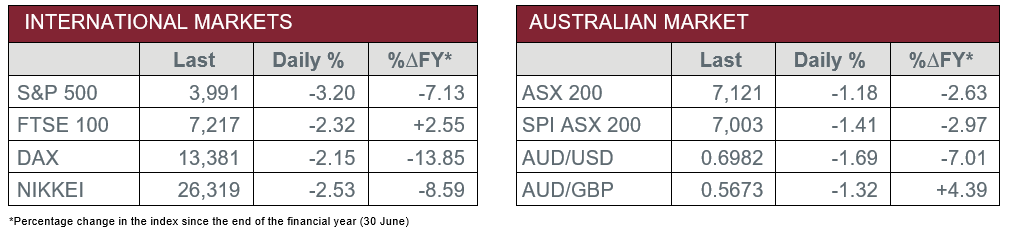

Pre-Open Data

Key Data for the Week

- Monday – CHINA – Trade Balance – The trade surplus widened to US$51.1 billion, from US$47.4 billion in March.

- Tuesday – AUS – NAB Business Conditions & Confidence

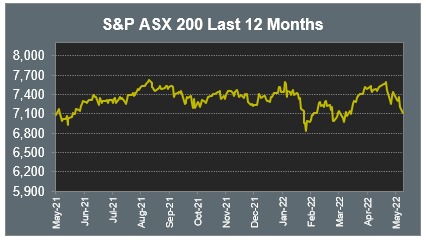

Australian Market

The Australian sharemarket dropped a further 1.2% yesterday, as the current volatility continues to weaken both domestic and global sharemarkets. All sectors except for Health Care closed the session lower on Monday, with the REITs sector the hardest hit.

Goodman Group led the declines in the REITs sector, as it fell 7.0% to continue its recent weakness. Among the other property trusts, Centuria Industrial REIT fell 4.1%, while Stockland and Dexus both dropped 1.3%.

The Information Technology sector fell 3.2%, following a weak lead from the tech heavy NASDAQ in the US. Buy-now-pay-later providers lost ground; Block fell 6.2% and Zip conceded 1.9%, while Humm Group shed 4.0%. Payment service providers also weakened, as EML Payments slipped 4.4% and Tyro Payments closed the session 2.3% lower.

The Financials sector closed lower, however, Westpac bucked the downward trend to close up 3.2%, as the company beat expectations in their first half earnings report. Magellan Financial Group lost 8.4% after the company announced it had sold its 11.6% stake in Mexican fast food chain Guzman Y Gomez, despite making a 36.3% profit.

The Australian futures market points to a 1.41% fall today, following weaker overseas markets overnight.

Overseas Markets

European sharemarkets lost ground overnight, with losses led by the Travel & Leisure sector. This comes as easyJet slipped 2.3% after the company announced they had removed passenger seats to cope with staff shortages. As a result, Lufthansa and International Consolidated Airlines Group followed suit and both lost 2.1%. By the close of trade, the UK’s FTSE 100 dropped 2.3% and the German DAX fell 2.2%, while the STOXX Europe 600 lost 2.9%.

US sharemarkets also dropped on Monday, as rising global interest rates continue to weigh on indices. The Information Technology sector lost ground; NVIDIA corporation fell 9.2%, Amazon dropped 5.2% and Netflix slipped 4.4%. The Financials sector also weakened, as Charles Schwab declined 4.9% and Goldman Sachs ended the session 1.3% lower. By the close of trade, the Dow Jones slipped 2.0% and the S&P 500 fell 3.2%, while the NASDAQ lost 4.3%.

CNIS Perspective

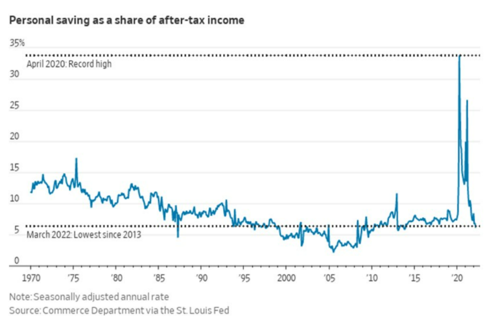

The most recent data of the US personal savings rate shows the savings built up over the last two years of COVID-19, has now began to evaporate.

During the pandemic, stimulus programs led to a savings surplus for consumers, leaving the average American in a strong financial position, with the savings rate peaking at an astronomical 34% in April 2020.

Excess savings were not confined to the household sector, as cash holdings also increased substantially during the pandemic across both small and large businesses.

However, a large unwinding of this has now left the savings rate at the lowest it's been since December 2013, as rising fuel, food, and rent costs outpace wages growth, and in turn, have eroded consumers’ disposable incomes.

Consumer spending makes up more than two-thirds of the US’s economic activity. Given the lack of savings now evident, it will naturally slow spending on those more discretionary based items, as individuals focus on day to day necessities that are becoming more expensive.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025