Pre-Open Data

Key Data for the Week

- Tuesday – EUR – Consumer Price Index increased 0.4% in August and 3.0% for the year.

- Tuesday – AUS – Building Approvals fell 6% in July.

- Wednesday – AUS – Gross Domestic Product

- Wednesday – EUR – Unemployment Rate

Australian Market

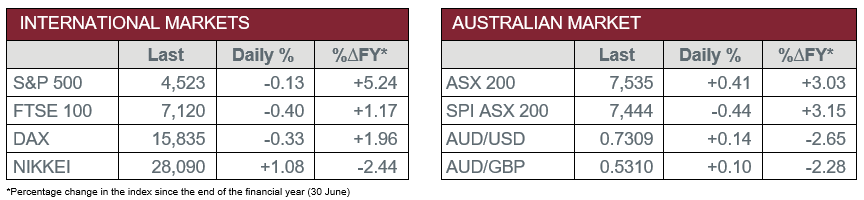

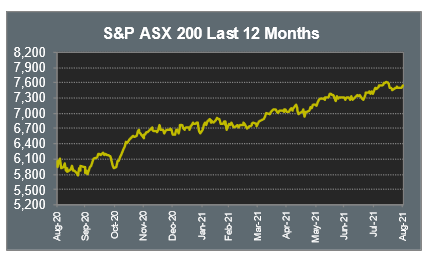

The Australian sharemarket added 0.4% yesterday, as the ASX extended its run of gains to eleven months. The ASX 200 gained 1.9% in the month of August.

The Financials sector eked out a less than 0.1% gain during yesterday’s trade. NAB was the best performer of the big four banks, up 0.7%, while Westpac added 0.1%. Commonwealth Bank and ANZ lost 0.3% and 0.5% respectively. Australian Ethical Investment continued its recent run of strength to close the session 6.3% higher, while Challenger shed 0.9%.

A 7.2% gain in artificial intelligence company, Appen, led the Information Technology sector higher. Buy-now-pay-later companies also advanced; Afterpay added 1.7% and Zip Co lifted 0.2%. Accounting software provider, Xero, closed the session 1.2% higher.

Health Care stocks advanced, led by market leader, CSL, which gained 0.5%. Sonic Healthcare added 1.9%, while Australian Clinical Labs lifted 0.9%. Shares in Mesoblast plummeted 15.9% after the company reported a full-year loss of US$98.8 million.

The Australian futures point to a 0.44% decline today, weakened by overseas markets.

Overseas Markets

European sharemarkets lost ground on Tuesday, as inflationary jitters worried investors. Despite this, markets rose approximately 2.0% in August, making it seven months of straight gains. Travel stocks weakened over new COVID restriction fears; Lufthansa shed 1.5% and easyJet lost 1.7%, while Ryanair conceded 3.5%.

By the close of trade, the UK’s FTSE 100 and the STOXX Europe 600 both lost 0.4%, while the German DAX slipped 0.3%.

US sharemarkets also closed lower overnight, weakened by losses in the Information Technology sector. Zoom Video Communications Inc led the losses, down 16.7%, after it suggested a faster-than-expected easing in demand following its pandemic-driven boom. Apple lost 0.8%, while Visa and Mastercard fell 0.9% and 1.9% respectively.

By the close of trade, the Dow Jones and the S&P 500 both conceded 0.1%, while the NASDAQ lost less than 0.1%.

CNIS Perspective

Today’s June quarter GDP announcement will be a nail-biter for the government.

With the September quarter almost guaranteed to be negative, it looks like being line ball as to whether June can be positive today or not, and therefore kick the two consecutive quarters of negative growth, i.e., recession, down the road to the recovering December quarter.

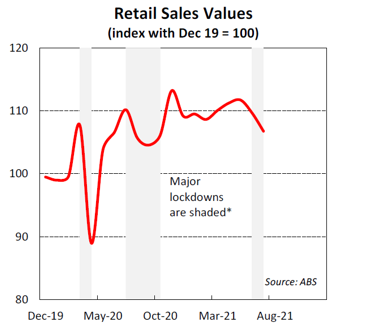

The most critical factor, consumer spending, fell 1.8% in June, along with a fall in consumer confidence. July retail spending was reported yesterday and was down 2.7% for the month, or 3.1% over the year. Retail sales have now fallen 4.4% in the past two months.

Lockdowns obviously continue to weigh on the near-term outlook. Encouragingly, spending tends to bounce back strongly once restrictions lift, with all eyes now focussed on the December quarter for the return to positive GDP.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.