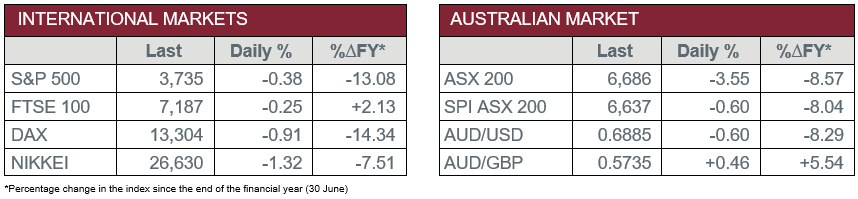

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – NAB Business Conditions and Confidence – Business Confidence fell 4 index points to 6 in May, while Business Conditions fell to 16 in May, from 19 in April.

- Tuesday – UK – Unemployment Rate lifted to 3.8% in April, from 3.7% in March.

- Wednesday – CHINA – Retail Sales

- Wednesday – US – FOMC Meeting

Australian Market

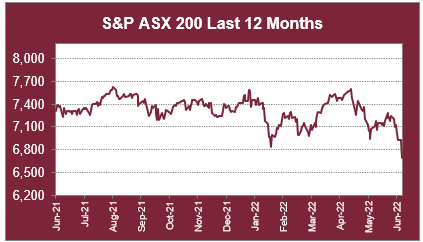

The Australian sharemarket slumped 3.6% on Tuesday to reach a 16-month low. The market weakened in response to accelerating inflation in the US, with an inflation rate of 8.6% reported for May 2022, which raised concerns the US Federal Reserve will announce a 75-basis point increase during their meeting tonight.

All sectors closed in the red, with Energy the main detractor, down 4.9%. Beach Energy gave up 5.6% and Woodside Energy shed 5.3%, while Santos fell 5.0%. The Materials sector was also a major laggard, weighed down by losses amongst the mining heavyweights; Fortescue Metals tumbled 8.5%, while BHP and Rio Tinto both lost 4.2%.

The interest rate sensitive Information Technology sector also slid 4.4%. Zip Co dived 15.9% and Block Inc retreated 15.1%, while WiseTech Global shed 6.0% and Xero slipped 1.2%.

All major banks posted losses; ANZ was the worst performer, down 4.6%, followed by NAB, which closed down 4.3%, while Westpac and Commonwealth Bank gave up 3.7% and 2.8% respectively.

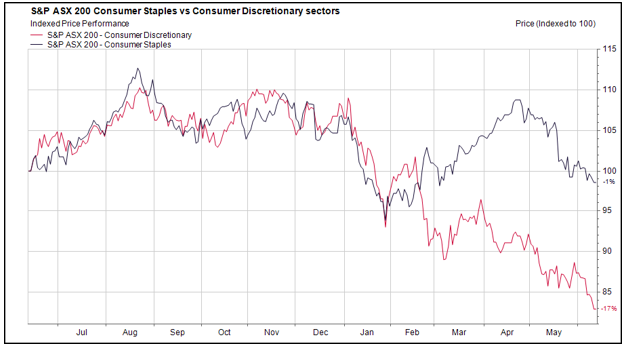

The defensive Consumer Staples sector outperformed; Bega Cheese fell 3.0% and Woolworths closed down 1.5%, while Coles slipped 1.4% and Endeavour Group finished the session flat.

The Australian futures market points to a 0.6% fall today.

Overseas Markets

European sharemarkets weakened on Tuesday, weighed down by the Health Care and Industrials sectors. However, banking stocks advanced; HSBC added 3.6% and Lloyds Bank lifted 1.8%, while Barclays Bank gained 1.0% and Deutsche Bank rose less than 1.0%. By the close of trade, the STOXX Europe 600 gave up 1.3%, while the German DAX and UK FTSE 100 posted losses of 0.9% and 0.3% respectively.

US sharemarkets were mixed overnight, as investors continued to await the US Federal Reserve interest rate decision. The Information Technology sector was the main outperformer, up 0.6%. NVIDIA lifted 1.2% and Fortinet gained 1.0%, while Microsoft and Apple added 0.9% and 0.7% respectively. However, the Health Care sector weakened; UnitedHealth Group fell 1.7% and Johnson & Johnson slid 1.5%, while Bristol-Myers Squibb and Danaher Corporation gave up 1.0% and 0.6% respectively. By the close of trade, the Dow Jones slipped 0.5% and the S&P 500 eased 0.4%, while the NASDAQ gained 0.2%.

CNIS Perspective

Ignoring the effect on the property market, rising interest rates will have an even greater effect on discretionary spending.

Assuming mortgage interest rates jump 2%, from 3% to 5%, over the course of the next six months (they are already up 35.6% in just a couple of months), this will force the repayments on a $500,000 mortgage up by $552 per month and up $1,104 month on a $1 million mortgage. For owner occupied properties, this is after tax dollars, which is a significant increase.

For people on fixed income repayment mortgages, this will create a very challenging situation. Hopefully they have been making repayments in excess of their minimum, so that these increases can be more easily absorbed.

If not, the absorption of the increased costs will be felt in lower spending, initially, on discretionary items.

The effect may not be that immediate on consumer staples, but for consumer discretionary businesses, they will probably be starting to feel the pain already.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025