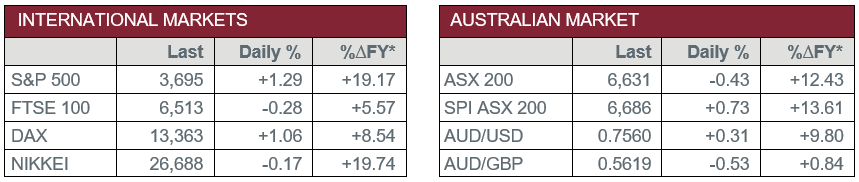

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – AUS – RBA Meeting Minutes reiterated the Board remains committed to not increasing the cash rate until actual inflation is sustainably within the 2% to 3% target range. The RBA does not expect to increase the cash rate for at least 3 years and is prepared to do more to stimulate the economy if necessary.

- Tuesday – UK – ILO Unemployment Rate edged higher from 4.8% in September, to 4.9% in the three months to October.

- Tuesday – US – Industrial Production rose 0.4% in November, following a 1.1% rise in October.

- Wednesday – UK – Consumer Price Index

- Wednesday – US – Retail Sales

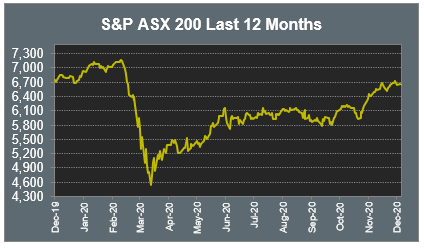

Australian Market

The Australian sharemarket slipped away in late afternoon trading to end the session down 0.43%, with the Energy and Materials sectors among the worst performers.

Coal miners continued to come under selling pressure after China formalised its ban on Australian coal imports, with the nation responsible for close to a quarter of Australia’s coal exports last year. Whitehaven Coal lost 5.9% and New Hope gave up 2.8% in response. Iron ore miners also slumped, after the commodity dropped 4.0% on Monday night, as mining heavyweights BHP and Rio Tinto slid 2.2% and 1.3% respectively.

The Financials sector was weighed down by the big four banks, which all slipped between 0.5% and 1.0%, with Commonwealth Bank the weakest performer.

The Australian futures market points to a 0.73% open today, driven by stronger US markets overnight.

Overseas Markets

European sharemarkets closed mostly higher on Tuesday, as investors looked past new COVID-19 lockdown restrictions in Germany, Italy and the UK, and instead chose to focus on vaccine optimism, with the possibility the European Union may approve its use by January. German carmaker Volkswagen soared 7.6% after its board eased internal corporate tensions by supporting CEO Herbert Diess. The German DAX strengthened 1.1% and the STOXX Europe 600 rose 0.3%, however, the UK FTSE 100 gave up 0.3%.

US sharemarkets rose on Tuesday, boosted by news of COVID-19 vaccine progress across the nation and increased optimism that US lawmakers will finally agree to a US$748 billion economic relief package. Apple lifted 5.0% following a report that revealed it plans to increase iPhone production by 30% in the first half of 2021, while Bristol-Myers Squibb climbed 4.3% after the company was added to Goldman Sachs’ conviction buy list. By the close of trade, the S&P 500 and the NASDAQ both gained 1.3%, while the Dow Jones rose 1.1%.

CNIS Perspective

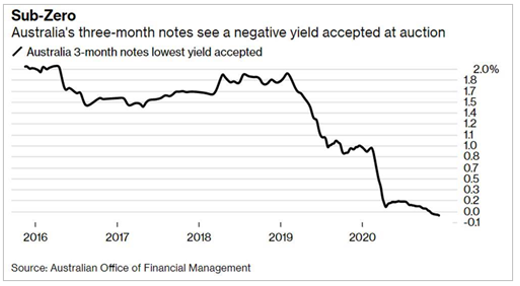

While interest rates in Australia are extremely low, comparatively to developed nations, Australia sticks out from the rest for ‘high yield’.

Australia sits in the top 10 developed countries for yield globally between 2-10 years and holds 2nd position for the highest yield on a 10-year note, at 0.99%. However, last week saw the Australian Federal Government paid to borrow money, as the interest rate on a three-month Treasury note sale turned negative for the first time.

Demand remains extremely strong for Australian Government bonds, with last week’s $1.5 billion bond offer for a three-month term 5.5 times oversubscribed, despite a weighted average yield of just 0.0099%.

However, the major news was one investor buying into the offer with a negative interest rate of -0.010%.

To date, the RBA has indicated they are unlikely to push cash rates into negative in Australia. However, last week’s bond sale may just be an indication of where the market is pushing Australian interest rates. The security of Australia’s AAA credit rating and strengthening Australian Dollar are looking ever attractive to international investors.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025