Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – EUR – Industrial Production

- Tuesday – AUS – RBA Meeting Minutes

- Tuesday – UK – ILO Unemployment Rate

- Tuesday – US – Industrial Production

- Wednesday – UK – Consumer Price Index

- Wednesday – US – Retail Sales

- Thursday – AUS – Unemployment Rate

- Thursday – UK – BoE Interest Rate Decision

- Friday – UK – Consumer Confidence

- Friday – UK – Retail Sales

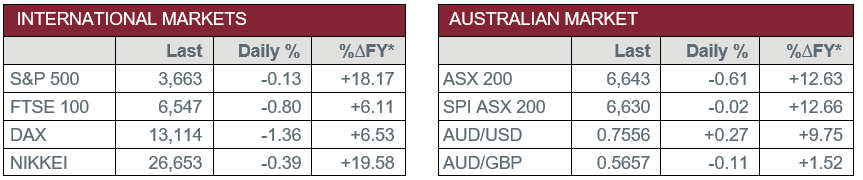

Australian Market

The Australian sharemarket closed down 0.6% on Friday, to post successive losses in the final trading sessions of the week. Most sectors ended the day lower, with Health Care the major laggard, weighed down by CSL, which slid 3.2% after the company announced it would not proceed past its current stage 1 joint trial with the University of Queensland due to the vaccine causing false positive HIV test results.

The Financials sector was a further weight on the market, dragged lower by the big four banks, which all gave up between 0.2% and 1.0%, with ANZ the weakest performer.

Information Technology and Energy stocks were amongst the standouts on Friday. ZipCo gained 1.9% after the company announced it has signed a partnership with Facebook, which will enable small and medium-sized Australian businesses to use Zip Business to pay for advertising on the global social platform.

Higher commodity prices continued to boost the major miners; BHP and Rio Tinto climbed 0.8% and 0.5% respectively, while Fortescue Metals lifted 2.0%.

The Australian futures market points to a flat open today.

Overseas Markets

European sharemarkets closed lower on Friday. Pharmaceutical giant Sanofi fell 4.0%, after the company announced its joint COVID-19 vaccine candidate with GlaxoSmithKline (-0.1%) showed an insufficient immune response in clinical trials. The broad based STOXX Europe and the UK FTSE 100 both slipped 0.8%, while the German DAX lost 1.4%.

US sharemarkets were weighed down by mixed sentiment on Friday. The US Food and Drug Administration advisory panel’s recommendation for the approval of Pfizer (-1.5%) and BioNTech's (-1.7%) COVID-19 vaccine for emergency use was offset by a renewal of more restrictions in New York City. Tesla lowered 2.7% after it received a broker downgrade. Walt Disney soared 13.6%, after the company announced a new streaming lineup featuring their heavyweight Marvel and Star Wars franchises. By the close of trade, the Dow Jones added 0.2%, however, the S&P 500 slipped 0.1% and the NASDAQ dropped 0.2%.

CNIS Perspective

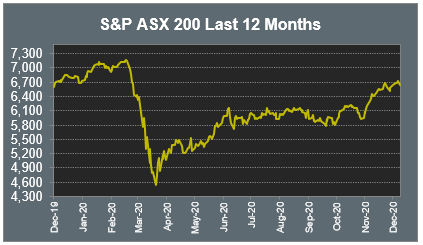

The buoyant investor sentiment currently driving stocks to new all-time highs is presenting opportunities for companies looking to list on the market and/or raise additional capital to continue to grow. An example of this is the S&P 500, which has rallied to well above its 200-day moving average at Friday’s close, with readings showing similarities to the bull market of 2009.

Worldwide, some US$800bn of equity has been raised in 2020 by non-financial firms, the highest sum on record. This equity-raising bonanza last week saw Tesla, one the standout stocks of 2020, sell US$5bn of new shares. DoorDash, a food-delivery company and global online rental marketplace Airbnb, listed in the US last week, each raising north of US$3 billion and both more than doubling from their listing prices in their first few days of trade, showing yet another sign of irrational exuberance.

Despite irrational exuberance, we are still some way from dot.com levels, with interest rates expected to stay lower and inflation under control, this may continue for some time. On one hand, many technology companies are attracting all-time high stock valuations, while Pfizer, which is earmarked to ‘save the world’ with its COVID-19 vaccine, has seen its stock price rise just 11% year to date (investing can be hard at times!).

While many indicators suggest a correction might need to take place in some segments of the market, with so much cash in the system the current euphoria is likely to continue, as was the case in the 1999 technology boom.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025