Pre-Open Data

Key Data for the Week

- Monday – CHINA – Industrial Production increased 6.4% year-on-year in July, missing expectations of a 7.8% rise.

- Tuesday – UK – ILO Unemployment Rate

- Tuesday – EUR – Gross Domestic Product

- Tuesday – US – Retail Sales

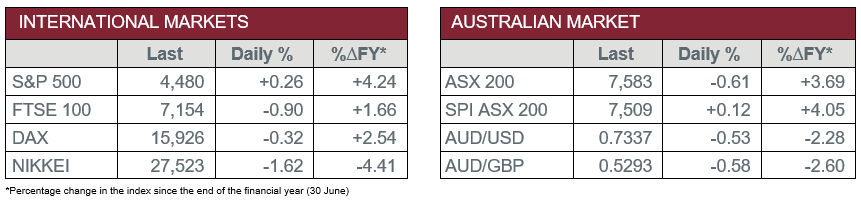

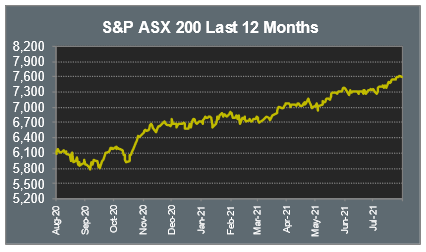

Australian Market

The Australian sharemarket lost 0.6% yesterday, as extended COVID-19 lockdowns and mixed earnings reports weighed on the market.

The Energy sector was the hardest hit, down 3.4%. Beach Energy fell 9.9% after releasing its earnings report, as increased production and operating costs detracted from their performance. Woodside Petroleum fell 4.6% as the company confirmed they have entered into discussions with BHP regarding the sale of BHP’s petroleum business.

The major banks weakened the Financials sector, with ANZ the worst performer of the four, down 2.7%. Commonwealth Bank and Westpac both shed 1.4%, while NAB recovered throughout the session to eke out a 0.1% gain.

The Consumer Staples sector provided the best performance on the day, up 1.1%. This was aided by gains in Woolworths Group and Coles Group, which added 0.6% and 0.5% respectively. Endeavor Group continued its recent run of strength since listing on the ASX to close up 1.6%, while takeover rumours saw The a2 Milk Company soar 12.1%.

The Australian futures point to a 0.12% gain today.

Overseas Markets

European sharemarkets were weakened overnight by slowing Chinese economic indicators. Oil and mining stocks fell approximately 1.5% each following the release of Chinese data that showed a lesser demand for oil and metals. As a result, Glencore conceded 1.4%, while BP and Royal Dutch Shell lost 1.9% and 2.3% respectively. The pan-European STOXX 600 slipped 0.5%.

US sharemarkets were mixed on Monday. Gains were seen in defensive sectors such as Healthcare and Utilities. UnitedHealth Group added 1.8%, Johnson & Johnson lifted 0.9% and Pfizer gained 0.9%. The Energy, Materials and Financials sectors all closed the session lower following the Chinese factory output data.

By the close of trade, the Dow Jones and the S&P 500 both added 0.3%, while the NASDAQ closed 0.2% lower.

CNIS Perspective

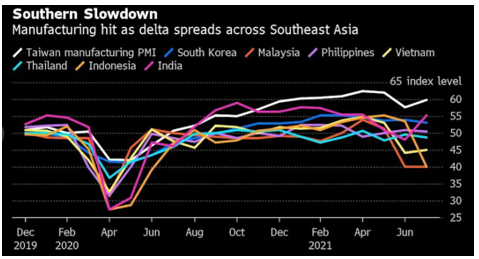

The vulnerability of global supply chains is quickly resurfacing on the global trade agenda.

The highly contagious Delta COVID-19 variant is beginning to weigh on factory output and port congestion in Asian countries.

With a reported 42% of global exports originating from Asia, this could see raw material prices rise and a continuation of the current shortage of supplies, including semiconductors which have been the roadblock in a number of industries since the back end of last year.

While this is unlikely to turn out to be as severe as the supply chain issues we faced last year, a slowing of goods out of Asia could again see price inflation become more evident as we progress through the back half of this year.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.