Pre-Open Data

Key Data for the Week

- Monday – CHINA – Consumer Price Index rose 1.0% over the year to July, down from 1.1% in June.

- Tuesday – AUS – NAB Business Conditions

- Tuesday – AUS – NAB Business Confidence

Australian Market

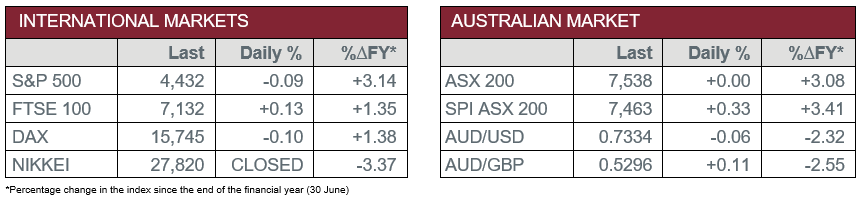

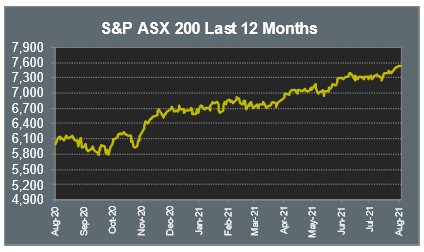

The Australian sharemarket closed relatively flat yesterday, as gains in the Financials sector were outweighed by general market weakness.

The Financials sector closed the session 1.3% higher, lifted by Suncorp, which soared 7.8%. Suncorp released their earnings report which showed a 42.0% improvement on full-year cash earnings, and announced shareholders will receive a special dividend along with the option to participate in an on-market buyback. Of the big four banks, ANZ added 1.4% and Commonwealth Bank lifted 1.2%, while Westpac and NAB gained 1.0% and 0.9% respectively.

The Materials sector was the main laggard, weakened by the major miners. The sector shed 1.1% as the price of iron ore continues to fall. As a result, Rio Tinto conceded 1.4%, Fortescue Metals lost 1.3% and BHP slipped 0.8%.

Industrials shares were lower, as extended lockdowns across NSW caused by the COVID Delta variant weighed on the sector. Sydney Airport lost 0.7%, while Transurban Group fell 2.0% after the company released their earnings report that showed the lockdowns had weighed on revenue.

The Australian futures point to a 0.33% rise today.

Overseas Markets

European sharemarkets were mixed overnight, impacted by weaker commodity prices. The Energy sector was the hardest hit, as extended lockdowns in Asia are set to impact the demand for oil. As a result, Royal Dutch Shell lost 0.8% and BP shed 0.5%. Technology stocks added 0.5% throughout the day’s trade, largely aided by Deliveroo, which jumped 6.4%. By the close of the session, the pan-European STOXX 600 added 0.2%.

US sharemarkets were also mixed on Monday, as worries regarding demand for fuel increased, however, a rise in bond yields lifted Financials stocks. The 10-year US Treasury yield returned to back above 1.3%, and as a result, Bank of America added 1.3%.

By the close of trade, the NASDAQ added 0.2%, while the S&P 500 and Dow Jones slipped 0.1% and 0.3% respectively.

CNIS Perspective

The iron ore price has been stubbornly high for the year so far. This has eventuated despite strict implementations of steel production controls, implemented by Chinese officials.

In an attempt to curb the price of iron ore, the Chinese Government at the start of the year announced its intention to start reducing steel production in 2021, to no avail.

However, we may just be experiencing the first signs of weakness in the Chinese economic recovery, with steel mill production beginning to taper and the COVID-19 Delta variant beginning to hinder demand.

This has seen a major retracement in the price of iron ore, falling nearly 20% in the month so far.

While arguably still elevated, iron ore prices are finally experiencing a well overdue pullback, with one potential vulnerability in the next few months being the Australian Dollar, which should bode well for Australians holding overseas investments, should this trend continue.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.