Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – EUR – ECB President’s Speech

- Tuesday – UK – ILO Unemployment Rate

- Tuesday – US – Consumer Price Index

- Wednesday – AUS – HIA New Home Sales

- Wednesday – US – Producer Price Index

- Thursday – AUS – Unemployment Rate

- Thursday – CHINA – Consumer Price Index

- Thursday – US – Initial Jobless Claims

- Friday – EUR – Consumer Price Index

- Friday – US – Industrial Production

- Friday – US – Retail Sales

Australian Market

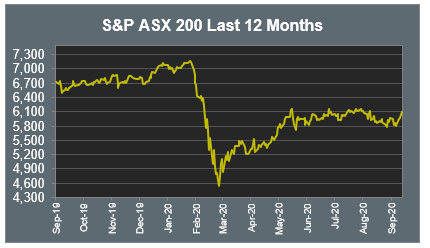

Despite a flat trading session on Friday, the local ASX 200 recorded its best week since April, boosted by the release of the government’s latest Federal Budget and hopes of further US economic stimulus.

Energy stocks were among the best performers, as the price of global oil continued to increase, with poor weather forecast for the Gulf of Mexico the latest catalyst for the movement. The area is an important oil hub for the US, responsible for 20% of the world’s oil supply and 1.7% of global production. Oil Search rose 2.5%, Santos climbed 1.4% and Woodside Petroleum gained 0.5% in response.

The Financials sector followed the overall market direction and was little changed, as the big four banks were mixed; ANZ and Westpac were the best performers, closing up 0.4% and 0.5% respectively. Materials stocks lagged; BHP lost 0.2% and Rio Tinto gave up 0.5%.

The Australian futures market points to a 0.08% fall today.

Overseas Markets

European sharemarkets rose to new three-week highs on Friday, boosted by the Travel & Leisure and Oil & Gas sectors. Danish jewellery maker Pandora rose 17.2% after it lifted profit guidance on the back of stronger sales, while consumer heavyweight Tesco lifted 1.8%. The German DAX added 0.1%, the broad based STOXX Europe 600 rose 0.6% and the UK FTSE 100 strengthened 0.7%.

US sharemarkets also closed higher on Friday, as investors remained hopeful of a new fiscal stimulus package. Heavyweight stocks Alphabet (+2.0%), Apple (+1.7%), Amazon (+3.0%), MasterCard (+2.1%), Microsoft (+2.5%), PayPal (+2.1%) and Visa (+1.8%) all posted gains. By the close of trade, the Dow Jones rose 0.6%, the S&P 500 lifted 0.9% and the NASDAQ climbed 1.4%.

CNIS Perspective

Since the end of the GFC, monetary policy has been the predominant economic stimulus measure employed by central banks. However, as interest rates sunk lower and lower, their effectiveness became less and actually helped fuel a not so favourable debt binge and asset bubble.

Over recent years cries for more fiscal stimulus seemed to fall on deaf ears. That was until COVID-19 struck, which has prompted a significant swing towards fiscal stimulus.

Government spending on infrastructure, subsidised wages, mortgage relief and tax cuts has seen fiscal policy become the dominant weapon against the COVID-19 slowdown. Fiscal stimulus packs a bigger and more targeted punch than monetary policy because it can channel cash directly to households and businesses who need it most during a crisis.

The graph below highlights the blowout in government budget balances as lower interest rates ran out of steam. Ironically, the massive debt blowout is now more affordable given the low interest rate environment that governments can borrow at.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 17 - 21 March 2025

Put your hard-earned dollars to work: Smart investing for doctors.

Fringe Benefits Tax year-end: Important updates and insights.

Cutcher's Investment Lens | 10 - 14 March 2025

Cutcher's Investment Lens | 3 - 7 March 2025