Pre-Open Data

Key Data for the Week

- Thursday – CHINA – Consumer Price Index rose 2.3%, compared to 1.5% in October.

- Thursday – US – Initial Jobless Claims fell to 184,000, the lowest level since September 1969.

- Friday – US – Consumer Price Index

- Friday – UK – Industrial Productions

Australian Market

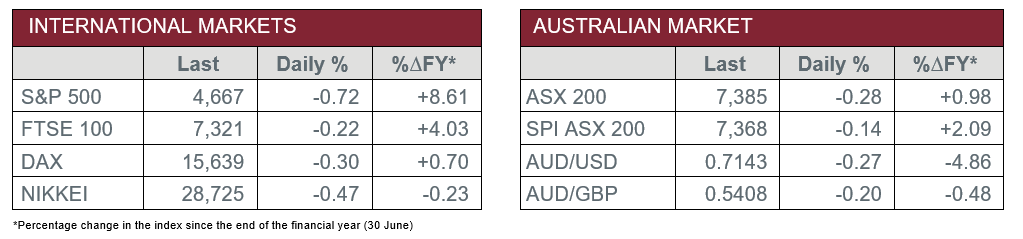

The Australian sharemarket edged 0.3% lower on Thursday, to end a four-day rally since the Omicron sell-off. Losses were led by the Energy sector, down 1.1%, after Woodside Petroleum (-0.9%), Oil Search (-1.4%) and Santos (-1.6%) all lost ground. Meanwhile, Xero (-3.2%) dragged down the Information Technology sector (-0.9%), while BHP (-1.2%) and Rio Tinto (-0.9%) weighed on the Materials sector (-0.5%).

A major standout in yesterday’s session was Vulcan Energy Resources (13.9%), a lithium battery producer, after it disclosed to the ASX that it had entered into an agreement with Volkswagen to supply between 34,000 and 42,000 tonnes of battery-grade lithium hydroxide over the next five years.

The Financials sector inched 0.1% lower, after a mixed session from the big four banks. Commonwealth Bank and NAB both added 0.2%, while Westpac and ANZ both lost 0.2%. The major detractor in the sector was Magellan Financial Group (-4.9%), which is now down ~18.4% for the December quarter. The company has weakened further after it announced two days ago that its CEO is set to stand down for personal reasons.

In other news, Australia’s largest waste management company, Cleanaway (-0.7%), received regulatory approval to proceed with its $501 million acquisition of Sydney waste facilities from French company Suez. Additionally, Sydney Airport rose 2.9%, after the Australian Competition and Consumer Commission approved its planned takeover by the Sydney Aviation Alliance consortium, led by IFM Investors.

The Australian futures market points to a 0.14% decline today.

Overseas Markets

European sharemarkets ended lower on Thursday, as COVID-19 worries persisted and a decline in oil prices impacted energy companies. The price of oil weakened after fears emerged that the Chinese economy, the world’s largest oil importer, has slowed. This sentiment came when two Chinese property developers received a ratings downgrade. Consequently, BP, Royal Dutch Shell and TotalEnergies all fell between 0.6-1.5%. Other key movers included Veolia Environnement (2.2%) and Deutsche Bank (-3.4%). By the close of trade, the STOXX Europe 600 (-0.6%), the German DAX (-0.3%) and the UK FTSE 100 (-0.2%) all edged lower.

US sharemarkets were mostly weaker on Thursday, after the S&P 500 lost 0.7% and the NASDAQ fell 1.7%, while the Dow Jones was flat. The Information Technology (-1.1%) and Consumer Discretionary (-1.7%) sectors were the primary laggards. Mega cap technology shares slipped, as Microsoft (-0.6%), NVIDIA (-4.2%) and Tesla (-6.1%) all fell. Meanwhile, Amazon conceded 1.1% after Italy’s regulatory watchdog fined the retailer US$1.28 billion for anti-competitive behaviour.

CNIS Perspective

If you have ordered anything online recently, you can probably relate to the impact of supply chain disruptions. Delays in deliveries have become standard.

Much of the problem stems from COVID-19-related developments. Transport bottlenecks emerged last year because of a sharp increase in global demand for goods. Due to lockdowns, the demand for goods jumped sharply while services consumption plummeted. For example, with travel off the cards, people opted to buy a new TV or fit out their home office.

At the same time, factories were hit with constraints on their operations. Social distancing requirements, restrictions on the movement of people, and other onerous health and safety measures, hindered the output of factories. Under these conditions, it wasn’t long before cracks began to appear in supply chains.

As 2020 wore on, a global shortage of shipping containers emerged, as well as a mismatch in the location of containers, which were often full in one direction and empty in the other. This shortage was exacerbated by congestion at some ports, as increased trading volumes coincided with reduced capacity from pandemic restrictions.

On top of that, global supply chains have also been hit by diplomatic tensions, power shortages in China and extreme weather. The Suez Canal debacle also contributed to the problem, blocking movement for six days.

All that is to say, bottlenecks in supply chains are a complex, multifaceted problem and they are unlikely to be resolved in the short term.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.