Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Thursday – UK – Gross Domestic Product

- Thursday – US – Consumer Price Index

- Thursday – US – Initial Jobless Claims

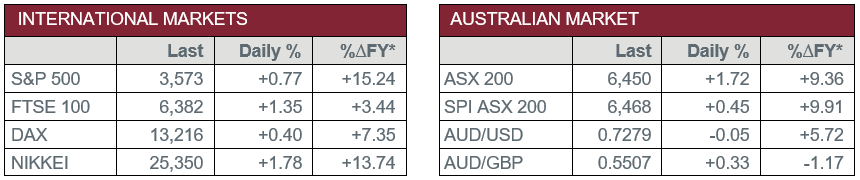

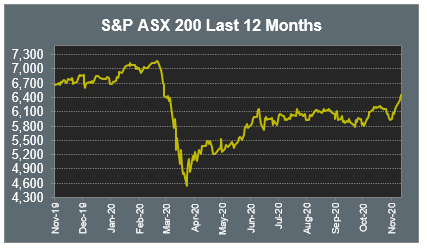

Australian Market

The Australian sharemarket added 1.7% yesterday, to close higher for the fifth-straight session. All sectors closed higher, with Energy the best performer due to a further lift in oil prices; Woodside Petroleum, Santos and Oil Search all added between 6.3% and 7.6%.

Commonwealth Bank lifted 2.8%, as the company reported cash profit was down 16% for 1QFY21. ANZ and NAB gained 3.2% and 2.6% respectively, while Westpac rose 0.3% after the company went ex-dividend and will pay $0.31 per share. Macquarie Group and Magellan Financial Group also closed higher, up 2.1% and 3.1% respectively.

Telstra added 3.1% to lead the Telecommunications sector higher. Consumer Staples companies Coles and Woolworths rose 1.1% and 1.6% respectively, while Wesfarmers closed up 0.3%.

The Materials sector was lifted by mining heavyweights; BHP and Rio Tinto gained 2.3% and 1.8% respectively, while Fortescue Metals fell 1.8% after outlining plans to start a renewable energy business at its annual general meeting.

Industrials also rallied; Auckland International Airport and Sydney Airport rose 1.6% and 2.4% respectively, while Transurban lifted 4.1%.

The Australian futures market points to a 0.45% rise today.

Overseas Markets

European sharemarkets closed higher on Wednesday, as the broad based STOXX Europe 600 closed up 1.1%. Investor sentiment remained high following the positive vaccine news, while the Industrials sector underperformed as stocks settled from recent surges; Eiffage lost 3.4% and Vinci fell 3.0%, while Veolia added 1.1%. Consumer stocks Tesco and Nestlé rose 2.1% and 1.8% respectively, while German real estate company Vonovia rallied 5.2%.

US sharemarkets were mixed overnight. Coronavirus cases and hospitalisation numbers hit new highs, with the seven-day moving average case numbers now over 120,000. The Information Technology and Consumer Discretionary sectors led the market, while Materials and Health Care underperformed.

Among technology stocks, NVIDIA and PayPal led the gains following recent weakness, up 5.1% and 4.9% respectively, while Amazon, Apple and Microsoft all rose between 2.6% and 3.4%. Health Care stocks Bristol-Myers Squibb lost 1.7%, Edward Lifesciences fell 1.5% and Johnson & Johnson slipped 0.3%. Renewable Energy companies outperformed; Enphase Energy climbed 10.1% and SolarEdge added 4.3%.

By the close of trade, the Dow Jones slipped 0.1%, while the S&P 500 added 0.8% and the NASDAQ lifted 2.0%.

CNIS Perspective

Chinese technology companies have sold off aggressively in recent days, as anti-trust dialogue from China’s regulators gathers pace, with Hong Kong’s Hang Seng Tech Index down approximately 12% since Monday. The move follows the Ant IPO drama, which reminded investors that no one is bigger than the Chinese Communist Party, with the government now looking at increased regulation for monopolistic e-commerce giants such as Alibaba, where 20% of the country’s consumer goods are now sold.

The new regulations for the e-commerce sector signal a ‘further tightening’ of the online economy, although the real impact will depend on how the rules are enforced. This news comes off the back of China’s online shopping event ‘Singles Day’, which is bigger than the US’s Black Friday and Cyber Monday sales combined. Alibaba announced yesterday that its platform handled 583,000 orders per second during peak activity.

The Chinese Communist Party’s efforts to rein in some of China’s most powerful companies is a shift from their previous relatively hands-off approach toward businesses. While these technology giants are currently being scrutinised, what Xi Jinping has made clear, is he wants China to be the global leader in technology.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025