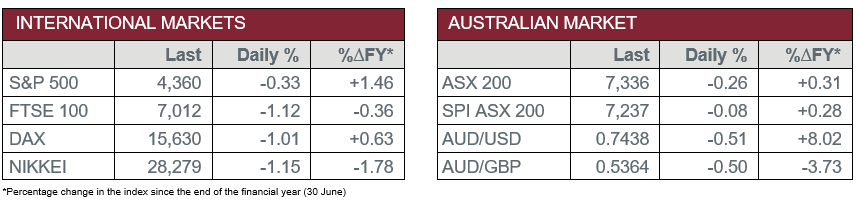

Pre-Open Data

Key Data for the Week

- Thursday – AUS – Unemployment Rate fell to 4.9% in June, down from 5.1% in May.

- Thursday – UK – Unemployment Rate rose to 4.8% in the three months to May.

- Friday – EUR – Trade Balance

- Friday – US – Retail Sales

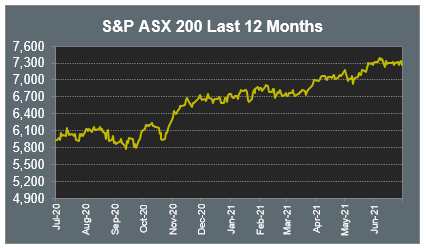

Australian Market

The Australian sharemarket eased 0.3% yesterday, as all sectors except Materials and Utilities closed lower.

Travel and leisure stocks remain under pressure as the NSW COVID-19 outbreak continued, with an additional 65 locally acquired cases reported yesterday, while it was announced Victoria will enter a five-day snap lockdown. Corporate Travel Management shed 3.3%, Flight Centre fell 2.6% and Webjet gave up 2.8%, while airlines Regional Express Holdings and Qantas lost 0.8% and 0.6% respectively.

The Materials sector was lifted by gains from mining heavyweights; Rio Tinto added 2.2% and Fortescue Metals rose 2.1%, while BHP closed up 1.1%. Gold miners were also stronger; Evolution Mining gained 2.7%, while Northern Star Resources and Newcrest Mining lifted 2.1% and 1.5% respectively.

Buy-now-pay-later providers continued to weaken due to news that Apple may enter the market; Afterpay slipped 2.3%, while Zip Co lost 5.6%. However, Sezzle rallied 5.2% after it was announced US credit card provider Discovery Financial Services is investing US$40 million with the company.

Sydney Airport lifted 0.1% yesterday following an announcement the board have rejected the Consortium’s takeover offer of $8.25 per share, as they concluded that the proposal undervalues the company and is not in the best interest of shareholders.

The Australian futures point to a 0.08% fall today.

Overseas Markets

European sharemarkets weakened overnight, as the UK recorded its highest daily increase in COVID-19 cases since 15 January. The Energy sector underperformed; BP gave up 2.9%, while Royal Dutch Shell shed 2.5%. Wind energy stocks saw declines; Siemens Gamesa Renewable Energy slumped 14.4% after the company revised earnings guidance following sharp increases in raw material costs, while Vestas Wind Systems lost 6.4%. By the close of trade, the UK FTSE 100 gave up 1.1%, while the German DAX and STOXX Europe 600 both fell 1.0%.

US sharemarkets were mixed on Thursday. The Energy sector was the weakest performer, down 1.4%, followed by the Information Technology sector, which fell 0.8%. Spotify lost 2.2% and Facebook slipped 0.9%, while Alphabet and Microsoft closed down 0.6% and 0.5% respectively. Financial services stocks were mixed; PayPal shed 1.4% and Mastercard slipped 1.2%, while Visa gained 1.0%.

By the close of trade, the Dow Jones added 0.2%, while the S&P 500 and NASDAQ fell 0.3% and 0.7% respectively.

CNIS Perspective

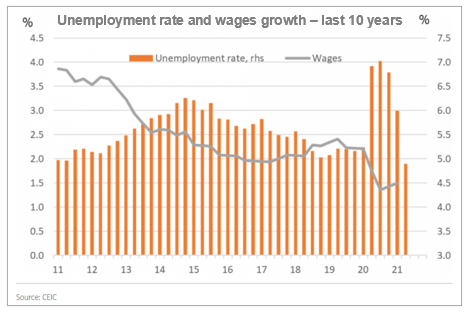

The Australian unemployment rate has dropped to its lowest level since 2011, to now sit at 4.9%, a remarkable achievement considering what the economy has endured over the past 18 months.

Yesterday’s data now points to a labour market moving beyond the ‘recovery’ phase and into an ‘expansionary’ phase.

The latest lockdowns may cause a slight hiccup to the rate in the short-term, however the long-term trajectory remains intact, with some economic forecasts pointing to a drop in the unemployment rate below 4% by the end of 2022!

However, what is yet to be seen is a material pick-up in wages growth, which typically occurs as the labour market tightens. It appears the unemployment rate needs to continue trending lower before we see this occur.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.