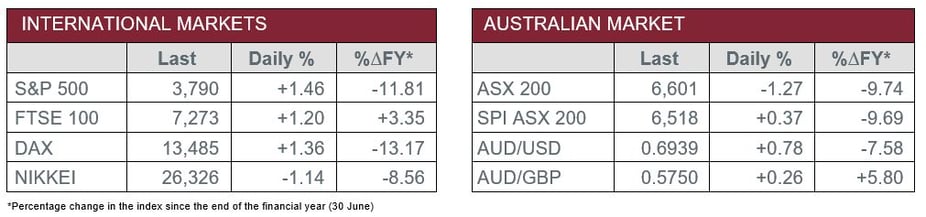

Pre-Open Data

Key Data for the Week

- Wednesday – CHINA – Retail Sales fell by an annual rate of 6.7% in May, softer than the expected 7.1% decline.

- Wednesday – US – FOMC Meeting – The cash rate target was increased by 0.75% to 1.50%-1.75%, the largest hike since 1994.

- Thursday – UK – BoE Policy Meeting

- Thursday – AUS – Unemployment Rate

Australian Market

The Australian sharemarket declined for the fourth day in a row on Wednesday, down 1.3%, as the local market remained cautious following an ABC interview with Reserve Bank Governor Philip Lowe on Tuesday night. In the interview Lowe outlined that inflation has not yet peaked, and could reach 7.0% by the end of the year, alluding to more rapid monetary policy tightening.

By the close of trade, all eleven industry sectors finished in negative territory, led by the Information Technology (-3.1%) and REITs (-2.9%) sectors. This was unsurprising given these sectors are the most sensitive to interest rates. Notable detractors included Xero (-5.2%), Megaport (-11.1%) and Goodman Group (-4.4%).

In company news, Rio Tinto made the first delivery of iron ore from its Gudai-Darri mine in Pilbara, Western Australia. Production is expected to ramp up as the year progresses and reach full capacity in 2023.

In other news, the Fair Work Commission raised the national minimum wage to $21.38 per hour from 1 July 2022. The 5.2% increase represents the largest percentage rise since 2006 and perhaps acknowledges the impact subdued wages growth has had on households in the current inflationary environment.

The Australian futures market points to a 0.37% increase today, after a strong lead from international markets overnight.

Overseas Markets

European sharemarkets broke their six day losing streak on Wednesday, after the European Central Bank said in an unscheduled meeting that it would intervene to temper the bond market rout and aid indebted Eurozone members. Bank stocks performed well in the session, broadly up 2.3%, while in company news H&M, the world’s second largest fashion retailer, declined 6.5%, despite its report of higher than expected quarterly sales. By the close of trade, the STOXX Europe 600, German DAX and UK FTSE 100 all advanced between 1.2%-1.4%.

US sharemarkets rallied on Wednesday, despite the 0.75% rate hike, as it seemed the market had already priced-in the move, after higher than expected inflation data last Friday. Additionally, the Federal Chairman Jerome Powell eased investor concerns with forward guidance, which indicated that such large rate hikes were not to be the new status quo. Ten out of eleven industry sectors advanced, led by Consumer Discretionary (3.0%), while the Energy sector was the only detractor, down 2.1%. By the close of trade, the Dow Jones added 1.0%, the S&P 500 rose 1.5% and the NASDAQ jumped 2.5%.

CNIS Perspective

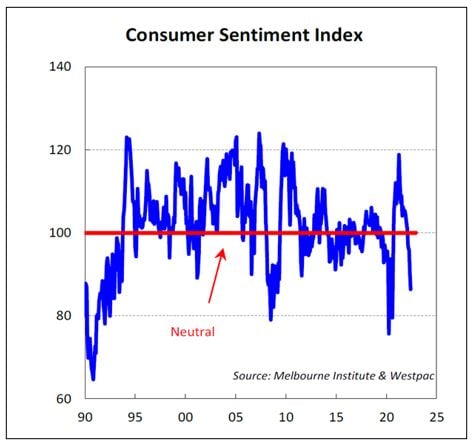

The RBA’s 0.5% increase in the Official Cash Rate has knocked the wind out of the sails of consumers.

Consumer confidence has fallen to its lowest level in almost 2 years, which reflects concerns households are having over personal finances.

Expectations for the economic outlook over the next year has also deteriorated.

Consumer spending bounced back strongly from lockdowns, however, the significant hit to consumer confidence over recent months points to downside risks to the outlook for consumer spending, which could lose all momentum by the end of the year.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025