Information Technology sector rebounded from the previous session. As a result, Microsoft added 2.0%, Google’s parent company, Alphabet, gained 1.8% and Amazon finished the day’s trade 1.0% higher.

By the close of the session, the S&P 500 and Dow Jones added 1.1% and 0.9% respectively, while the NASDAQ lifted 1.3%.

CNIS Perspective

It was business as usual yesterday when, as expected, the RBA left the Official Cash Rate at its record low of 0.10%.

What was interesting however, were two comments that suggest the days of cheap and easy money may be approaching an end.

The RBA noted the “Council of Financial Regulators (CFR) has been discussing the medium-term risks to macroeconomic stability of rapid credit growth at a time of historically low interest rates”. The CFR announced last week that APRA will be releasing a paper in the coming months on its framework for implementing macroprudential policy.

It appears it will be a matter of when, not if, changes aimed at curbing debt levels are introduced.

In the past, measures to curb lending have included limits on investor and interest only lending.

There is a growing consensus that regulators will target debt-to-income ratios this time around. The RBA inserted a new phrase, citing the “need for appropriate loan serviceability buffers, including the ability to accommodate future increases in interest rates” – also referred to as a “loan serviceability buffer”.

These changes shouldn’t come as a surprise, and in reality, should be welcomed, as a measure that will hopefully reduce the risks of debt fuelled asset bubbles.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.