Pre-Open Data

Key Data for the Week

- Tuesday – AUS – RBA Board Meeting Minutes

- Tuesday – UK – Unemployment Rate

- Wednesday – US – Retail Sales

- Wednesday – US – Federal Reserve Meeting

- Thursday – AUS – Unemployment Rate

- Thursday – UK – BoE Policy Meeting

- Friday – EUR – Trade Balance

Australian Market

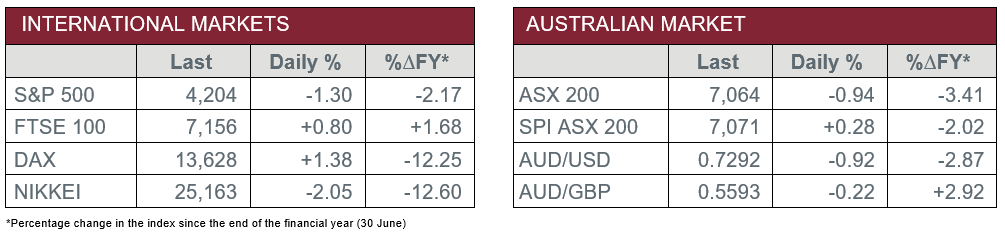

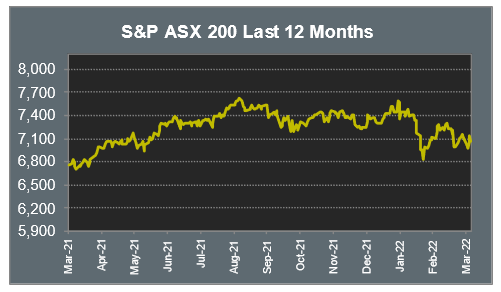

The Australian sharemarket dropped 0.9% on Friday, as most sectors closed the trading session lower. Over the week, the ASX 200 declined 0.7%, as investors expect the Federal Reserve will raise interest rates in this week’s meeting.

The Information Technology sector, which will be affected by the increased interest rates, lost 3.2%. Buy-now-pay-later providers were among the worst performers; Zip lost 7.6%, Sezzle conceded 6.9% and Block shed 3.2%. Accounting software provider, Xero, fell 5.9%, while artificial intelligence provider, Appen, closed the session 6.2% lower.

Sector giant, CSL, weighed on the market as it dropped 2.5%. This led the Health Care sector lower, as Sonic Healthcare lost 2.1%, Ramsay Health Care conceded 1.1% and Australian Clinical Labs slipped 0.2%.

The Materials and Energy sectors were the only two sectors to enjoy gains on Friday, lifted by commodity prices. As a result, Rio Tinto added 1.0%, while Fortescue Metals and Mineral Resources lifted 0.2% and 2.7% respectively. Lithium miners also increased; Core Lithium jumped 11.7%, while Allkem rose 5.0%.

The Australian futures market points to a 0.28% rise today.

Overseas Markets

European sharemarkets finished higher on Friday, as all sectors closed in the green. The Travel and Leisure sector increased; International Consolidated Airlines jumped 6.1%, while easyJet added 2.3%. The Energy sector was mixed despite a rise in the price of oil, as BP added 1.2%, while Royal Dutch Shell closed the session 0.2% lower.

By the close of trade, the STOXX Europe 600 added 1.0% and the UK’s FTSE 100 lifted 0.8%, while the German DAX rose 1.4%.

US sharemarkets lost ground on Friday, as losses among technology stocks weighed on the indices. Netflix lost 4.6% and NVIDIA shed 2.5%, while Microsoft and Alphabet slipped 1.9% and 1.7% respectively. Chinese technology giants, Alibaba and Baidu, fell 6.7% and 12.0% respectively, after the SEC hinted at possible de-listings for failing to abide by US accounting regulations.

By the close of trade, the Dow Jones lost 0.7%, while the S&P 500 and NASDAQ declined 1.3% and 2.2% respectively.

CNIS Perspective

The ABS has quoted new dwellings (+4.2%) and automotive fuel (+6.6%) as the significant contributors to the 1.3% rise in domestic CPI for the December 2021 quarter, which totalled 3.5% annually. This came amid shortages in building supplies and labour with continued strong housing demand.

Inflationary pressures remain in the March 2022 quarter, given the geopolitical tensions in Europe affecting global energy prices and the floods in QLD and NSW exerting pressure on building supplies to repair damage.

This pressure, not just evident on households, saw an announcement from consumer staples provider SPC, which noted the price to supermarkets of 100 household food goods, including SPC baked beans and spaghetti, Ardmona canned tomatoes and Goulburn Valley fruits, will rise 10 to 20 per cent as the parent company either passes on the biggest price inflation shift or “faces the prospect of going out of business”.

The company’s fuel cost is up $30,000 a month, which comes on top of higher freight costs, packaging costs and product costs, including wheat prices pushing up the price of spaghetti, another fallout from the European crisis.

This could push a can of baked beans from $1.70 to $2.20 if supermarkets pass on the cost to shoppers.

SPC is likely to not be the only Australian business citing global pricing pressures in the near future.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025