Pre-Open Data

Key Data for the Week

- Tuesday – AUS – NAB Business Conditions and Confidence

- Tuesday – EUR – Industrial Production

- Tuesday – UK – ILO Unemployment Rate

- Wednesday – US – Retail Sales

- Wednesday – UK – Consumer Price Index

- Wednesday – CHINA – Industrial Production

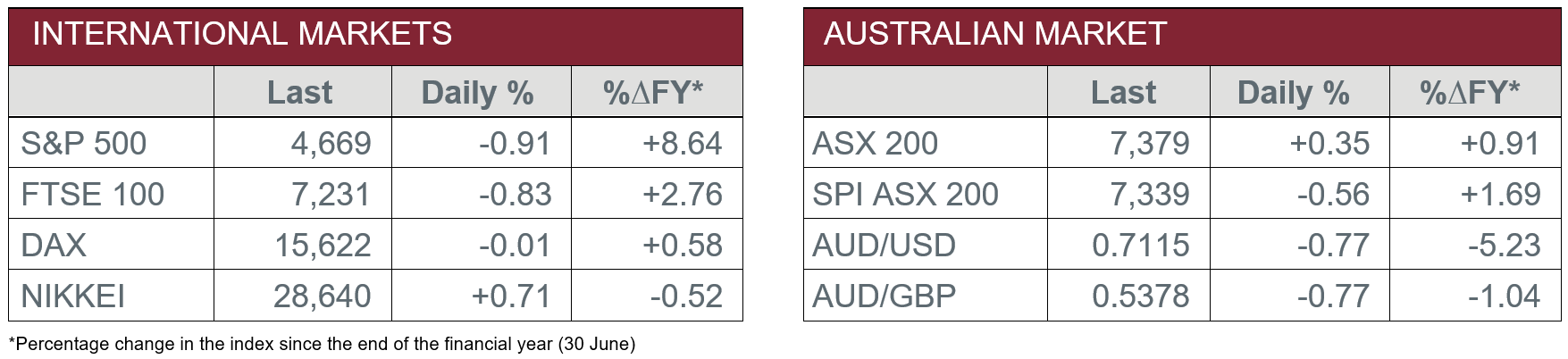

Australian Market

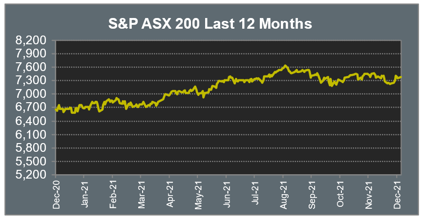

The Australian sharemarket added 0.4% yesterday, as investors seemed optimistic despite further Omicron worries.

The Materials sector closed the session 1.6% higher given the recent rally in the price of iron ore. Fortescue Metals added 2.0%, Rio Tinto gained 2.3% and BHP lifted 2.7%. Mineral Resources was up 2.6%, after the company announced they would pursue lithium opportunities in Europe.

Given the perceived decreased severity of the Omicron variant, the price of oil rose, as investors disregard the possibility of more lockdowns. As a result, Woodside Petroleum lifted 1.1%, while Beach Energy and Santos gained 3.4% and 1.9% respectively.

The major banks were mixed as they are set to have their Annual General Meetings this week. Commonwealth Bank was the best performer, up 0.1%, while Westpac lost 0.1% and ANZ and NAB conceded 0.4% and 0.5% respectively.

The Australian futures market points to a 0.56% decline today.

Overseas Markets

European sharemarkets lost ground on Monday, as elevated COVID worries decreased investor optimism. The Travel and Leisure sector was the hardest hit; Lufthansa conceded 3.4% and Ryanair lost 4.0%, while easyJet shed 4.2%. These Omicron jitters also detracted from the Energy sector’s performance, as BP lost 3.0% and Royal Dutch Shell closed the session 2.4% lower.

By the close of trade, the German DAX closed relatively flat, while the STOXX Europe 600 fell 0.4% and the UK FTSE 100 dropped 0.8%.

US sharemarkets also closed lower overnight, with Omicron worries the best explanation for the pullback. The Information Technology sector declined; NVIDIA lost 6.8% and Spotify shed 3.3%, while Amazon gave up 1.5%. Losses were also seen in the Consumer Discretionary sector, as Foot Locker lost 5.1% and Nike shed 1.3%.

By the close of trade, the Dow Jones and the S&P 500 both lost 0.9%, while the NASDAQ closed the session 1.4% lower.

CNIS Perspective

There is much talk about raising interest rates and removing stimulus from the global economy and the US Federal Reserve being the key in managing this.

However, what is interesting to delve into is how far rates can actually increase.

The best guide to determine this is the bond market, which is signalling the US Federal Reserve will raise rates a number of times from the mid-part of 2022. However, the spread between short-term and long-term interest rates is actually very small.

The two-year Treasury yield sits at 0.64%, while the 10-year yield is just 1.41%, giving a spread of 77 basis points. Heading into a rate rising environment this is considered an extremely flat ‘yield curve’, where the bond market is suggesting rate rises are going to cap out very quickly.

It is very hard to disagree with what the bond market is currently pricing. At the end of the day, the globe is stuck in a low interest rate environment which is loaded with debt. The stifling of economic growth if rates rise too significantly is going to occur, as consumers are required to tighten their purse strings.

The same occurred in 2015; rates began to creep higher over a three-year period (to a maximum of 2.5%), only to begin to revert in 2019, and return to zero in 2020.

This time around, rates returning to even a low 2.5% is going to be a stretch for the Federal Reserve.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.