Pre-Open Data

Key Data for the Week

- Thursday – AUS – Unemployment Rate edged 0.1% higher to 4.6%.

- Thursday – CHINA – Consumer Price Index rose 10.7% over the year to September, the highest rate on record after 9.5% annual growth in August.

- Friday – US – Retail Sales

Australian Market

The Australian sharemarket advanced for the first time this week on Thursday, as it closed 0.5% higher. Most sectors recorded gains, except Financials (-0.5%), Utilities (-0.2%) and Energy (-0.9%). The Energy sector lost ground as recent energy price appreciation slowed. Despite this slowdown, analysts warn energy prices could bring about stagflation, a situation where high inflation is met with stagnant economic growth.

The Information Technology sector steamed ahead on Thursday, up 4.1%, which drove the local market higher. Confidence in Technology stocks, amid inflation concerns, was bolstered by the NASDAQ’s performance Wednesday night. All sector heavyweights made commendable gains, as Afterpay, Xero and WiseTech Global grew 4.5%, 5.3% and 7.2% respectively.

The Materials sector recovered modestly, ahead 1.7%, with key performers being South32 (4.9%), Fortescue Metals Group (2.3%) and James Hardie (1.9%). South32’s share price climbed after it announced the company will purchase a 45% stake in Chile’s Sierra Gorda copper mine for $US1.55 billion ($2.1 billion). BHP and Rio Tinto also closed ahead, up 0.6% and 1.2% respectively.

The Financials sector stumbled further, down 0.5%, with NAB (0.1%) again being the only major bank in the green. Commonwealth Bank, Westpac and ANZ lost 1.3%, 0.1% and 0.7% respectively. Meanwhile, Macquarie Group gave up gains made on Wednesday, to close down 0.6%.

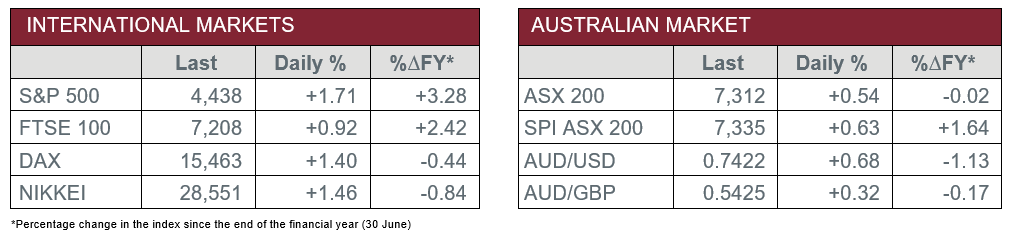

The Australian futures point to a 0.63% rise today.

Overseas Markets

European sharemarkets performed well again on Thursday, pushed higher by mining stocks, which broadly gained 3.3%. UK listed BHP and Rio Tinto both closed 3.7% higher. The STOXX Europe 600, German DAX and UK FTSE 100 rose 1.2%, 1.4% and 0.9% respectively. Technology was the other major performer, as European chipmakers benefitted from the positive industry outlook portrayed by Taiwan Semiconductor Manufacturing Company (TSMC), after it reported a 13.8% increase in third quarter profit.

US sharemarkets advanced on Thursday, supported by positive third quarter corporate earnings reports. All sectors closed higher, led by Materials (2.4%), Information Technology (2.3%) and Industrials (1.9%). The Materials sector was boosted by higher base metal prices, after copper and zinc both rose 3.8%, while all other metals rose between 1.0-2.0%. Key movers in the session included technology giants NVIDIA (3.9%), Apple (2.0%) and Alphabet (2.6%).

CNIS Perspective

As the pandemic started to subside in the US, Americans have been on an extraordinary buying spree. One measure of this is the daily tally of container ships idling outside the congested ports of Los Angeles and Long Beach, the entry point for about 40% of goods imported into the US.

The ports inability to match round the clock operations of their Asian counterparts has been a source of frustration for President Joe Biden’s administration, which unveiled a series of measures to ease the congestion and keep the US economic recovery on track.

The White House have stated they are allocating US$17 billion to ports and had also secured pledges from private sector heavyweights such as UPS and FedEx to extend their working hours. Shifting to 24/7 operations will require enormous coordination between the government operated ports and private sector groups, including large retailers and freight companies.

The question is how quickly these measures will be able to improve the movement of goods through a complex nationwide network that is strained to breaking point. Adding to the problem is a shortage of warehouse space and truck drivers.

These supply chain pressures have ripple effects throughout the economy that hurt US retailers, and there is a sense of urgency as the Christmas season looms.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.