Pre-Open Data

Key Data for the Week

- Tuesday – US – Retail Sales rose 1.7% in October, as it beat expectations of 1.4%.

- Tuesday – US – Industrial Production added 1.6% last month.

- Wednesday – EUR – Consumer Price Index

- Wednesday – US – Building Permits

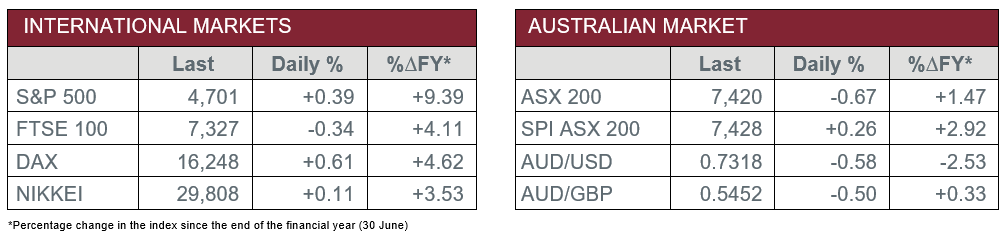

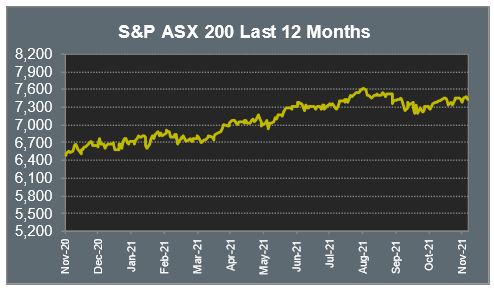

Australian Market

The Australian sharemarket closed down 0.7% yesterday, as investors fear that interest rates may not remain at current lows. Yesterday’s loss was the biggest this month, with all sectors except for Information Technology closing the session lower.

The Materials sector weighed on the market, as the sector fell 1.7%. BHP was the worst performer of the major miners, down 2.6%, while Rio Tinto and Fortescue Metals conceded 2.2% and 0.3% respectively. Lithium miners also lost ground; Pilbara Minerals shed 2.0% and Orocobre dropped 1.6%, while Core Lithium fell 0.9%.

The big four banks dragged the Financials sector lower. NAB shares ended 0.6% lower, while Commonwealth Bank, Westpac and ANZ all lost between 0.2% and 0.4%. Fund managers also weakened; Australian Ethical Investment dropped 2.9%, while Challenger and Magellan Financial Group closed the session down 1.0% and 3.0% respectively.

The Information Technology sector was the only sector to post a gain, as it added 0.2%. This was led by a 1.7% gain in Afterpay.

The Australian futures market points to a 0.26% gain today, lifted by stronger overseas markets.

Overseas Markets

European sharemarkets closed mainly higher overnight, boosted by gains in the Information Technology sector. The sector was aided by easing tensions between China and the US. As a result, Prosus jumped 4.2%, while Infineon Technologies added 0.7%. By the close of trade, the German DAX lifted 0.6% and the STOXX Europe 600 rose 0.2%, however, the UK FTSE 100 closed 0.3% lower.

US sharemarkets lifted on Tuesday, as retail sales surged in the month of October, with consumers preparing for the upcoming holiday season. As a result, Consumer Discretionary was the best performing sector and jumped 1.4%. The Information Technology sector also gained, as Microsoft added 1.0%, Apple lifted 0.7% and Tesla soared 4.1%.

By the close of trade, the Dow Jones rose 0.2% and the S&P 500 added 0.4%, while the NASDAQ lifted 0.8%.

CNIS Perspective

Minutes released yesterday of the RBA board meeting in the first week of November provide an interesting insight into the RBA’s thoughts on inflation and the future direction of interest rates in Australia.

The RBA believes it is ‘plausible’ the first cash rate hike will be in 2023 or 2024, but continued to push back the possibility of rate hikes in 2022.

Having said that, their future decisions and guidance will be “based on the state of the economy” and not “dates on the calendar”.

They reiterated wages growth will likely need to be above 3% to sustainably move inflation towards the middle of its 2-3% inflation band over time.

However, they don’t appear as concerned about inflation in Australia as other advanced economies are, for a few reasons.

Firstly, the starting point for inflation and wages was lower in Australia. Secondly, labour market participation rebounded very quickly in Australia, unlike some other economies, which puts less upwards pressure on wages.

Finally, the impact of supply-chain disruptions and energy price shocks has been less pronounced in Australia.

So inflation is well and truly on their radar, but not in flashing lights like some other advanced economies.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Cutcher's Investment Lens | 7 - 11 April 2025

The failed $3 million super tax: Division 296 is done… or is it?

Cutcher's Investment Lens - Update on Trump & Tariffs | 31 March - 4 April 2025

Liberation Day - April 2025 Snapshot

Smart investing for SMEs: The basics on how to get started and grow your business.