Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Thursday – EUR – ECB Interest Rate Decision remained unchanged at 0%.

- Thursday – UK – Gross Domestic Product was 0.4% for October, down from 1.1% in September.

- Thursday – US – Consumer Price Index rose to 0.2% for November, while on an annual basis remained unchanged at 1.2%.

- Friday – US – COVID-19 Vaccine Announcement

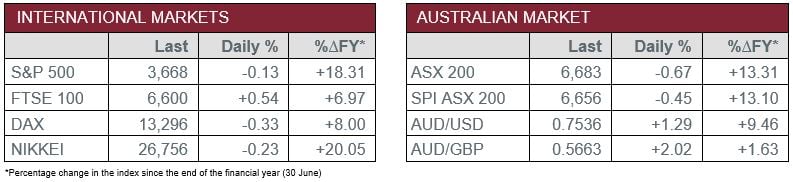

Australian Market

The Australian sharemarket fell 0.7% yesterday, to snap a seven-session winning streak as all sectors closed lower. The Information Technology sector was the weakest performer as Appen slipped 12.4% after the company downgraded its FY underlying EBITDA guidance.

The big four banks were mostly lower to weigh on the Financials sector; ANZ, Commonwealth Bank and Westpac all fell between 0.1% and 0.6%, while NAB bucked the trend to rise 0.4%.

The Materials sector closed lower, as goldminers Northern Star and Saracen Mineral slipped 5.6% and 5.8% respectively. Mining heavyweights were mixed; BHP fell 0.6% and Rio Tinto closed flat, while Fortescue Metals continued its strong run to gain 3.3%.

Coles, Wesfarmers and Woolworths all fell between 0.2% and 1.0%, while Treasury Wine Estates lost 2.1% as China imposed an extra tariff on Australian winemakers.

The Australian futures market points to a 0.45% fall today, driven by weakness overseas.

Overseas Markets

European sharemarkets were mixed on Thursday. The ECB expanded its stimulus measures, adding €500 billion to its pandemic emergency purchase programme, while there was no breakthrough on Brexit talks. HelloFresh outperformed, up 15.0%, after the company announced it plans to double capacity over the next 15-18 months, while expecting FY21 revenue growth of 20-25%.

US sharemarkets were also mixed overnight. Starbucks lifted 5.1% after management reaffirmed FY21 guidance and provided strong FY22 earnings growth expectations. Airbnb more than doubled on the first day of trading as a listed company, pushing the company’s market cap to nearly US$100 billion. Spotify continued its strong run to add another 3.3%. Payment providers were mixed; PayPal rose 2.2%, while MasterCard and Visa slipped 1.6% and 0.9% respectively.

By the close of trade, the Dow Jones fell 0.2% and the S&P 500 lost 0.1%, while the NASDAQ rose 0.5%.

CNIS Perspective

Bitcoin is back. Three years after the cryptocurrency bubble burst in a startling manner, plunging more than 80%, the virtual cryptocurrency hit an all-time high last week of over US$19,000 per coin. Bitcoin has climbed over 150% this year as the pandemic accelerated consumer confidence towards non-cash payments. Global fintech groups such as PayPal and Square have added legitimacy by announcing they are looking to incorporate crypto payments, with the CEO of PayPal noting the shift to digital currencies as ‘inevitable’.

Bitcoin’s (and other cryptocurrencies) surge this year is likely to have also been supported by central banks, led by the Federal Reserve, debasing the value of their currencies by printing money. This printing of money and debt expansion has led some commentators to suggest that the US Dollar remains on the brink of losing its position as the world’s global reserve currency, with more traditional assets such as gold and new contenders such as Bitcoin leading the charge to claim this status for themselves.

In times of economic uncertainty, the US Dollar has traditionally been a safe haven, however, with the US Government showing little enthusiasm for reining in its mounting debt, the world’s confidence in the currency is waning. However, Bitcoin is not a practical replacement at present, given it is not widely exchanged or utilised and its history of volatility means it is not yet a viable reserve currency, nor does it have the backing of an enormous, transparent government bond market.

As Bitcoin moves towards becoming more mainstream, it should serve as a warning to government money printers that traditional currencies may not be the only medium of exchange that people will trust.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025