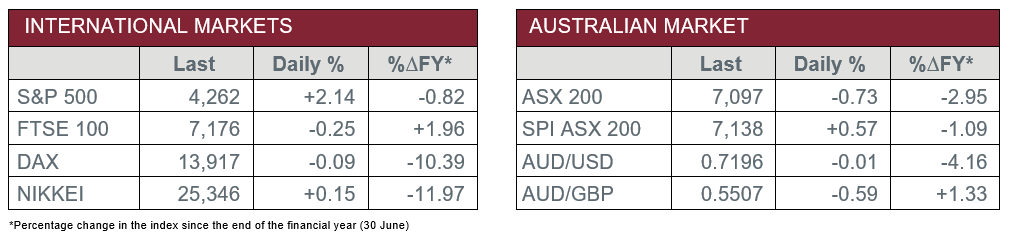

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – RBA Board Meeting Minutes confirmed policy settings were left unchanged in the March meeting.

- Tuesday – UK – Unemployment Rate dropped from 4.1% to 3.9%.

- Wednesday – US – Retail Sales

- Wednesday – US – Federal Reserve Meeting

Australian Market

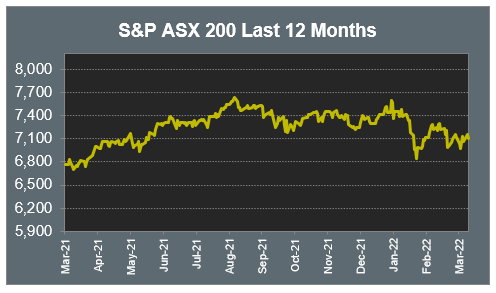

The Australian sharemarket dropped 0.7% yesterday, as the price of oil hit a two-week low to approximately US$102 per barrel. The Reserve Bank of Australia gave no intention they will seek to follow other nations and raise interest rates soon.

The Materials sector was the main laggard yesterday, as Australia’s largest trading partner, China, entered lockdowns due to a surge in COVID cases. As a result, the price of iron ore dropped from recent highs and Fortescue Metals lost 4.9%, while BHP and Rio Tinto conceded 4.2% and 3.9% respectively. Lithium producers were also impacted by the Chinese lockdowns; Allkem lost 6.8% and Pilbara Minerals closed the session 7.6% lower.

The fall in the price of oil weighed on the Energy sector, which lost 2.9%, as Woodside Petroleum shed 2.9% and Santos slipped 4.1%. Coal miners struggled; Yancoal dropped 6.8%, while Whitehaven Coal declined 2.4%.

The big four banks lifted the Financials sector to a 1.0% gain. Commonwealth Bank outperformed, up 1.8%, while NAB, ANZ and Westpac each gained between 0.5% and 1.1%.

The Australian futures market points to a 0.57% rise today.

Overseas Markets

European sharemarkets closed lower overnight, as no progress was made in peace talks between Russia and Ukraine. Chinese COVID restrictions weighed on the Materials sector; London-listed Rio Tinto shed 2.9%, while Glencore lost 4.0%. The major banks led the Financials sector lower; Barclays dropped 1.2%, while ING Groep closed the session down 0.3%.

Renewable energy providers were mixed, as semiconductor providers, Infineon Technologies and ASML Holdings, added 0.8% and 1.1% respectively. Wind turbine producers lost ground; Vestas Wind Systems slipped 3.2%, while Siemens Gamesa Renewable Energy dropped 2.5%. By the close of trade, the STOXX Europe 600 and the UK’s FTSE 100 both lost 0.3%, while the German DAX closed the session relatively flat.

US sharemarkets enjoyed gains on Tuesday, as the Information Technology sector rallied. NVIDIA jumped 7.7%, Amazon added 3.9% and Apple lifted 3.0%. The Travel and Leisure sector made gains, as major airlines provided updates regarding easing COVID pressures. As a result, Ryanair added 2.8%, while United Airlines Holdings and Southwest Airlines jumped 9.2% and 4.9% respectively.

By the close of trade, the Dow Jones added 1.8%, while the S&P 500 and NASDAQ lifted 2.1% and 2.9% respectively.

CNIS Perspective

If managing inflationary pressures wasn’t going to be difficult enough for central banks, Russia’s invasion of Ukraine will, according to the RBA, lead to an “adverse supply shock that would result in lower growth and higher inflation”.

Russia’s invasion complicates the job of policymakers. The disruption to energy markets will weigh on global growth and push up inflation, materially increasing the risk of stagflation.

Stagflation is the situation where, in an inflationary environment, economic growth slows or is stagnant and unemployment rises.

Raising interest rates to fight inflation (which is what is being mooted right now), will risk triggering a debt crisis and recession; but if they maintain a lower interest rate policy, they will risk double-digit inflation – and deep stagflation when the next negative supply shocks emerge.

Policymakers haven’t been in such a difficult situation for many years, but will now need to balance supporting economic activity, through lower interest rates and taming inflation.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025