Pre-Open Data

Key Data for the Week

- Tuesday – AUS – NAB Business Conditions and Confidence

- Tuesday – EUR – Industrial Production

- Tuesday – UK – ILO Unemployment Rate

- Wednesday – US – Retail Sales

- Wednesday – UK – Consumer Price Index

- Wednesday – CHINA – Industrial Production

- Thursday – AUS – Unemployment Rate

- Thursday – UK – BoE Interest Rate Decision

- Friday – UK – Retail Sales

- Friday – EUR – Consumer Price Index

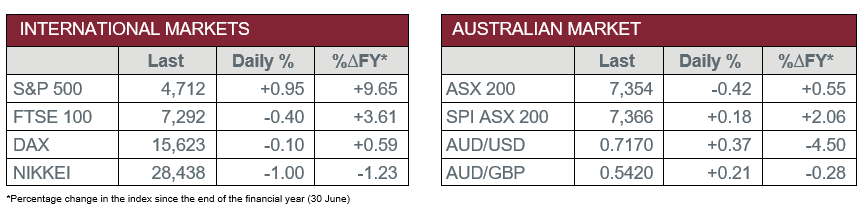

Australian Market

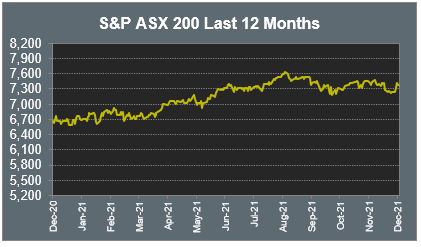

The Australian sharemarket eased 0.4% on Friday, weighed down by the Health Care and Energy sectors, which lost 1.8% and 1.5% respectively. However, over the week, the local ASX 200 added 1.6%, its first weekly gain in five weeks.

The Materials sector closed lower, dragged down by losses among mining heavyweights; Fortescue Metals fell 0.8% and BHP gave up 0.6%, while Rio Tinto finished the session flat. Gold miners were mixed; Evolution Mining rose 1.0%, while Northern Star Resources and Newcrest Mining slipped 1.4% and 1.7% respectively.

The Financials sector lost 0.3%, as all major banks weakened; Westpac gave up 0.8% and ANZ fell 0.5%, while Commonwealth Bank and NAB slipped 0.3% and 0.2% respectively. Fund managers advanced; Challenger rose 0.5% and Australian Ethical Investment added 0.8%, while Magellan Financial Group lifted 0.9%.

The Australian futures market points to a 0.18% rise today.

Overseas Markets

European sharemarkets weakened on Friday on concerns the spread of the Omicron COVID-19 variant would hinder the progress of the economic recovery. Retail and technology stocks were the main laggards. Banking stocks also underperformed; Barclays and HSBC slipped 0.2% and 0.4% respectively, while Lloyds Bank fell 0.6% and Deutsche Bank lost 0.9%.

Automaker stocks were weaker; Volkswagen gave up 1.2% and BMW fell 0.6%, while Porsche slipped 0.4%. Food delivery services Just Eat Takeaway and Deliveroo lost 3.2% and 2.4% respectively, following concerns a new European Commission proposal, which would see ride-hailing and food delivery drivers entitled to employee protections, would impact company profits.

By the close of trade, the German DAX slipped 0.1% and the STOXX Europe 600 fell 0.3%, while the UK FTSE 100 shed 0.4%.

US sharemarkets closed higher on Friday, as all sectors advanced. The Information Technology sector was the top performer; Fortinet climbed 5.1%, while Apple and Microsoft both added 2.8%. Financial services stocks were mixed; Visa lifted 1.0% and BlackRock gained 0.7%, while PayPal slid 1.7%. Health Care stocks were also mixed; UnitedHealth rose 1.0%, while Johnson & Johnson and Danaher slipped 0.3% and 0.6% respectively.

By the close of trade, the Dow Jones added 0.6% and the NASDAQ lifted 0.7%, while the S&P 500 gained 1.0%. Over the week, the NASDAQ and S&P 500 closed up 3.6% and 3.8% respectively, while the Dow Jones added 4.0%.

CNIS Perspective

US inflation data, as measured by the Consumer Price Index (CPI), jumped to its highest annual rate in almost 40 years last week, since 1982, when Ronald Regan was president. The annual increase of 6.8% was in line with consensus expectations, with President Biden betting that price increases have peaked and will decelerate more rapidly than expected.

The US Federal Reserve, which meets this week to set the country’s monetary policy, is now expected to announce a more rapid drawdown of its stimulus, setting the stage for possible interest rate increases next year. The delicate balancing act of removing a decade of easy money and tackling inflation, all whilst easing the US economy as it recovers from the pandemic, is no simple task.

Job growth indicators have been at the forefront of the US central bank’s arguments when defending their recent ultra-loose monetary policy stance, however, this has begun to shift as prices surge and incomes provide for less. The employment market has structural changes post the pandemic that suggests the read through from traditional employment data is not as reliable as it has been in the past.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.