Pre-Open Data

Key Data for the Week

- Tuesday – UK – ILO Unemployment Rate

- Tuesday – US – Retail Sales

- Tuesday – US – Consumer Price Index

- Tuesday – AUS – Wage Price Index

Australian Market

The Australian sharemarket rose 0.4% on Monday, led by the Health Care sector, which broadly gained 1.2%. Regenerative medicine company, Mesoblast (11.8%), was the sector’s key contributor, after it announced remarkable trial results regarding its cardiovascular treatment in a US conference. Other major performers included Australian Clinical Labs (3.6%) and CSL Limited (0.8%).

The Consumer Discretionary sector was the other major contributor to the market’s overall performance. Gains were widespread, however, important movers included Wesfarmers (1.5%) and Super Retail Group (1.7%).

Most other sectors closed ahead, or relatively flat, with Energy (-0.2%) being the weakest performer. This came despite sector heavyweight, Woodside Petroleum (1.1%), announcing a sale and purchase agreement with Global Infrastructure Partners. It meant Woodside Petroleum would remain the operator, and majority stakeholder, of the Pluto Train 2 Joint Venture, which involves the establishment of new liquefied natural gas facilities. Such facilities are likely to be important as Australia, and the world, transition toward less pollutive energy options.

The Financials sector closed flat, after mixed performances from the major banks. ANZ and Westpac rose 0.7% and 0.6% respectively, while Commonwealth Bank lost 0.1%. NAB (-1.6%) closed lower as the stock traded ex-dividend. Meanwhile, fund manager Australian Ethical Investment (3.6%) performed strongly.

The Australian futures point a 0.48% fall today.

Overseas Markets

European sharemarkets rose on Monday, following comments from European Central Bank Chief Christine Lagarde, where concerns over tighter monetary policy were alleviated. Airbus rose 1.9%, after the plane maker received a multi-billion dollar order for 255 passenger jets from private-equity firm Indigo Partners’ portfolio airlines, while Royal Dutch Shell lifted 2.1%, after the company reported it would simplify its business and move its head office from the Netherlands to Britain. Meal kit delivery provider HelloFresh continued to improve, with the company closing up 2.7% for the session. By the close of trade, the German DAX and the STOXX Europe 600 both rose 0.4%, while the UK FTSE 100 eked out a 0.1% gain.

US sharemarkets were broadly flat overnight, with utilities and bank stocks amongst the best performers. The Materials sector lost 0.5% after base metal commodities broadly weakened. Payment services companies were mostly stronger; PagSeguro Digital surged 5.3%, PayPal climbed 2.0% and Visa rose 0.1%, however, MasterCard slid 0.6%. Meanwhile, cybersecurity providers lost ground, as Fortinet gave up 2.0% and CrowdStrike plunged 10.6%. Despite the mixed performance, seven out of the eleven industry sectors closed higher on Monday.

CNIS Perspective

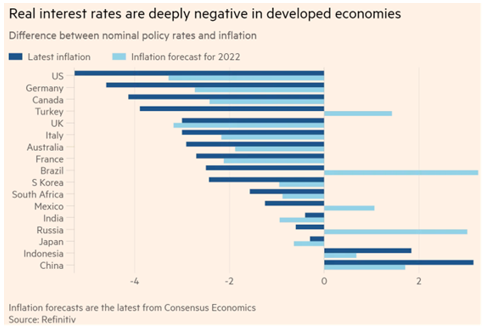

As central banks continue to grapple with whether the surge in inflation is transitionary or more permanent in nature, the world’s leading economies are confronted with their lowest real interest rates in decades.

Real interest rates, which are central bank policy rates less the inflation rate, reflect the real return on savings. Taking this into account, cash savings in real dollar terms are going backwards at a more rapid rate than at any point since the 1970s, when energy prices pushed up inflation.

In many developed countries, where nominal interest rates are at, or near zero, real rates stand at around -5.3% in the US, -4.6% in Germany, -3.0% in the UK, and -2.9% in Australia.

While central banks delay any abrupt tightening on monetary policy to contain inflation, cash savings will continue to deteriorate in real dollar terms. However, there is always a flip side when it comes to interest rates, with the real benefit for borrowers, with cost of borrowing being eroded by inflation.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.