Pre-Open Data

Key Data for the Week

- Wednesday – CHINA – Trade Balance widened to US$66.8 billion, as exports rose 28.1% and imports slowed 17.6% from a year earlier.

- Wednesday – US – Consumer Price Index rose 0.4% in September and 5.4% over the year.

- Wednesday – EUR – Industrial Production declined 1.6% in August, however, was still 5.1% higher over the year.

Australian Market

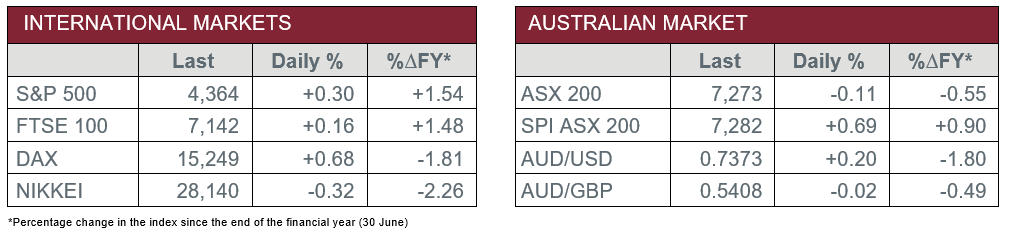

The Australian sharemarket lost ground for a third straight session on Wednesday, as investors considered inflation and central bank hawkishness, supply bottlenecks, global energy shortages, China’s ongoing Evergrande situation and US fiscal policy.

The major miners offset gains made by most market sectors, attributable to the reversal in iron ore prices, which undermined the strong recovery experienced earlier in the week. The Materials sector closed down 1.1%, as heavyweights BHP, Rio Tinto and Fortescue Metals Group fell 1.0%, 3.2% and 5.3% respectively.

On the other hand, the stronger performers included the REITs (1.5%), Consumer Staples (0.7%), and Consumer Discretionary (0.5%) sectors. Unsurprisingly, as NSW re-opened from lockdown this week, ANZ reported a surge in spending. Key movers included Goodman Group (2.2%), Scentre Group (2.0%) and Coles Group (0.8%).

The Financials sector stumbled, down 0.6%, as NAB (0.3%) was the only major bank to advance. Commonwealth Bank, Westpac and ANZ conceded 1.6%, 1.3% and 0.4% respectively. Meanwhile, Macquarie Group supported the sector, after it rose 0.5%.

The Australian futures point to a 0.69% rise today.

Overseas Markets

European sharemarkets performed modestly on Wednesday, after positive earnings guidance from Europe’s most valuable tech company, SAP (3.9%), and healthy quarterly results from luxury goods producer, LVMH (3.2%), helped soothe worries about inflation. Banks were the major laggards, down 2.1%, with Barclays being a key mover (-2.3%). The STOXX Europe 600 and German DAX both rose 0.7%, while the UK FTSE 100 edged 0.2% higher.

US sharemarkets were mostly higher on Wednesday, as third quarter earnings results were digested by investors. The world’s largest money manager, BlackRock, rose 3.8%, after it beat quarterly profit targets. Meanwhile, JPMorgan (-2.6%) lost ground despite a strong earnings report. Apple reported low production levels for its new iPhone 13, which led to a slight decline in the share price, down 0.4%. The Dow Jones closed flat, while the S&P 500 and NASDAQ gained 0.3% and 0.7% respectively.

CNIS Perspective

US inflation rose 5.4% from a year earlier, as it remains at its highest rate in a decade. Inflation has been stubbornly high, since hitting 5.4% in June/July as the US economy re-opened from its COVID induced lockdown.

The outbreak of the COVID-19 crisis in 2020 dramatically reduced demand for many types of goods such as travel and energy, causing their prices to plunge.

Fast forward 12 months, unusually high demand is driving inflation higher, with spending jumping 11.9% in the second quarter as more people received COVID vaccines, businesses reopened and trillions of dollars of government stimulus was deployed throughout the economy.

Supply chain disruptions in the automotive sector have also contributed to recent inflation. US consumers are now paying US$3.20 a gallon for fuel, the highest level in 7 years!

A shortage of truckdrivers and continued demand for goods has logjammed ports, causing delays in deliveries of goods and sending shipping prices soaring! A shortage of semi-conductors has hit auto production, causing prices to soar for new and used vehicles. The average price for a new vehicle in September was almost US$4,900 higher than a year ago.

Supply chain issues will have a wide ranging effect, not only on inflation, but are also likely to be the main focus of the current company earnings season.

At the end of the day, the US Federal Reserve’s role is to ensure inflation is kept under control and their policies should adapt to make sure this happens.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.