Pre-Open Data

Key Data for the Week

- Wednesday – US – Retail Sales rose 0.3% in February, down from 4.9% in January.

- Wednesday – US – Federal Reserve Meeting – The Fed lifted rates by 25 basis points, the first increase since 2018.

- Thursday – AUS – Unemployment Rate

- Thursday – UK – BoE Policy Meeting

Australian Market

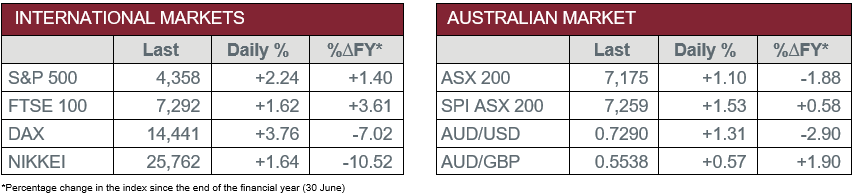

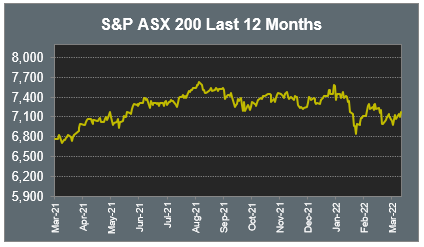

The Australian sharemarket gained 1.1% yesterday, as all sectors closed higher. The Information Technology sector led the gains, up 3.3%, followed by the Consumer Discretionary and Consumer Staples sectors, which both added 2.0%.

The announcement of a $243 million support package by the Australian Government lifted the Materials sector. The package aims to support the critical minerals, electric vehicle and battery markets, including a $45 million grant awarded to Alpha HPA, which jumped 15.2% yesterday. Mining heavyweights were mixed, as the price of iron ore declined; BHP slipped 0.4%, while Rio Tinto and Fortescue Metals added 0.1% and 1.5% respectively.

The Financials sector advanced 1.0%, boosted by fund manager Magellan Financial Group (3.9%), which announced an on-market share buyback for approximately 5.0% of shares on issue. Australian Ethical Investment and Challenger also enjoyed gains, up 6.3% and 0.5% respectively. The major banks closed higher; ANZ added 1.8%, Commonwealth Bank and Westpac both lifted 0.9%, while NAB rose 0.4%.

The Health Care sector closed 1.6% higher; Ramsay Health Care added 2.6% and biotechnology heavyweight CSL gained 1.8%, while Sonic Healthcare rose 1.4%. However, Cochlear slipped 0.2%.

The Australian futures market points to a 1.53% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets advanced overnight as negotiations between Russia and Ukraine resumed, restoring investor optimism of a resolution after weeks of conflict. Banking stocks advanced; Deutsche Bank jumped 7.2% and Barclays Bank gained 4.2%, while HSBC and Lloyds Bank added 3.1% and 2.9% respectively. Renewable energy stocks also closed higher; Vestas Wind Systems rose 3.3%, while Siemens Gamesa Renewable Energy lifted 2.2%. Consumer staples stocks rose, as meal-kit provider HelloFresh rallied 12.2%.

By the close of trade, the UK FTSE 100 added 1.6% and the STOXX Europe 600 gained 3.1%, while the German DAX climbed 3.8%.

US sharemarkets lifted following the US Federal Reserve’s expected 25 basis point rate rise, with projections the rate will reach 2.8% in 2023. Technology heavyweights advanced; NVIDIA closed up 6.9% and Fortinet gained 5.0%, while Alphabet and Apple rose 3.1% and 2.9% respectively.

Semiconductor companies rallied; ASML Holdings jumped 7.1% and Intel rose 4.1%, while, Taiwan Semiconductor Manufacturing added 4.0%. Renewable energy stocks also enjoyed gains; ChargePoint Holdings climbed 10.4% and Enphase Energy lifted 7.6%, while NextEra Energy rose 0.7%.

By the close of trade, the Dow Jones and S&P 500 added 1.6% and 2.2% respectively, while the NASDAQ lifted 3.8%.

CNIS Perspective

The rising price of energy and inflation is starting to be factored in as a definite risk to economic growth. Respected global investment bank, Goldman Sachs, has cut its expected US GDP growth in the second quarter of 2022 from 2.0% to 1.75%, compared to the fourth quarter of 2021.

This is driven by the impact on income and consumer spending as a result of higher food and fuel prices.

Financial conditions continue to tighten as the US Dollar and bond yields rise and equities fall. This adds to the headwind to growth in the second quarter of 2022.

Whether this translates into recession however is doubtful, given;

- The strength of the labour market

- Pent-up demand where supply constraints have been limiting growth, e.g., motor vehicles and building materials

- Strong housing, which means consumer net worth continues to rise

- Strong loan growth and still negative real interest rates

- Strong household balance sheets

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.

ATO updates: A quick guide on what business owners need to know.

Cutcher's Investment Lens | 24 - 28 March 2025