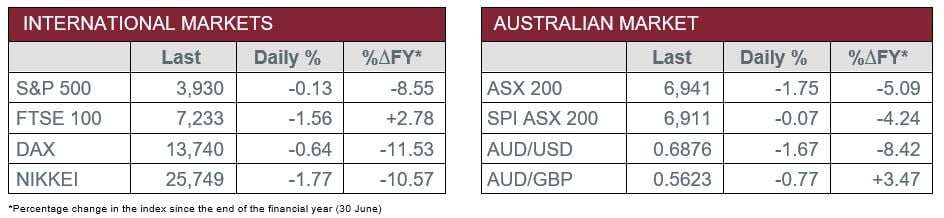

Pre-Open Data

Key Data for the Week

- Thursday – UK – Gross Domestic Product fell 0.1%, after being flat in February, which meant the economy expanded just 0.8% in 1Q 2022.

- Thursday – AUS – Consumer Inflation Expectations lowered slightly to 5.0%, down from 5.2% in the prior period.

- Friday – EUR – Industrial Production

Australian Market

The Australian sharemarket slipped 1.8% on Thursday, after stronger than expected US inflation data proved global price pressures had not slowed as quickly as hoped. The results indicate that central banks may be forced to ramp up their monetary policy tightening in an attempt to control inflation. By the close of trade, all sectors in the local sharemarket had declined.

Sustained levels of high inflation was a major concern amongst investors, as the interest rate sensitive Information Technology sector plunged 8.7%. A key detractor was Xero (-11.6%), despite its report of double digit revenue growth, as their earnings results seemed to underwhelm investors. Another important mover in yesterday’s session was Block, which sank 17.6%.

On the other hand, the Financials sector outperformed the broader market, however, still lost 0.8%. The sector was propped up by Commonwealth Bank (0.6%), which reported that, despite a 1.0% decrease in operating income and 2.0% fall in its net interest income, it produced a cash profit of $2.4 billion in 3Q 2022. Meanwhile, NAB rose 1.0% amid news that it wants to buy the banking segment of Suncorp Group, which would add nearly $60 billion in loans to NAB’s balance sheet. Suncorp’s share price also benefited from the news, up 1.1%. However, these gains were offset by their peers, as Westpac fell 1.9% and ANZ lost 0.9%. Another notable detractor was Macquarie Group, which sank 3.8%.

The Australian futures market points to a relatively flat open today, following suit from US sharemarkets overnight.

Overseas Markets

European sharemarkets slumped on Thursday, as the volatility gauge for the Eurozone spiked to 33 points, up 4.1%. Cyclical related stocks were the main detractors from yesterday’s session, most notably the Information Technology (-0.5%), Energy (-2.5%) and Materials (-2.9%) sectors. By the close of trade, the STOXX Europe 600 (-0.8%), German DAX (-0.6%) and UK FTSE 100 (-1.6%) all declined.

US sharemarkets were also volatile on Thursday, however closed relatively flat, despite sinking almost 2.0% earlier in the session. By the close of trade, the Dow Jones edged down 0.3%, the S&P 500 inched 0.1% lower and the NASDAQ added 0.1%. Unsurprisingly, the Information Technology sector was the weakest, broadly down 1.1%, with mixed company performance. Microsoft (-2.0%) and NVIDIA (-2.7%) lost ground, while Meta Platforms (1.3%) and Netflix (4.8%) recovered. Another notable mover was e-commerce platform provider Shopify, which surged 11.0%, after its executives said they are personally buying shares given current weakness in the company’s price. Electric vehicle infrastructure company, ChargePoint Holdings (7.5%), also outperformed, following news it will report earnings later this month.

CNIS Perspective

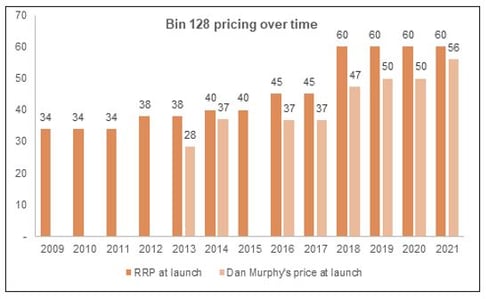

It may not be widely recognised as a leading indicator of China’s economic condition, but it does give an insight into it. In August 2019, Treasury Wines Estates launched into the Chinese market its 2019 vintage Bin 28 and Bin 128.

The lucky Chinese numbers make this established Australian wine particularly attractive to the Chinese market.

Shanghai and Beijing are the biggest markets for these wines, but given COVID lockdowns, demand has dropped off.

In 2019 when the Bin 128’s RRP was $60 a bottle, it was selling in Dan Murphy’s for $56. It’s now down to $42.86!

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025