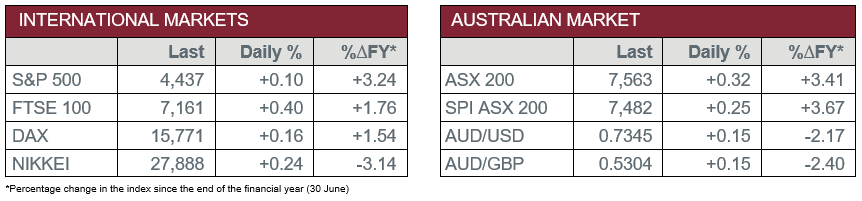

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – NAB Business Conditions dropped 14 points, its lowest level since late 2020.

- Tuesday – AUS – NAB Business Confidence fell 19 points to a one-year low of -8.

- Wednesday – US – Consumer Price Index

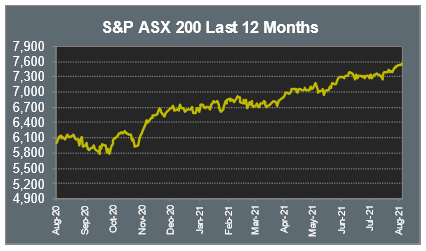

Australian Market

The Australian sharemarket rose 0.3% yesterday, aided by gains in the Information Technology and Financials sectors.

The Information Technology sector added 1.6%, as the buy-now-pay-later providers outperformed. Afterpay gained 3.2% to continue its run of strength since the company received a takeover offer from Square, while Zip lifted 1.5%.

The Financials sector lifted 0.8%, ahead of a key week of earnings reports from the major banks. Commonwealth Bank was the best of the big four, up 1.5%, while Westpac and NAB added 0.9% and 0.2% respectively. ANZ detracted from the Financials sector performance, as it lost less than 0.1% throughout the day’s trade.

James Hardie shares hit an all-time high as the company released its earnings report. The company lifted their earnings forecast for the financial year, as well as increased their net income forecast. As a result, shares were up 2.9%.

The Australian futures point to a 0.25% rise today.

Overseas Markets

European sharemarkets extended gains for a seventh straight session on the back of strong earnings reports. Flutter Entertainment soared 7.8% after the company announced its US business would turn a profit by 2023. Meal-kit provider, HelloFresh jumped 9.2%, following strong second-quarter growth and a significant increase in customers.

US sharemarkets also rose overnight as President Biden’s US$1 trillion infrastructure package was passed by the Senate. The Energy sector benefited from a jump in crude oil prices as Exxon Mobil added 1.7% and Chevron lifted 1.9%. The Information Technology sector was mixed; Alphabet added 0.1%, while Apple and Amazon shed 0.3% and 0.6% respectively.

By the close of trade, the NASDAQ lost 0.5%, while the S&P 500 and Dow Jones rose 0.1% and 0.5% respectively.

CNIS Perspective

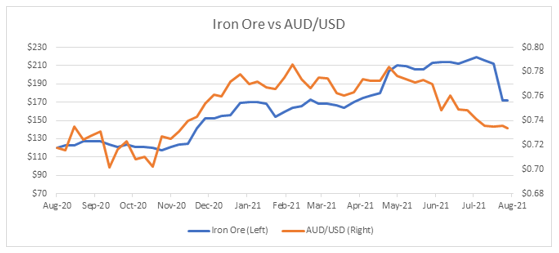

Yesterday’s note looked at the falling iron ore price and reasons for it.

While the foreign exchange market is a huge market with many different participants acting for a myriad of different reasons, there has been a correlation between iron ore and the AUD in place over an extended period of time.

With Australia now lagging in the global COVID recovery, iron ore prices finally coming back to earth and the US Federal Reserve inching closer to tapering bond purchases, one potential vulnerability in the next few months is the AUD.

The graph below highlights the AUD and iron ore correlation and suggests it’s heading downward.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.