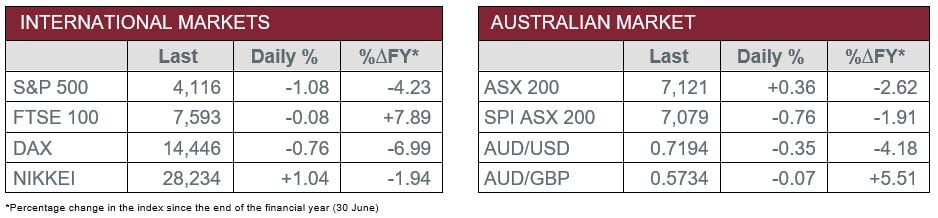

Pre-Open Data

Key Data for the Week

- Wednesday – EUR – Industrial Production – German production was much weaker than expected in April, up 0.7%, compared to the expected 2.7%.

- Wednesday – EUR – Gross Domestic Product figures were revised up to 0.6% in the March quarter, ahead of preliminary estimates of 0.3%.

- Thursday – CHINA – Trade Balance

- Thursday – EUR – ECB Policy Decision

Australian Market

The Australian sharemarket edged 0.4% higher on Wednesday, as losses in the Financials (-2.9%) sector were offset by strong performances from the Energy (4.2%), Utilities (3.2%) and Industrials (2.0%) sectors.

The index heavy Financials sector weighed on the market after the Reserve Bank of Australia announced a higher than expected cash rate hike of 0.50% on Tuesday. While on the surface investors might expect this to provide a tailwind for banks, in reality it puts pressure on their Net Interest Margins and increases the likelihood of bad debt. Three of the big four banks were among the ten worst performing blue chip stocks on Wednesday, which included Westpac (-6.1%), Commonwealth Bank (-4.4%) and NAB (-4.0%). Other notable detractors included Bendigo and Adelaide Bank (-7.2%) and Bank of Queensland (-4.3%).

On the other hand, the Energy sector surged 4.2%, its best day since March, to reach highs not seen since February 2020. This followed after the price of US crude finished around 14-year highs on Tuesday night. The sector also benefited from market sentiment, as such stocks are perceived by investors to be an inflation hedge. Key contributors to sector performance included Woodside Energy (5.6%), Yancoal Australia (7.8%) and Paladin Energy (13.5%).

Atlas Arteria was the best performer on Wednesday, up 16.2%, after news of a potential takeover by IFM Global Infrastructure.

The Australian futures market points to a 0.76% decline today.

Overseas Markets

European sharemarkets declined on Wednesday, dragged lower by bank stocks, which broadly fell 0.9%. This came after Credit Suisse warned of a likely group-wide loss in the second quarter, which sparked investor concern around industry profitability, particularly with the European Central Bank’s meeting on Thursday. Credit Suisse fell as far as 7.0% in the session, however, recovered to end up 3.8% higher, after a report of a potential takeover by US-based State Street. By the close of trade, the STOXX Europe 600 lost 0.6% and the German DAX declined 0.8%, while the UK market was flat.

US sharemarkets fell on Wednesday, retracing most of the gains made on Tuesday, with ten of eleven industry sectors in the red. Losses were led by the REITs (-2.4%) and Materials (-2.1%) sectors, while the Energy sector edged up 0.2% on the back of higher oil prices. In company news, chipmaker Intel fell 5.3% in response to a negative broker report, while music streamer Spotify rose 6.1%, after it stated it expects to reach US$100 billion revenue per annum within the next 10 years and promised high profit margin returns on its costly expansion into podcasts and audiobooks. By the close of trade, the Dow Jones (-0.8%), S&P 500 (-1.1%) and NASDAQ (-0.7%) all declined.

CNIS Perspective

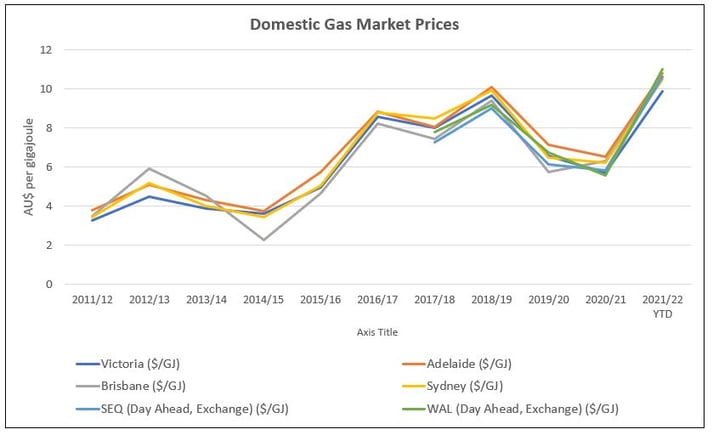

The media is saturated at the moment with home owners complaining about rising interest rates and the effect they will have on their standard of living.

However, the cost of energy will have just as a significant effect, and possibly even more so, on the immediate financial position of the average Australian household.

Gas, oil and petrol prices have been rising for some time and gas providers have recently increased prices by almost 10%.

Inflationary pressures are currently being felt in just about every aspect of everyday living. Mortgage costs, food, building materials and energy costs are all working in unison to spur inflationary pressures. Any thought of inflation being transitory or short term, certainly doesn’t seem accurate at the moment.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025