Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Monday – CHINA – Industrial Production

- Monday – CHINA – Retail Sales

- Tuesday – AUS – RBA Meeting Minutes

- Tuesday – US – Retail Sales

- Wednesday – US – Housing Starts

- Thursday – AUS – Unemployment Rate

- Friday – AUS – Retail Sales

- Friday – UK – Retail Sales

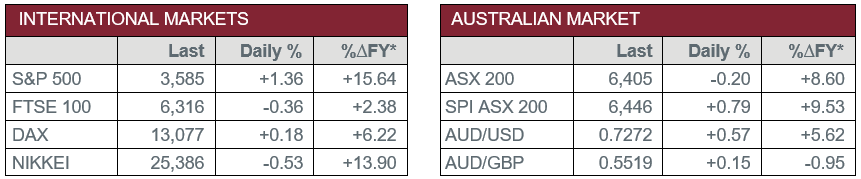

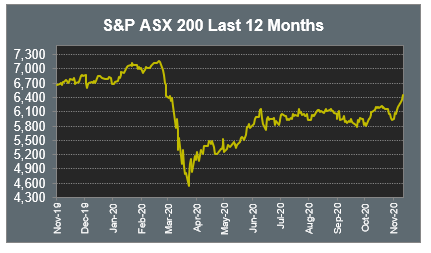

Australian Market

The Australian sharemarket slipped 0.2% on Friday to end the week on a disappointing note. Sector performance was mixed, with the defensive REITs, Industrials and Utilities names the major laggards. Despite Friday’s loss, the local ASX 200 closed the week 3.5% higher.

Telecommunications was the best performing sector on Friday, boosted by Telstra, which closed up 1.6%. The Materials sector also rose, as gold miners offset weakness from mining heavyweights BHP and Rio Tinto, which gave up 1.9% and 0.4% respectively. Newcrest lifted 2.8%, while Evolution and Northern Star both gained over 7.0%.

Ramsay Health Care slid 1.6%, after the company provided a quarterly trading update. Performance was mixed over the first quarter of FY21 due to differences in regional results. Revenue improved 1.5% in Australia, despite disruptions from Victoria’s second lockdown, while surgical volumes rose 5.4% in France. However, revenue declined nearly 10% in the UK (in GBP terms). The private hospital company declined to provide FY21 guidance, given the uncertainties associated with the COVID-19 pandemic.

The Australian futures market points to a 0.79% rise today, being driven by stronger US markets on Friday.

Overseas Markets

European sharemarkets were mixed on Friday, as optimism of a COVID-19 vaccine continued to be offset by a surge in coronavirus cases and renewal of lockdown restrictions in the region. Banking stocks led the gains, while travel names lagged the broader market. Infrastructure giants Eiffage and Vinci strengthened 2.0% and 2.5% respectively, while Tesco added 0.6%. The German DAX gained 0.2%, the broad based STOXX Europe 600 closed flat and the UK FTSE 100 slid 0.4%.

US sharemarkets rose on Friday, as the S&P 500 posted a fresh record closing high. Walt Disney rose 2.1% after the company announced fiscal Q4 EPS and revenue beat expectations, while Cisco Systems strengthened 7.1% after it reported positive earnings results. With ~90% of S&P 500 companies having reported, Refinitiv IBES estimates that profits have fallen 7.8% from last year, compared with an earlier expectation for a 21.4% decline. Payment services companies boosted the market, with MasterCard and Visa closing up 2.1% and 1.1% respectively, while Alphabet gained 1.6% and Microsoft added 0.5%. By the close of trade, the Dow Jones and S&P 500 both climbed 1.4%, while the NASDAQ lifted 1.0%.

CNIS Perspective

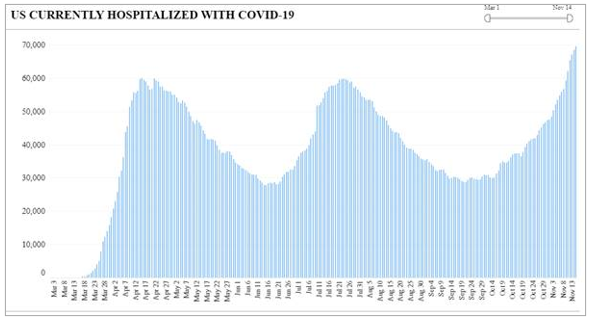

While all eyes are currently focused on the progress towards a COVID-19 vaccine, there is a more immediate concern, especially in the US, as policy makers are rapidly approaching a tipping point with regards to enforcing restrictions or lockdowns.

The chart shows the number of US patients currently hospitalised with COVID-19 has reached a new high as a result of the third wave of infections, which for now shows no sign of slowing.

From a policy perspective, the clear constraint is the viability of the health care system to treat patients, given fixed health care resources.

The opposition in the US to a return to full lockdown conditions is strong and would heavily impact employment. The situation at present looks to be heading for an outcome that would require a significant round of fiscal stimulus, and US leadership to refocus on the situation at hand and move forward from the election outcome.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025

Is your current super fund holding you back? It might be time for an SMSF.

Cutcher's Investment Lens | 17 - 21 March 2025