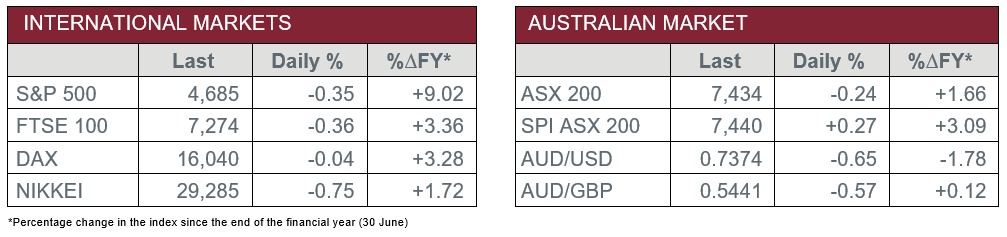

Pre-Open Data

Key Data for the Week

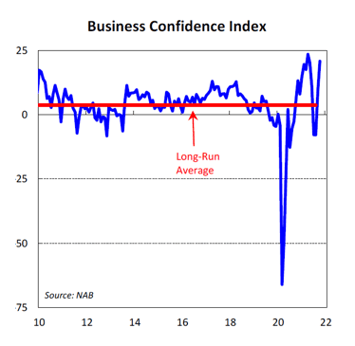

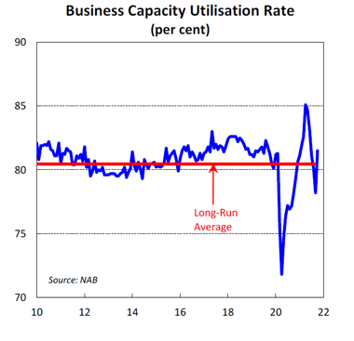

- Tuesday – AUS – NAB Business Confidence and Conditions – Confidence jumped 11 points, while Conditions rose 6 points.

- Wednesday – AUS – Construction Work Done

- Wednesday – US – Gross Domestic Product

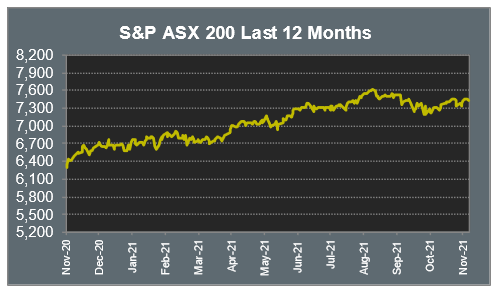

Australian Market

The Australian sharemarket closed 0.2% lower yesterday, weakened by losses in the Financials and Energy sectors.

NAB shares dropped 0.8% despite reporting a 76% gain in full-year profit. Investors were more concerned with decreased profit margins from interest incomes given the low interest rates. ANZ was the worst performer of the big four, down 1.6%, while Westpac and Commonwealth Bank conceded 1.4% and 1.2% respectively. As a result, the Financials sector shed 1.0%.

The Energy sector fell despite gains in the price of oil. Woodside Petroleum slipped 1.2% and Santos shed 1.3%, while Beach Energy lost 1.9%. Coal miners enjoyed gains; Whitehaven Coal jumped 4.1% and Yancoal added 0.7%.

Fortescue Metals added 1.8% after the company announced its sustainability financing framework. Of the other miners, BHP was up 1.0% and Rio Tinto closed the session 0.2% lower.

The Australian futures market points to a 0.27% rise today.

Overseas Markets

European sharemarket slipped from recent highs overnight, as Financials stocks retreated. ING Groep lost 0.3% and Barclays shed 1.3%, while Deutsche Bank closed the session 1.8% lower. The Materials sector also lost ground; BHP lost 2.4% and Glencore conceded 1.4%.

By the close of trade, the German DAX slipped less than 0.1% and the UK FTSE 100 lost 0.4%, while the STOXX Europe 600 closed 0.2% lower.

US sharemarkets also lost ground on Tuesday, as the S&P 500 snapped its longest streak closing at all-time highs for the last eight sessions. Tesla fell a further 12.0% after the online Twitter poll raised concerns with the US Securities Exchange Commission. PayPal slumped 10.5% after the company missed third-quarter expectations and lowered financial year guidance.

By the close of trade, the NASDAQ lost 0.6%, while the S&P 500 and Dow Jones slipped 0.4% and 0.3% respectively.

CNIS Perspective

Not surprisingly, Business Conditions and Confidence rose significantly in NAB’s October survey, as lockdowns were lifted in NSW and Victoria.

Business Confidence jumped 11 points to 21, not far behind the record high of 24 in April last year.

The survey continues to point to rising price pressures, with the measure for input costs reaching its highest level in a decade.

This reflects a sharp increase in goods demand, which has been exacerbated by ongoing supply chain disruptions and border restrictions.

Forward orders also increased sharply, pointing to a solid pipeline of work, while capacity utilisation jumped back above its long-term average. Higher capacity utilisation is associated with increases in capital expenditure and employment.

It’s difficult not to imagine all this positive data, plus the pent-up consumer spending, won’t translate into higher inflation at least into next quarter’s CPI result.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.