Pre-Open Data

Key Data for the Week

- Wednesday – AUS – Consumer Sentiment Index edged up 0.6% in November so far, following a decline of 1.5% in October.

- Wednesday – US – Consumer Price Index rose by 0.9% in October, to represent 6.2% over the year to October.

- Thursday – AUS – Private Capital Expenditure

Australian Market

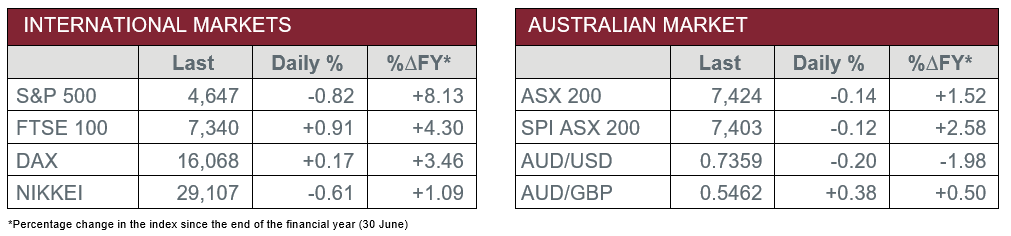

The Australian sharemarket edged lower for a third straight session on Wednesday, down 0.1%, as the Materials sector (-1.5%) weighed on the market. This came as the price of iron ore weakened further, trading below US$90 per tonne in the futures market, as lower Chinese steel production diminished Australia’s primary commodity export. Key detractors included BlueScope Steel (-5.8%) and Orocobre (-4.7%), alongside sector heavyweights BHP (-2.7%), Fortescue Metals Group (-2.1%) and Rio Tinto (-1.7%).

Most sectors closed in the red, with the Energy sector (-1.1%) being the other major laggard. Notable movers included Woodside Petroleum and Beach Energy, both down 1.5%, alongside Whitehaven Coal (-3.1%). Meanwhile, uranium producer, Paladin Energy (1.5%), lifted the sector after it provided an update to its Langer Heinrich Mine Restart Plan late last week.

The Industrials sector (0.2%) held its value yesterday, after toll road developer and operator, Atlas Arteria, advanced 2.7%, while Sydney Airport (0.2%) and Auckland International Airport (0.8%) also held their ground.

The Financials sector also performed strongly, up 0.7%, led by NAB, which advanced 4.4%. The other big banks also improved, as Westpac and ANZ both gained 0.8%, while Commonwealth Bank inched 0.1% higher. On the other hand, fund managers weakened, as Australian Ethical Investment (-1.2%) and Magellan Financial Group (-2.8%) both declined.

The Australian futures point slightly lower today.

Overseas Markets

European sharemarkets closed at record highs on Wednesday, after strong earnings reports came from the Media (+1.5%) and Energy (+0.8%) sectors. British broadcaster, ITV, climbed 15.1% after it forecast record high advertising revenue this year. Furthermore, Siemens Energy pushed 3.5% higher after it made strong free cash flow gains and proposed a dividend payout to investors. On the other hand, online food delivery stocks slipped, as investors considered intensified competition. The STOXX Europe 600 and German DAX both rose 0.2%, while the UK FTSE 100 lifted by 0.9%.

US sharemarkets closed lower yesterday, after the October CPI report intensified concerns that inflation could threaten the economic outlook. The Energy sector led losses, down 3.0%, roughly in line with global oil prices which fell 2-3%. The Information Technology sector (-1.7%) also weighed on the market, as key stocks like Microsoft (-1.5%), NVIDIA (-3.9%) and Apple (-1.9%) lost ground, impacted by a potential rise in interest rates. This led to the technology heavy NASDAQ being down 1.9%, followed by the S&P 500 (-1.0%) and the Dow Jones (-0.7%).

CNIS Perspective

US CPI data is the number financial markets have been sweating on for some time and its announcement last night shouldn’t have come as too much of a surprise.

The stronger headline inflation rose to its fastest annual pace since December 1990 as the massive economic stimulus, pent up consumer demand and supply chain shortages drove demand and prices higher.

As a result, bond and equity markets sold off and the Australian Dollar fell to a one month low of US$0.7326.

The CPI number prompted investors to adjust their expectations of when the US Federal Reserve would need to start raising interest rates to control inflation, causing the bond market sell-off and jump in yields.

It’s far too early to contemplate any increase in interest rates in the US just yet.

There is still far too much conjecture that the early signs of inflation are transitory and not a more permanent structural change.

A large part of that answer depends on when the supply of goods returns to normal and pressure on the cost of goods sold weakens. There is a belief the worst of the “great supply chain disruption” is already behind us.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.