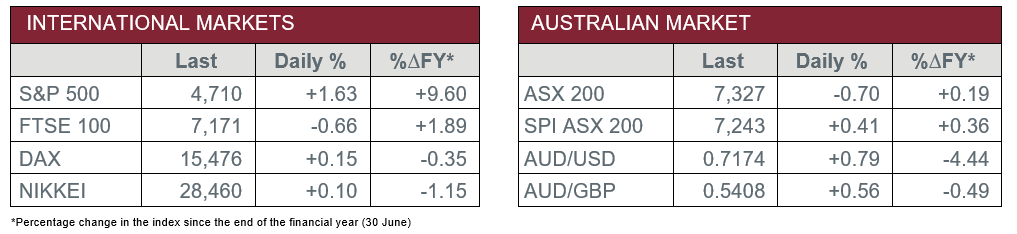

Pre-Open Data

Key Data for the Week

- Wednesday – US – Retail Sales rose by a seasonally-adjusted 0.3% in November.

- Wednesday – UK – Consumer Price Index jumped 5.1% in the twelve months to November, above the expected 4.7%.

- Wednesday – CHINA – Industrial Production grew 3.8% in the twelve months to November, above the expected 3.6%.

- Thursday – AUS – Unemployment Rate

- Thursday – UK – BoE Interest Rate Decision

Australian Market

The Australian sharemarket closed 0.7% lower on Wednesday, led by a sharp decline in the Information Technology sector (-2.6%). Other major detractors included the REITs (-1.5%), Telecommunications (-1.2%) and Materials (-0.9%) sectors. Utilities was the only sector which closed in the green, up 0.3%.

Key detractors in yesterday’s session included buy now pay later providers Zip (-6.9%) and Afterpay (-3.1%), alongside communication service providers SEEK Limited (-3.4%) and Carsales.com (-2.1%). Real Estate stocks broadly suffered, as index heavyweight Goodman Group fell 2.2%, while Dexus and Stockland lost 1.2% and 3.8% respectively.

The recent recovery in the price of iron ore, along with a sharp decline in international competitor output, bolstered the major miners. Rio Tinto added 0.2%, while BHP (-0.5%) and Fortescue Metals Group (-0.3%) outperformed the broader market.

The Financials sector edged 0.2% lower, dragged down by Commonwealth Bank (-0.6%), as all other major banks made modest gains between 0.3-0.5%.

The Australian futures point a 0.41% rise today.

Overseas Markets

European sharemarkets were mixed on Wednesday, pushed higher by stronger Technology (1.3%) and Health Care (1.1%) stocks. Notable movers included Airbus (-2.5%) and Veolia Environnement (2.3%). By the close of trade, the STOXX Europe 600 (0.3%) and German DAX (0.2%) edged higher, while the UK FTSE 100 fell 0.7%, after the UK reported a record number of COVID-19 cases as Omicron continues to sweep across the region.

US sharemarkets advanced on Wednesday, after the S&P 500 (1.6%), NASDAQ (2.2%) and Dow Jones (1.1%) all rose. This came after the US Federal Reserve announced it will increase the pace in which it will wind back its expansionary monetary policy. This forward guidance, in response to inflation concerns, seemed to have been received well by investors. Major movers included chip designer NVIDIA (7.5%), alongside cybersecurity stocks like Fortinet (6.6%) and CrowdStrike (6.0%).

CNIS Perspective

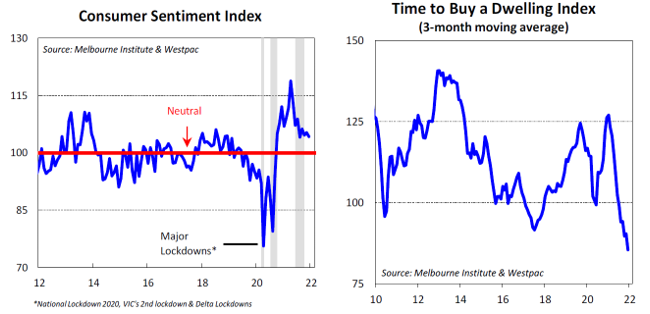

As mentioned in yesterday’s morning market update, business conditions, particularly in the retail sector, supports the notion of strong future economic conditions. Yesterday’s Melbourne Institute Consumer Sentiment Index further supports this.

Whilst the Index fell slightly in the month due to concerns over the emergence of the Omicron variant, it still remains well above long term averages.

Interestingly, the fall in the measure was driven primarily by a drop in the “time to buy a major household item” sub-index. This may also reflect supply chain disruptions and a rebalancing of spending towards services rather than physical goods as lockdowns have lifted.

Pent up demand, large household saving buffers, and the strong housing market should support strong growth in spending in the period ahead.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.