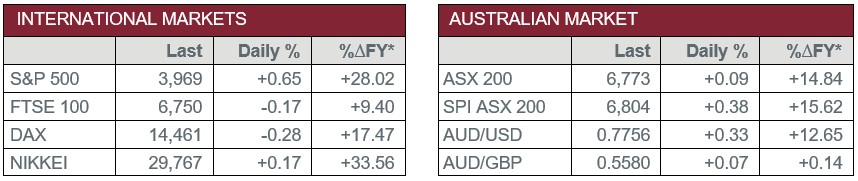

Pre-Open Data

Key Data for the Week

- Monday – AUS – HIA New Home Sales rose 22.9% in February, following a 69.4% decline in January.

- Monday – CHINA – Retail Sales increased 33.8% year-on-year in January-February, following a 4.1% rise in December.

- Tuesday – AUS – RBA Meeting Minutes

- Tuesday – US – Retail Sales

Australian Market

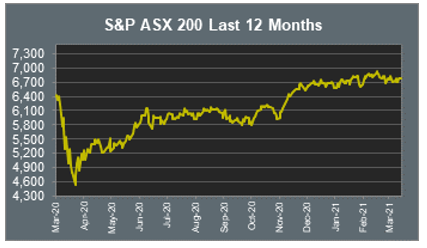

The Australian sharemarket gained 0.1% on Monday in a mixed session of trade. The Health Care and REITs sectors led gains, up 1.1% and 1.0% respectively, while Information Technology lost 1.9% and Materials slipped 0.6%.

The Materials sector was weighed down by mining heavyweights as iron ore prices dropped 3.1% over the weekend. Fortescue Metals gave up 4.1% after the company announced they had brought forward their carbon-neutral target by 10 years to 2030, while Rio Tinto lost 2.2% and BHP slipped 0.2%. However, goldminers enjoyed gains; Newcrest Mining added 1.4%, while Evolution Mining lifted 2.5% after the company agreed to acquire Canadian-based goldminer Battle North Gold for C$343 million.

The Financials sector enjoyed gains yesterday as all major banks, except Commonwealth Bank, closed higher. ANZ lifted 0.6%, Westpac rose 0.5% and NAB added 0.2%, while Commonwealth Bank fell 0.1%. Asset managers also outperformed; Magellan Financial Group climbed 4.9%, while Challenger lifted 0.3%.

The Australian futures market points to a 0.38% rise today, driven by stronger US markets.

Overseas Markets

European sharemarkets eased on Monday. Travel and leisure stocks outperformed; International Airlines Group lifted 2.5% and easyJet rose 2.2%, while Lufthansa added 1.1%. Flutter Entertainment jumped 6.8% after the company announced it is considering listing a small shareholding of its FanDuel business in the US. By the close of trade, the German DAX lost 0.3% and the UK FTSE 100 fell 0.2%, while the STOXX Europe 600 closed flat.

US sharemarkets advanced overnight. Travel and leisure stocks were stronger. American Airlines jumped 7.7% and Delta Air Lines lifted 2.4%. The Information Technology sector also saw gains; NVIDIA closed up 2.6% and Apple rose 2.5%, while Facebook and Fortinet both lifted 2.0%. By the close of trade, the NASDAQ gained 1.1%, while the S&P 500 and Dow Jones rose 0.7% and 0.5% respectively.

CNIS Perspective

Value investing consists of quantifying what a share is worth intrinsically based on fundamentals and its ability to generate cash flow. These cash flows are estimates of future earnings and are discounted into present value using a discount rate of the current risk-free rate, which is generally the government bond rate plus a premium for the uncertainty of investing in equities. Value investing is using certain inputs and deciding on an asset’s fair value and looking to buy at a discount relative to long term fundamentals.

Financial markets are not always rational and the manic mood swings of exuberance or despondence means a value investor can be presented with opportunities to acquire equities which are trading away from their actual value. However, value investors require patience and emotional discipline to act when such opportunities are presented, with careful analysis required as low valuation metrics alone can lead to ‘value traps’ (stocks that look cheap because future earnings potential is weak).

The contrast between value and growth investing can be seen as recently as last week, when the technology heavy NASDAQ, synonymous with growth stocks, entered correction territory (-10% from February highs), on the same day the Dow Jones Industrial index registered a new record high. This rotation from growth stocks into value can be considered a shift in investor mindset back towards fundamentals.

These rumblings are set to continue as the two approaches have divided the investment world for 50 years. While growth investing has dominated the past decade, value investors continue to suggest a resurgence is just around the corner.

Whichever camp you’re in, we are witnessing a great broadening of the current bull market with classic value stocks, like Energy and Financials, catching up with growth (technology) names, which is much better than the narrow rally we witnessed over the past year.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025