Pre-Open Data

Key Data for the Week

- Wednesday – AUS – HIA New Home Sales in the three months to August were 15.4% higher than in 2018 and 2019, while 15.5% lower than in 2020, attributed to COVID-19 and the HomeBuilder scheme.

- Wednesday – EUR – Industrial Production increased to 5.9% as the Producer Price Index exceeded expectations by 0.5%.

- Thursday – AUS – Unemployment Rate

Australian Market

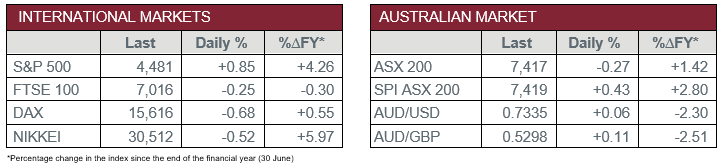

The Australian sharemarket fell 0.3% yesterday, despite a mid-session rally. The local market performed broadly in line with overseas sharemarkets, as economically sensitive stocks stumbled, while the Information Technology (1.0%) and Health Care (1.2%) sectors strove ahead. Super Retail Group was an exception, as it shrugged off overall market weakness, to close ahead 2.6%.

The Energy sector was the worst performer, down 2.2%, despite an increase in oil prices. Santos, Oil Search and Beach Energy all slid 3.0-4.0%. AGL Energy plunged 7.4%, to now be down 60% over the last 12 months. The Materials sector fell 1.4%, despite an upswing from Pilbara Minerals (8.4%), as it reported strong interest at its lithium digital auction on Tuesday afternoon.

The major banks were mixed on Wednesday, as the Financials sector fell 0.3%. Westpac advanced 0.3%, while Commonwealth Bank, ANZ and NAB all dipped between 0.2% and 0.4%.

The Australian futures point to a 0.43% increase today.

Overseas Markets

European sharemarkets were weaker on Wednesday, as the STOXX Europe 600 slid 0.8%, the German DAX fell 0.7% and the UK FTSE 100 lost 0.3%. The Utilities sector was among the weakest performers, down 2.9%, after Spain’s move to cap energy bills to redirect company profit to households.

Retail stocks also slipped 2.3%, which impacted luxury stocks, as recent COVID-19 outbreaks and concerns around a slowing Chinese economy impacted investor sentiment.

US sharemarkets advanced overnight, as investor concerns about higher inflation, and subsequent monetary policy tightening, eased. The Dow Jones, S&P 500 and NASDAQ all gained 0.7-0.9%. Microsoft was a notable gainer, up 1.7%, after it announced a dividend increase and a US$60 billion share repurchase program.

The Energy sector performed well, supported by an ~3.0% rise in global oil prices, subsequent to a report from the US Energy Information Administration, which indicated reduced supplies.

CNIS Perspective

The actions of developed world central banks over the past 18 months has been strikingly similar. All have printed billions at a rapid rate i.e., ‘quantitative easing’, with all embracing unconventional monetary policy.

That’s except for China, which is the clear outlier. Rather than cutting interest rates and printing money, they have elected a different approach.

In the wake of the outbreak of Coronavirus, China supported its economy via another fixed-asset investment splurge, similar to their GFC approach. In the process, they have consumed an enormous amount of raw materials, including concrete and steel, and buoyed the iron ore price, which has clearly now peaked.

This has left China in a unique position, where interest rates can be cut further, and money can be printed to stimulate their economy, which looks to be stalling in the second half of this year, as this infrastructure investment boom tapers off.

Perhaps the US, Europe and Australia would like to have this luxury now?

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.