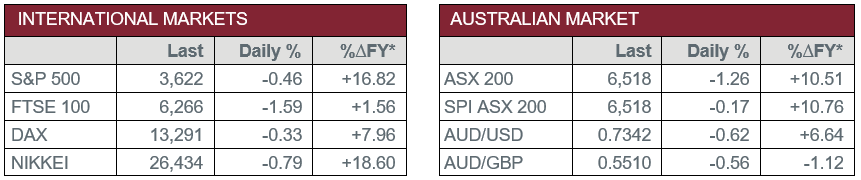

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – AUS – TD Securities Inflation increased to 0.3% in November, from -0.1% in October.

- Tuesday – AUS – RBA Interest Rate Decision

- Tuesday – EUR – Consumer Price Index

- Tuesday – US – Markit Manufacturing PMI

Australian Market

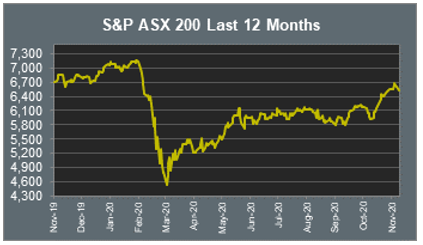

The Australian sharemarket closed 1.3% weaker on Monday, as all sectors finished in the red except the Information Technology sector. Despite yesterday’s weakness, the ASX 200 gained 10.0% in November, the market’s strongest month since March 1988. Market performance was boosted throughout November by promising COVID-19 vaccine developments, the US election result and reopening of domestic borders.

The Financials sector gave up 1.5% yesterday as all four big banks closed weaker; Commonwealth Bank sunk 2.0% and ANZ slipped 1.9%, while NAB and Westpac lost 1.8% and 1.5% respectively. Insurers also saw losses; NIB fell 0.6%, while QBE Insurance Group slumped 2.6% and Insurance Australia Group dropped 3.2%.

The Health Care sector also underperformed yesterday. CSL gave up 1.9% and Cochlear slipped 0.8%, while Sonic Healthcare and Ramsey Health Care both lost 1.0%.

The Consumer Discretionary sector was among the weakest performing sectors yesterday, down 1.6%. Kathmandu tumbled 5.3% after Chief Executive Xavier Simonet announced his resignation. Wesfarmers fell 0.9% and Super Retail Group lost 1.0%, while Harvey Norman slumped 2.5%.

The Australian futures market points to a 0.17% fall today.

Overseas Markets

European sharemarkets closed lower overnight, as the broad-based STOXX Europe 600 fell 1.0%. Despite yesterday’s losses, the index saw its best monthly performance on record, up 13.7%. The Energy sector was the weakest performer on Monday, down 3.4%. BP and Royal Dutch Shell sunk 5.8% and 5.4% respectively, while Total SE tumbled 5.0%. The Financials sector also underperformed; HSBC dropped 4.1% and Lloyds Bank lost 4.5%, while Barclays and Deutsche Bank slipped 3.6% and 1.5% respectively.

US sharemarkets also fell on Monday, as all sectors closed weaker except Information Technology and Health Care. The Health Care sector was lifted by Moderna, which posted a 20.2% gain overnight after the company announced plans to apply for US and European emergency authorisation for its COVID-19 vaccine. In the Information Technology sector, Spotify jumped 5.0% and Apple added 2.1%, while NVIDIA gained 1.0%. The Energy sector was the worst performer, as ExxonMobil shed 5.1% and Chevron gave up 4.5%. By the close of trade, the NASDAQ slipped 0.1% and the S&P 500 fell 0.5%, while the Dow Jones lost 0.9%. Despite Monday’s weakness, the Dow Jones posted its best monthly gain since 1987, up 11.8%.

CNIS Perspective

Early in the COVID-19 pandemic it became clear the global economy would require a massive amount of public and private debt to avoid a deep and prolonged recession.

The unprecedented explosion in debt has provided a bridge over the collapse in global economic output and corporate bankruptcies, and the financial hardship for households has been significantly reduced as a result.

In light of the recent progress on vaccines, investors are becoming more confident the end of the debt bridge is in sight. Nevertheless, this year’s surge in borrowing has been called the largest wave in a great “debt tsunami”.

As a result, global equities have reached new record highs and credit spreads have narrowed, almost as if extreme debt is a good, not a bad, economic development.

The forces of secular stagnation (where there is negligible or no economic growth) have created an excess of global savings over investment, at a time where real interest rates and inflation are low. This has encouraged central banks in advanced economies to purchase government debt, mitigating the risks of funding crises.

A dangerous, systemic debt crisis would likely require a strong reversal of secular stagnation and a rapid rise in world inflation, forcing tighter monetary policy. Luckily, that still seems a very long way off.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025