Pre-Open Data

Key Data for the Week

- Tuesday – AUS – House Price Index

- Tuesday – AUS – NAB Business Confidence and Conditions

- Tuesday – US – Consumer Price Index

Australian Market

The Australian sharemarket closed 0.3% higher on Monday, with gains restricted by the ongoing impact of the Delta variant lockdowns across NSW and Victoria.

A third bid by a consortium of superannuation companies for Sydney Airport at $8.75 per share led to the company adding 4.6% during the day’s trade. Following this bid, the company will let the consortium examine its books, suggesting it is closer to a decision on the takeover offer. On this news, Auckland International Airport rose 1.7%.

The Materials sector advanced 1.0%, as there were mixed performances among the major miners. Rio Tinto shed 0.2%, while BHP added 0.6% and Fortescue Metals lifted 0.8%. Gold miners enjoyed gains; Northern Star Resources jumped 3.4% and Evolution Mining was up 4.0%.

The price of oil rose, as expectations remain that demand will increase following the impact of the Delta variant. This led to gains in the Energy sector; Beach Energy lifted 1.0% and Santos added 1.8%, while Woodside Petroleum rose 1.7%.

The Australian futures point to a 0.19% fall today.

Overseas Markets

European sharemarkets broke a four-day losing streak to gain overnight. Gains were led by the Energy sector, aided by an increase in oil prices. BP added 2.2% and Royal Dutch Shell lifted 2.5%. Gains were also seen across the Financials, Materials, and Industrial sectors. By the close of trade, the STOXX Europe 600 gained 0.3%, while the UK FTSE 100 and the German DAX both lifted 0.6%.

US sharemarkets were mixed on Monday as investors await upcoming economic data. The Health Care sector incurred the largest loss. Moderna and Pfizer Inc lost 6.6% and 2.2% respectively on the news booster shots may not be required. ‘Big Tech’ companies were mixed; Microsoft added 0.4%, and Apple lifted 0.4%, while Amazon conceded 0.4%.

By the close of trade, the Dow Jones and S&P 500 gained 0.8% and 0.2% respectively, while the NASDAQ lost 0.1%.

CNIS Perspective

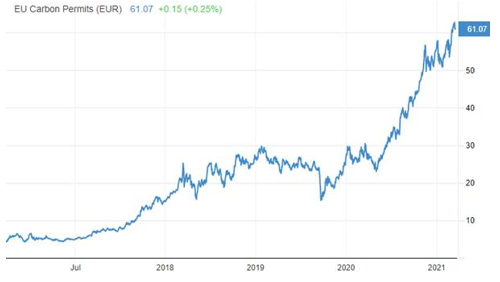

For commodity traders, 2021 will probably be remembered as the year when carbon trading emerged as a legitimate and regularly traded product.

The market for carbon credits is growing at a rapid rate globally, with the significant tailwind of governmental pressures to meet emissions targets set by the Paris Agreement.

Companies around the world have flocked to buy offsets from groups that plant and protect trees and install renewable energy. The trade is relatively simple, with one offset equal to one tonne of carbon saved or removed from the atmosphere, which can be banked against a polluter’s own emissions.

To date the carbon market only makes up a very small part of the commodities industry. However, it is projected to surpass copper and gold by 2030, and likely to become the largest of commodity markets, by taking over oil, by 2040.

The largest mandatory emissions trading scheme, the European Union Emissions Trading System, has seen volumes of offsets boom this year, while the price of carbon credits sets record highs. EU Carbon Permits started the year around €30 per tonne, before increasing to €50 in May, and has now surpassed €60 per tonne to sit at record levels.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.